is currently trading near 0.5248, hovering just above a key horizontal support zone around 0.5220–0.5200 that has acted as both support and resistance several times over the past few months. Price action has largely remained range-bound since mid-July, reflecting a period of consolidation following the sharp decline from the May highs near 0.5450.

The 15-day and 20-day moving averages are moving almost in tandem, both flattening out, which highlights the lack of strong directional momentum. This neutral alignment indicates that neither buyers nor sellers currently have clear control, and a breakout from the current range will likely determine the next major move.

On the upside, a daily close above 0.5300 would signal renewed bullish momentum, with potential upside targets at 0.5370, followed by 0.5450. Sustained closes above this region would suggest a shift back to an uptrend and open the way toward the 0.5500 handle.

On the downside, a break and daily close below 0.5200 would confirm bearish continuation, exposing lower levels at 0.5150 and possibly 0.5100, where previous buying interest emerged in June.

For now, the pair remains neutral within a tight consolidation zone. Holding above 0.5200 keeps the structure intact, but a decisive break in either direction — above 0.5300 or below 0.5200 — will likely set the tone for the next directional phase.

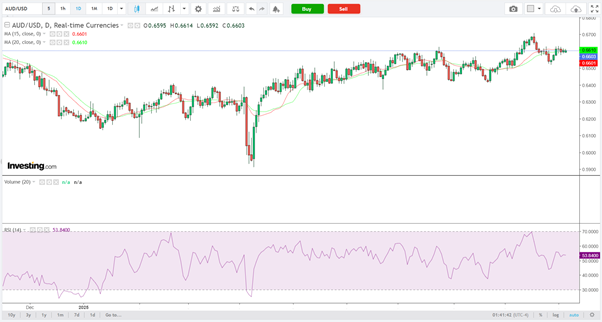

is currently trading near 0.6600, hovering just below a key horizontal resistance zone that has capped gains several times since July. The pair has been in a gradual recovery from its April lows near 0.6200, though the broader trend remains neutral to mildly bullish after an extended period of sideways consolidation.

The 15-day moving average is slightly above the 20-day moving average, both flattening out, suggesting momentum is fading after the recent rally toward the 0.6700 area. This alignment indicates that the pair is currently in a pause phase, awaiting fresh directional cues.

On the upside, a daily close above 0.6650–0.6700 would confirm a bullish breakout and open the path toward 0.6800, followed by 0.6900, where stronger resistance from prior swing highs is located.

Sustained closes above 0.6900 would reinforce a longer-term bullish reversal from the multi-month base.

On the downside, a failure to hold above 0.6550 would expose the pair to renewed downside pressure, targeting 0.6450, and potentially 0.6350, which represents a key demand zone from August.

For now, the pair remains range-bound below resistance, with 0.6600–0.6700 serving as the upper boundary. Holding above 0.6550 keeps the short-term bullish bias intact, but a breakdown below that level would confirm a deeper retracement within the broader consolidation structure.

is currently trading near 1.1738, consolidating just above the short-term support zone around 1.1700–1.1650 after retreating from the late-September highs near 1.1900. The pair remains in a broader uptrend, having steadily advanced since the March lows near 1.0600, but recent price action indicates a loss of momentum as buyers struggle to extend gains beyond the mid-1.18 region.

The 15-day moving average is marginally above the 20-day moving average, though both are flattening — reflecting a neutral to mildly bullish short-term outlook. The consolidation around the moving averages suggests that the market is pausing after an extended rally, awaiting new catalysts to define direction.

On the upside, a daily close above 1.1850 would confirm renewed bullish momentum, opening the path toward 1.1950 and the key resistance zone near 1.2050, where sellers are likely to re-emerge. Sustained closes above 1.2050 would reinforce the long-term bullish structure and expose 1.2150–1.2200 as the next targets.

On the downside, a break and close below 1.1650 would signal a deeper pullback, exposing supports at 1.1550 and 1.1450, where prior consolidation levels and the 20-day SMA converge.

For now, the pair remains broadly bullish but range-bound, with 1.1650–1.1850 serving as the key trading corridor. Holding above 1.1700 keeps the short-term bias tilted upward, while a breakdown below this zone would shift momentum in favour of a deeper corrective phase.

is currently trading near 1.3478, hovering just below a key horizontal resistance zone around 1.3550–1.3600, which has capped gains multiple times over the past few months. The pair has been trading sideways since August, consolidating within a broad range following its mid-year recovery from the 1.2600 region.

The 15-day SMA is slightly below the 20-day SMA, both flattening out — a signal of neutral momentum and indecision in the market. This suggests that traders are awaiting a clear directional catalyst, possibly from upcoming economic data or central bank commentary.

On the upside, a daily close above 1.3600 would confirm a bullish breakout, opening the path toward 1.3720 and 1.3850, where previous highs from June and July could attract renewed selling pressure. Sustained closes above 1.3850 would shift the broader structure back into an uptrend and expose 1.4000 as the next resistance.

On the downside, a break below 1.3350 would suggest renewed bearish control, exposing deeper support at 1.3200 and 1.3050, levels that previously acted as major demand zones earlier in the year.

For now, the pair remains in a neutral consolidation phase, with the 1.3350–1.3600 range defining short-term sentiment. Holding above 1.3350 keeps the potential for an upside breakout alive, while a failure to sustain this level would likely trigger a deeper retracement.

is currently trading near 1.3947, maintaining upward momentum after breaking out from its September consolidation zone around 1.3700–1.3800. The pair has been steadily climbing since late July, supported by rising short-term moving averages and sustained buying pressure.

The 15-day moving average remains above the 20-day moving average, signalling a continuation of the bullish bias. Momentum has strengthened in recent sessions, with price action staying consistently above both averages — a sign that dips continue to attract buyers.

On the upside, the immediate resistance lies around 1.4000–1.4050, a key psychological and technical barrier last tested in May. A clear daily close above this zone would confirm a bullish breakout, opening the path toward 1.4150 and potentially 1.4300 in the coming weeks.

On the downside, initial support is seen at 1.3850, followed by a stronger floor near 1.3730–1.3700, where the 20-day moving average currently sits. A sustained move below this level would signal weakening bullish control and could trigger a deeper pullback toward 1.3600.

For now, the bias remains bullish, with the trend structure and moving averages supporting further upside while price holds above 1.3800. A break above 1.4050 would confirm renewed bullish momentum toward the mid-1.41s.

is currently trading near 0.7952, consolidating in a narrow range after a prolonged downtrend that began in March. The pair remains capped below both the 15-day and 20-day simple moving averages, indicating that bearish pressure continues to dominate.

After months of gradual declines, the price action has flattened out, suggesting a potential base formation around the 0.7900–0.8000 zone. This level has acted as both support and resistance multiple times over the past few months, making it a key pivot area to watch.

A clear daily close above 0.8050 could hint at a short-term bullish reversal, targeting the next resistance levels around 0.8200 and 0.8350. However, the pair will need to sustain above the moving averages for confirmation of a trend shift.

On the downside, support sits at 0.7850, with further weakness likely to open the path toward 0.7700, the next significant low from early 2025.

Overall, the pair remains bearish-to-neutral, with momentum stalling but not yet reversing. Bulls will need to reclaim 0.8050–0.8100 for any sustainable recovery, while failure to do so keeps the downtrend intact toward lower lows.

is currently trading around 147.46, consolidating after a short-lived rally that peaked near 150.00 in late September. The pair remains largely range-bound, with the 15-day and 20-day simple moving averages converging tightly — reflecting a period of indecision between bulls and bears.

Price action since July shows multiple failed attempts to sustain momentum beyond 149.50, highlighting this area as a strong resistance zone. Meanwhile, the 146.00–145.50 range has provided consistent support, creating a clear sideways channel.

A decisive break above 148.50–149.00 could renew bullish momentum, potentially retesting 150.00–151.00, which remains a critical multi-month ceiling. On the downside, a close below 145.50 could trigger a short-term correction toward 143.50 or even 141.80, where buying interest last emerged.

Overall, the pair is neutral-to-bullish — the long-term uptrend remains intact, but momentum has weakened. Traders may watch for confirmation of a breakout from this consolidation range before positioning for the next directional move.

is currently trading near 17.18, sitting at its lowest levels since early 2024 and maintaining a clear downtrend that began after the April highs above 19.90. The pair has been steadily losing ground, with the 15-day and 20-day simple moving averages reinforcing persistent downside momentum.

Price action shows consistent lower highs and lower lows, confirming bearish structure. The zone between 17.10–17.00 has acted as a strong support, tested multiple times since August. A daily close below 17.00 would open the door for a further slide toward 16.75 and potentially 16.40, levels last seen in late 2023.

On the upside, resistance is layered around 17.45–17.60, where the short-term moving averages are converging. A sustained break above this region could trigger a corrective bounce toward 17.90, though the broader bias remains negative unless price reclaims the 18.00 handle.

Overall, the pair remains bearish, with sellers in control. A close below 17.00 would likely accelerate the decline, while only a break above 17.60 would hint at the start of a medium-term recovery.