On surface level, discount retailer Dollar General (NYSE:DG) easily delivered the goods. Thanks to a strong financial disclosure and an upgraded outlook, professional traders and institutions cheered DG stock with a sizable move higher in the premarket session. However, trading was volatile when the reins shifted over to the public realm — forcing a deeper conversation.

For the second quarter, Dollar General posted what appeared to be strong numbers. Per the retailer’s press release, the company generated net sales of $10.7 billion, an increase of 5.1% from the year-ago quarter. Diluted earnings per share jumped 9.4% to hit $1.86. During Q2, operating profit increased by 8.3% to $595.4 million.

Fundamentally, same-store sales — a key metric for the retail industry — rose 2.8%. Further, year-to-date cash flows from operations increased 9.8% to $1.8 billion.

Prior to the disclosure, Wall Street analysts had pegged Dollar General to post EPS of $1.57 on sales of $10.68 billion. That seemed more than enough to excite the premarket crowd, which initially drove DG stock up nearly 7%. However, open market investors disagreed, with DG at one point falling nearly 4% against yesterday’s close.

At time of writing, the security poked its head about half-a-percent above parity. It raises the obvious question: why the disparity in sentiment?

The public likely looked deeper into the figures. One potential headwind that stood out was operating costs. Sales, general and administrative expenses rose to 25.8% of sales, compared to 24.6% last year. Per the press release, the “primary expenses that were a higher percentage of net sales in the second quarter of 2025 were incentive compensation, repairs and maintenance, and benefits”

Another big concern is slowing expansion. Dollar General opened 360 stores year-to-date but closed 208, leaving just 152 net new stores. That’s a conspicuous drop-off from the year-ago period’s 359 net new stores count.

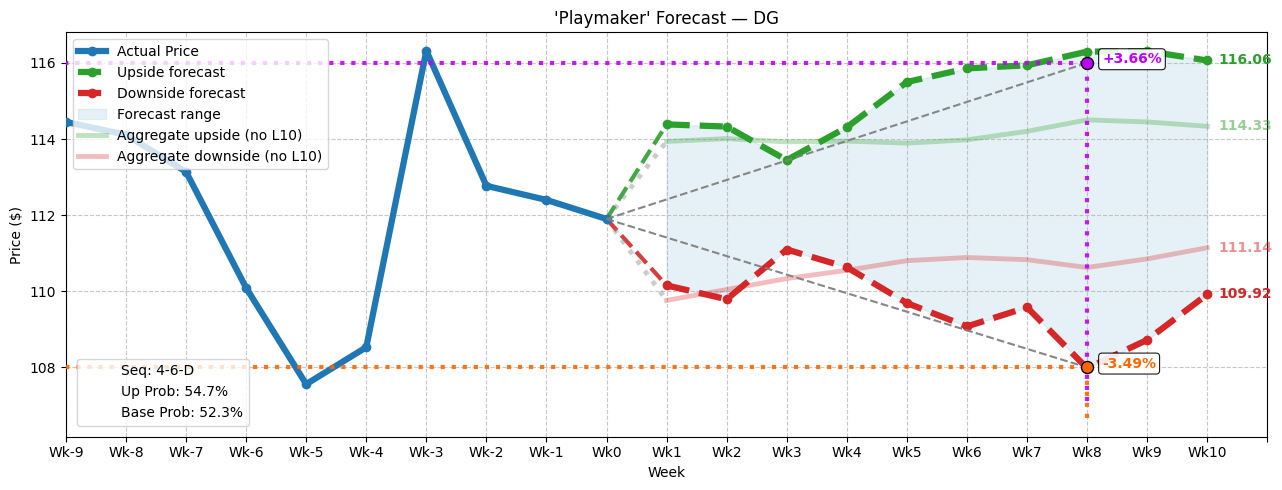

Looking ahead, the natural drift associated with DG stock may see the security range from a median low of $111.14 to a median high of $116.06 over the next 10 weeks. Based on how the market historically responds to DG in its current quantitative setup — posting four up weeks, six down weeks, with an overall downward trajectory (4-6-D) — the conditional drift may see DG range from $109.92 to $116.06.

Big picture, Dollar General has been impressive amid very difficult circumstances. Therefore, it wouldn’t be surprising if DG stock ended near the higher end of the projected range. That said, advanced traders may see to buy volatility given the delta between the baseline drift and the conditional drift.