Remittance inflows to Bangladesh grew by 12 percent year-on-year in September, thanks to an increasing number of expatriates sending money through official channels, helping the nation gradually recover from a forex shortage and bring stability to the exchange rate.

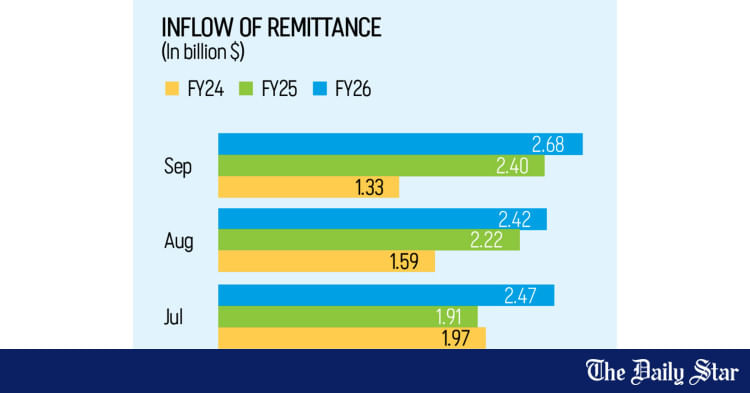

Last month, remittance flow stood at $2.68 billion, up from $2.40 billion a year ago, according to the latest Bangladesh Bank (BB) data.

The increase has been attributed to a narrowing gap between official and informal exchange rates, a crackdown on money laundering, and increased outflow of people going abroad for jobs in recent years.

Over 40 lakh people left the country for jobs in foreign countries in the four years to the end of the fiscal year (FY) 2024-25, according to the Bureau of Manpower, Employment and Training (BMET).

With the latest addition, Bangladesh received a total of $7.58 billion in remittance in the first three months (July-September) of FY26, an 8 percent jump from $6.54 billion during the same period in the previous year.

Mati Ul Hasan, managing director and CEO of Mercantile Bank PLC, said due to the stable foreign exchange market and government incentives, remitters are increasingly sending money through official channels.

Moreover, since irregular or alternative payment methods are now being controlled, the demand for dollars has declined, which has caused a drop in foreign currency inflow through ‘hundi’ or informal channels.

Hasan also noted that the central bank is now keeping a close watch on Letters of Credits (LCs) for imports and maintaining stability in the forex rate.

For large LCs, banks are now required to consult with the central bank to verify whether the exchange rate and the source of funds are legitimate – something that was not practiced before, he said.

However, there is still room to increase remittance earnings in the country. “We are still lagging behind Pakistan and far behind India.”

A BB official also attributed the surge in remittance to expatriates sending money through proper banking channels.

Buoyed by the inflow, overall foreign exchange reserves rose over the last year. The reserves, which were $21 billion in early October last year, rose to $26.62 billion yesterday as per the calculation method of the International Monetary Fund.

Bangladesh received a historic high $30.3 billion in remittances in the FY25, a 26.8 percent increase from the previous year. Th second highest remittance inflow was recorded in FY21, when expatriates sent $24.8 billion.

The FY25 inflow was supported by the market-based competitive exchange rate, ongoing cash incentives, and improved capture of transfers through strict oversight, said the Asian Development Bank in its latest Asian Development Outlook.

The government offers a 2.5 percent cash incentive for remittances sent through formal channels.

In March 2025, Bangladesh saw its highest-ever monthly remittance figure, reaching $3.29 billion.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.