CANADA – 2025/10/04: In this photo illustration, the Roblox Corporation logo is seen displayed on a smartphone screen. (Photo Illustration by Thomas Fuller/SOPA Images/LightRocket via Getty Images)

SOPA Images/LightRocket via Getty Images

Roblox stock (NYSE: RBLX) has fallen 9% in the past five trading days, fueled by a Wall Street analyst’s pessimistic assessment—citing slowing booking growth—and insider selling by a company director. Crucially, even after this dip, the stock remains relatively expensive. This high valuation, combined with a track record of only slow and modest rebounds from previous declines, points to a notable level of risk for investors. Consider the following data:

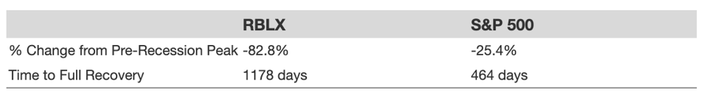

While we like to purchase dips if the fundamentals check out – for RBLX, see Buy or Sell RBLX Stock – we are cautious with falling knives. Specifically, it is important to evaluate if the situation worsens significantly, and RBLX falls another 20-30% to the $86 range, will we be able to maintain our position in the stock? What would be the worst-case scenario? We refer to this as downturn resilience. Interestingly, the stock has performed significantly worse than the S&P 500 index during various economic downturns. We assess this based on both (a) how much the stock declined and (b) how quickly it bounced back.

RBLX stock has recently dropped significantly, and we currently find it quite costly. Even though this may seem like an opportunity, considerable risk exists in depending on a single stock. Conversely, there is great value in a broader diversified approach we utilize with the Trefis High Quality Portfolio. It has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 91% since its inception. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Below are the details, but first, as a quick background: RBLX offers an online entertainment platform featuring free tools for developers to create, publish, and manage 3D experiences, serving customers worldwide across various regions.

2022 Inflation Shock

- RBLX stock dropped 82.8% from a peak of $134.72 on 19 November 2021 to $23.19 on 10 May 2022, in contrast to a peak-to-trough decline of 25.4% for the S&P 500.

- However, the stock fully rebounded to its pre-Crisis peak by 31 July 2025.

- Since that time, the stock climbed to a high of $141.56 on 29 September 2025, and is currently trading at $122.69.

RBLX Stock Performance During The 2022 Inflation Shock

Trefis

Concerned that RBLX might decline even further? You might want to check out the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.