August 2025 Stock Market Outlook Key Takeaways

- Valuations increased faster than the market return but are concentrated in only five stocks.

- Growth stocks remain at an especially high premium.

- Small-cap stocks remain very attractively valued but may take a while before they start to work.

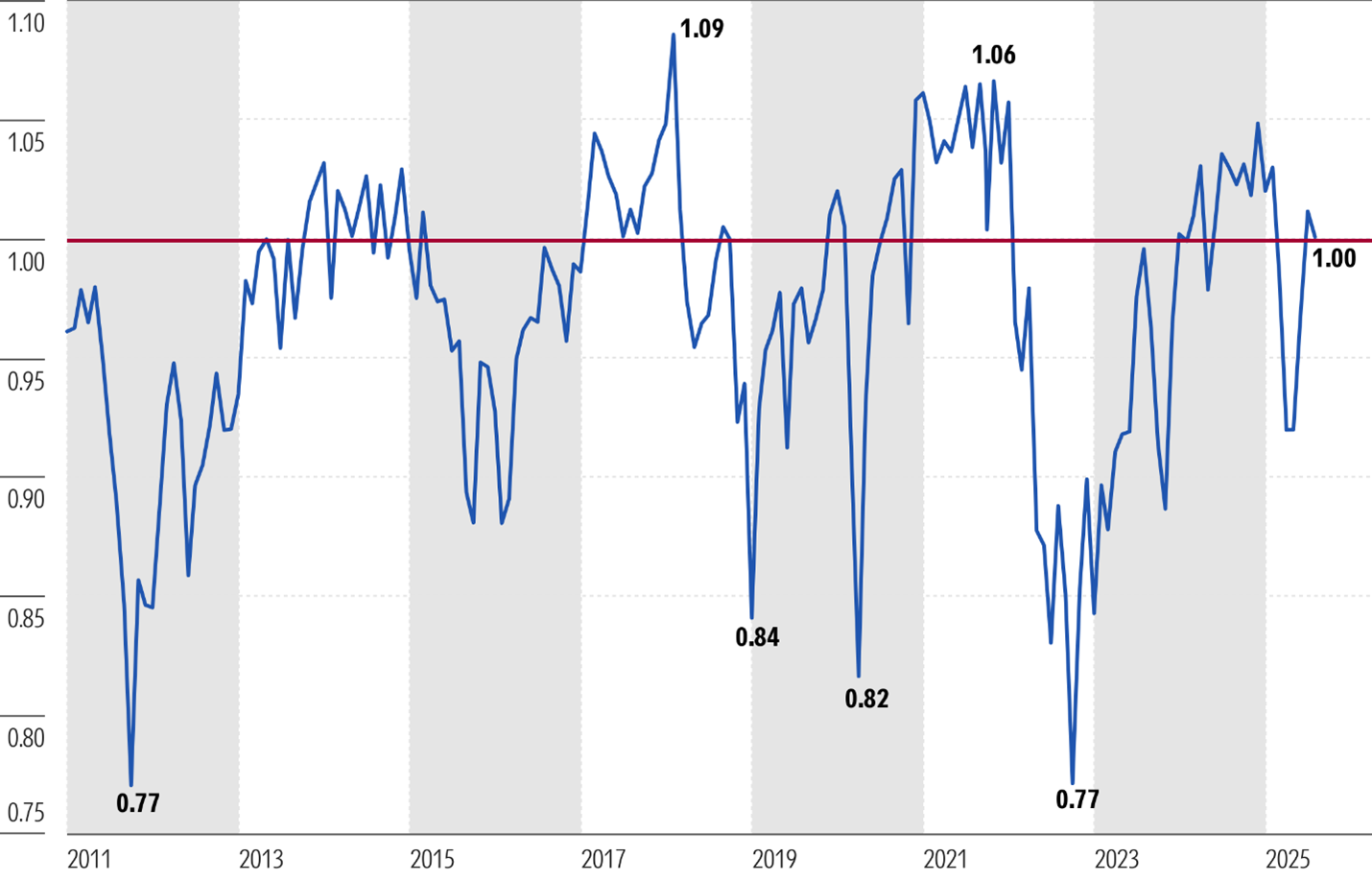

As of July 31, 2025, the US equity market was trading equal to a composite of our fair value estimates. Even though the market rose 2.3% in July, the market valuation dropped from a slight premium at the end of June to in line with our valuations. Effectively, the increases in our fair values rose by a greater amount than the market capitalization of the entire market. Over the course of the past month, we increased our fair value on 143 stocks under coverage whereas we only cut our fair value on 36 companies.

While the number of fair value increases far outpaced the number of decreases, only five stocks comprised the preponderance of capitalization increases. For example, we increased our fair value on Nvidia NVDA by over 20% after the US government allowed the company to resume selling its H2O Ai GPUs to China. Considering Nvidia has a $4.3 trillion market cap, that’s equivalent to an increase of approximately $900 billion of market capitalization. That’s like adding almost the entire market capitalization of Tesla TSLA, the 10th largest company by market capitalization, to the index.

Similarly, we increased our fair value on Microsoft MSFT by almost 20%. Considering Microsoft’s market capitalization is $4 trillion, that’s equivalent to $800 billion in market capitalization. That’s about the same as the market capitalization of either JPMorgan Chase JPM or Walmart WMT, which are the 11th and 12th largest companies in our index by market capitalization. We increased our fair value on Meta Platforms META by 10%, which is equal to $200 billion in market capitalization, about the same as the market capitalization of Caterpillar CAT. We also increased our fair valuations on Taiwan Semiconductor TSM and JPMorgan by approximately $170 billion each.

In total, the valuation increases for just these five companies equate to $2.2 trillion of market capitalization. To put that into context, that’s equivalent to 22 companies with $100 billion market capitalization each—and there are only about 140 companies with market capitalization of $100 billion or more.

With Stocks Trading at Fair Value, There Is No Margin of Safety to Compensate for Macro Risk

At the current premium, the market is not providing any margin of safety to compensate investors for any of the myriad risks on the horizon. One of the most pressing near-term risks is the ongoing trade and tariff negotiations; those with many of the US’ largest trade partners (China, Canada, Mexico) still need to be completed. In addition, the rate of economic growth in the US is slowing sequentially, and Preston Caldwell, Morningstar’s Chief US Economist, doesn’t foresee a reacceleration until the beginning of 2026 at the earliest. Yet, it’s not just the US whose economy is slowing, as it appears economic growth is slowing in China and Japan, and, while growth in Europe may picking up, it is coming from a low base.

Among other risks, inflation metrics have yet to show much of a pickup in tariff-related inflation, but Caldwell expects tariffs will lead to an increase in inflation over the second half of 2025. While Caldwell expects the Fed to begin easing monetary policy by cutting the federal-funds rate at the September meeting, the Fed is on hold for now. With the Fed on hold over the next two months and inflation expected to increase, long-term interest rates have remained stuck near the bottom of their trading range since last October.

Valuation Increases Bolster Growth Stocks, Yet They Remain Overvalued

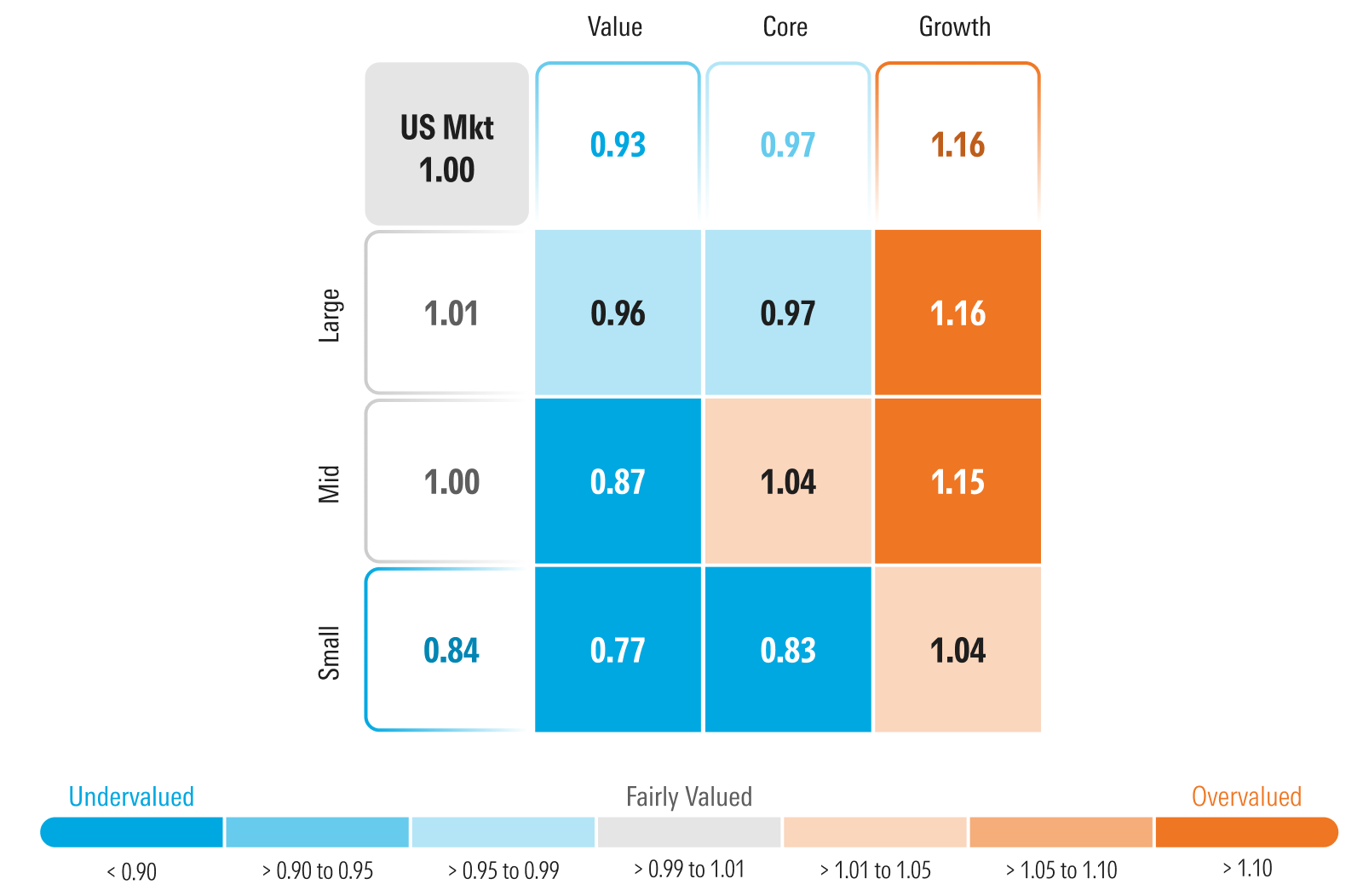

The Morningstar US Growth Index outperformed the broader market and rose 2.95% in July. However, our price/fair value metric declined slightly to a 16% premium at the end of July from an 18% premium at the end of June. The reason is that our valuation increases in Nvidia, Microsoft, and Meta Platforms outweighed the amount that the growth index rose.

From a category perspective, based on our valuations, we continue to advocate for an overweight position in the value category as it trades at a 7% discount to fair value. In order to fund this overweighting, we also advocate for an underweighting in the growth category, as it trades at a 16% premium to fair value. From a category perspective, rarely do growth stocks trade at such a large premium. Yet, while the category may be overvalued, we continue see a number of attractive undervalued growth stocks such as Marvell MRVL and Workday WDAY. While diversification has many benefits for investors, in this instance, investors may be better positioned in individual undervalued stocks as opposed to broader exchange-traded funds or funds that focus on growth stocks.

Value stocks remain the most attractively valued on both an absolute and relative valuation basis. Core stocks are more attractively valued following a number of fair value increases on individual stocks last month.

The Morningstar US Small Cap Index rose 2.1% in July, just barely lagging the broader market. On both an absolute value and relative value basis, small-cap stocks remain very attractive, trading at a 16% discount to our fair value estimate. With large-cap stocks trading at a 1% premium, investors can fund an overweighting in small caps with a small underweighting in large caps.

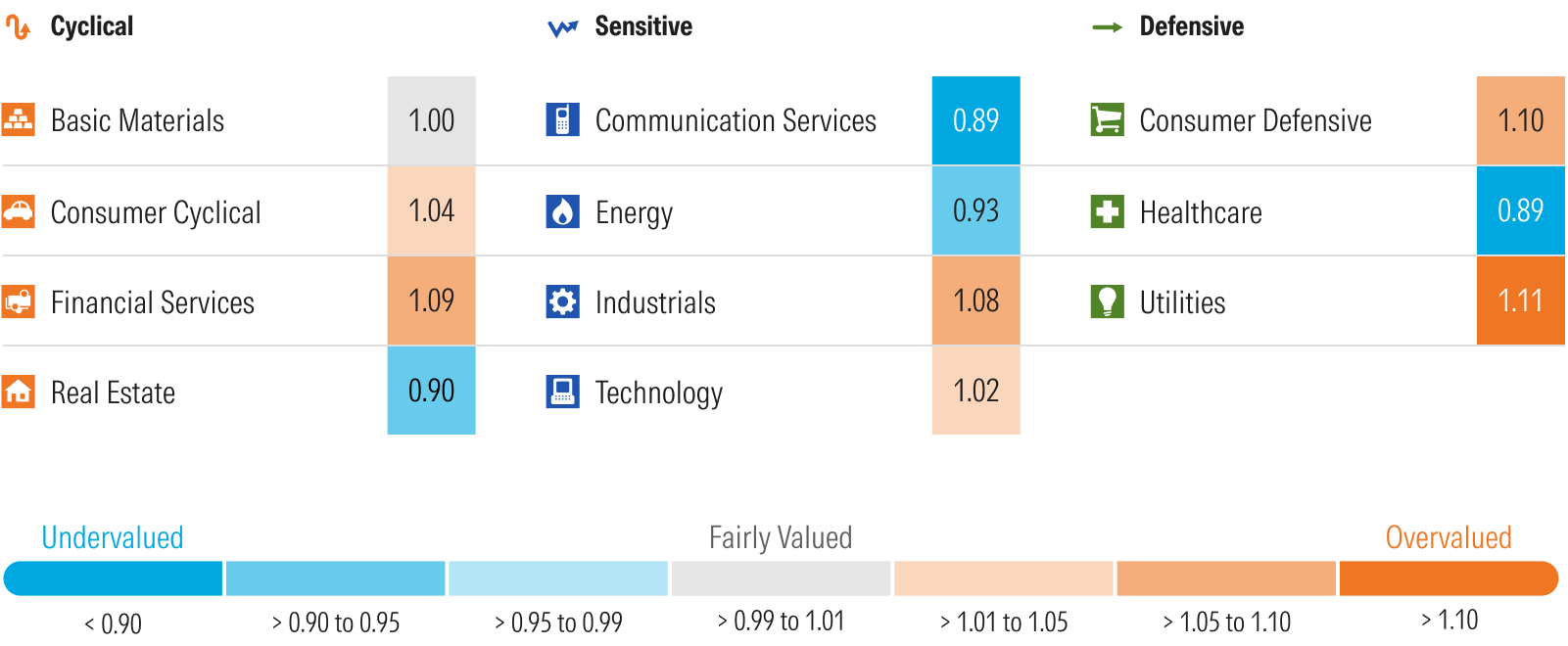

Where We See Value by Sector

This earnings season, it has been all about artificial intelligence. Our largest fair value increases have been concentrated in information technology and communications sectors, as those are the most directly tied to manufacturing the hardware to run AI, host AI on their cloud platforms, or are in the early stages of utilizing AI to enhance their own products and services. But it hasn’t been limited to just AI. Financial services have also seen a significant increase in valuations. Large US banks have been in a virtuous cycle from ongoing increases in net interest income and fee income where loan losses have remained low as economic activity, while slowing, has been high enough to prevent an increase in defaults.

Greatest reductions to our fair values have been concentrated in the healthcare sector as large pharmaceutical companies and healthcare insurance companies have come under increasing pressure. Elsewhere, we have cut our fair values in stocks of companies where we expect AI will significantly disrupt their businesses, such as advertising. Lastly, we have lowered fair values among several economically sensitive companies, such as the airlines and basic materials industries.

Healthcare

The healthcare sector ties the communications sector as the most undervalued. Conversely, as the communications sector has become less undervalued as stocks in that sector have traded up, healthcare has become more undervalued as stocks have traded down. Healthcare stocks have fallen out of favor as uncertainty as to how changes in government policy and reimbursement weighed on sentiment. Year to date through July 31, the Morningstar US Healthcare Index has been the worst performing sector index, dropping 3.87%, and one of only two sectors with negative returns this year. Stocks of healthcare insurance companies have been some of the worst-performing stocks across the entire market for the year to date. Rising medical costs, heightened regulatory pressures, and disappointing earnings guidance (especially in Medicare Advantage products) have been a toxic combination to their valuations. In addition, stocks of large-cap pharmaceuticals have been under intense pressure as the Donald Trump administration is evaluating policy changes to lower drug costs.

Communications

Communications is the best performing sector this year yet still remains tied for being the most undervalued. Within the communications sector, returns were driven by Meta Platforms and Alphabet GOOGL. An attribution analysis reveals that, in July, these two companies accounted for a greater amount of return than the overall sector. Although mega-cap stock Alphabet remains rated 4 stars and skews the broad sector valuation down, we continue to see significant value in many traditional communications and media stocks, as a broad swath of the sector is rated 4 or 5 stars.

Real Estate

The Morningstar US Real Estate Index was essentially flat for the month of July. There was no significant return concentrations as the amount of gains and losses were pretty evenly balanced. We continue to prefer real estate with defensive-oriented characteristics such as medical office buildings, research & development, multifamily housing, cellphone towers, and self-storage facilities.

Energy

The Morningstar US Energy Index rose 2.5% in July, slightly edging out the broad market return, yet it remains one of the more undervalued sectors. Fundamentally, we think oil stocks are undervalued, even after incorporating our relatively bearish view on oil prices. In our valuation models, we use the market’s forward strip price for oil for the next two years and then step the price down toward our midcycle price forecast of $55/barrel for West Texas Intermediate crude oil. In addition, we think oil companies provide investors with a natural hedge in their portfolio if inflation were to stage a comeback or geopolitical risks were to push oil prices higher.

Overvalued Sectors

The utilities sector is broadly overvalued and offers few undervalued opportunities. While we incorporate heightened demand for electricity in our financial forecasts as artificial intelligence computing requires multiple times more power than traditional computing, we think the market is overestimating too much growth for too long.

The consumer defensive sector remains one of the most overvalued, yet the sector valuation is skewed into overvalued territory by 1-star-rated Costco COST and Walmart as well as 2-star-rated Procter & Gamble PG. These three stocks account for 34% of the market capitalization of the index. Excluding these three stocks, the rest of the sector trades at an attractive 7% discount to fair value. We find stocks for packaged-food companies to be particularly compelling.

The financials sector has been one of the better performing sectors this year, but we think the market is overestimating the amount of long-term earnings growth. Stocks across the sector are broadly overvalued as the number of overvalued stocks is triple the number of undervalued stocks.

Considering we expect the rate of economic growth will decelerate sequentially over the course of 2025, we’d be especially cautious investing in industrials and would require significant margins of safety to guard against slowing earnings over the short term.

Correction: The Morningstar US Real Estate Index was essentially flat in the month of July, not June. The article has been updated.