US Dollar

The shutdown came as a bolt from the blue for the . The greenback was confident that Democrats and Republicans would reach a last-minute agreement. That did not happen. During previous government shutdowns, the dollar index typically fell on expectations of slowing and mass layoffs. In 2025, the situation will worsen because the labour market is already cooling down.

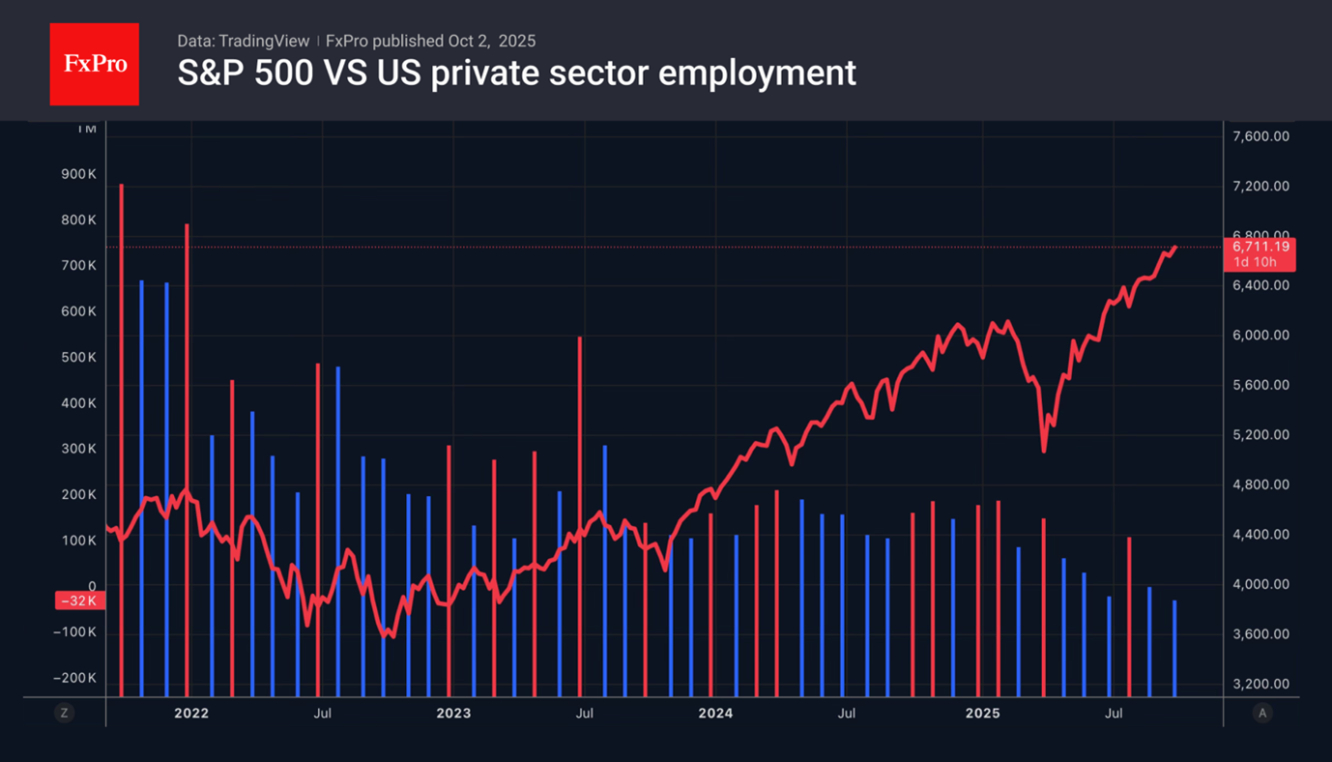

Due to the shutdown, the publication of important data will be postponed. Therefore, the importance of the report increases. Over the last two months, there has been a decline in private sector employment. This increased the chances of a federal funds rate cut in October to 99% and in December to 87%. Treasury bond yields and the US dollar fell.

There is increased demand for safe-haven assets in the markets. continues to break records, Treasury yields are falling, and the has moved away from the political crisis in Japan and is growing steadily. In contrast, European currencies are not yet able to take full advantage of the weakness of the US dollar. The is hampered by geopolitics and events in France.

Stock Indices

The shrugged off the shutdown and marked its 29th record high since the beginning of the year. Pharmaceutical and technology companies, which received a tariff deferral, led the rally. The market was pleased by the news that OpenAI had become the largest startup in history, with a valuation of over 500 billion dollars.

Jerome Powell’s comments about the high valuation of US stocks led only to a temporary pullback in the S&P 500.

Investors immediately bought up the dip. History shows that since 1996, similar rhetoric from the Fed chairman has led to an average 13% increase in the broad stock index over the next 12 months. The market views high Price-to-Earnings ratios as the new reality. Corporate reporting is improving, the US economy has shifted its focus from manufacturing to technology, and artificial intelligence makes the US stock market unique and attractive.

The on private sector employment did not deter the S&P 500. It finally convinced investors that the would cut the federal funds rate twice more in 2025.

The FxPro Analyst Team