Following a phase of strong outperformance many mid-cap stocks have been very volatile in 2025.

However, the mid-cap segment still provides great opportunities for investors as the companies tend to balance scalability, growth flexibility, and market resilience.

While small-caps are fraught with extreme volatility, and large-caps could provide moderate growth in a high-valuation period, mid-caps balance growth and risk.

Hence these stocks are considered a good option for long-term wealth generation.

Under the prevailing market scenario, where selective growth sectors such as private banking, consumption, and technology-related mid-caps are gaining traction, investors must look at funds that not only generate returns but also keep risk in check.

These measures like standard deviation, Sharpe ratio, and Sortino ratio are tools in this analysis. They help explain how a fund performs compared to the risk it assumes and provide investors with an understanding of protection against losses, portfolio risk, and consistent return generation.

By paying attention to these parameters, you can steer clear of funds that look appealing based on front-page returns but might leave them vulnerable to unnecessary volatility or drawdowns.

In this context, some mid-cap funds have distinguished themselves with their steady risk-adjusted returns. These funds enable investors to ride the growth path of mid-cap companies without experiencing the more extreme swings that could be present with small-cap investments.

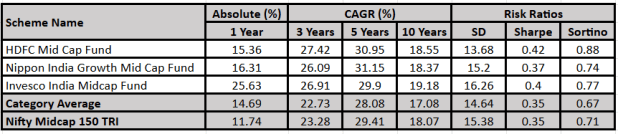

The 3 mid-cap funds mentioned in this editorial were identified by evaluation of 5-year rolling CAGR and risk metrics such as standard deviation, Sharpe ratio, and Sortino ratio.

#1 HDFC Mid Cap Fund

Launched in June 2007, HDFC Mid Cap Fund previously HDFC Mid-Cap Opportunities Fund, remains among the well-known names in the mid-cap segment.

Managed with a research-based, disciplined approach, the fund screens for high-quality mid-sized companies that may grow into market leaders of the future.

Rather than tracking fads or short-term momentum in the market, the fund takes a bottom-up stock-picking philosophy, focusing on business fundamentals, management effectiveness, and long-term earnings expansion.

During the last five years, the fund has yielded a rolling CAGR of 31.15%, highlighting its potential to generate premium risk-adjusted returns.

Good numbers like a low SD of 13.68, good Sharpe ratio (0.42) and Sortino ratio (0.88) ratio further establish its reliability in rewarding investors without taking too much risk.

As of September 2025, the fund has assets under management (AUM) of Rs 848.54, with exposure of about 65–70% in mid-caps, augmented by selective exposure to largecaps and smallcaps for liquidity and tactical allowance.

Its major holdings include Max Financial Services (4.76%), Balkrishna Industries (3.54%), and Indian Bank (3.26%), representing a blend of cyclical recovery themes and structural growth opportunities.

Sector-wise the allocation is tilted towards automobiles & ancillaries (16.33%), banks (13.35%), and healthcare (12.55%).

#2 Nippon India Growth Mid Cap Fund

Nippon India Growth Fund is one of the oldest mid-cap funds in India with a robust tradition of beating the market over market cycles.

Its inception in October 1995 has seen the scheme navigate various economic cycles, keeping its emphasis on discovering quality mid-sized companies with long-term growth visibility, enhancing profitability, and scalable business models.

The fund is picks stocks based on a growth-oriented, bottom-up stock-picking strategy, searching for businesses that are poised to be future largecaps.

This strategy enables it to tap the India growth story through nascent leaders in industries like industrial manufacturing, financial services, auto components, and consumer discretionary, which continue to pick up momentum in today’s economic landscape.

In the last five years, Nippon India Growth Fund has provided a rolling CAGR of more than 31%, backed by a standard deviation of 15.2, Sharpe ratio of (0.37), and Sortino ratio of (0.74).

As of September 2025, the fund has AUM of about Rs 393.28 bn, with more than 70% allocation to mid-cap stocks, supplemented by judicious large-cap holdings for absorbing volatility.

Notable positions include Fortis Healthcare (3.33%), BSE (2.64%), and Cholamandalam Financial Holdings (2.55%), which represent a blend of cyclical and secular growth stories.

What distinguishes Nippon India Growth Fund is its long-term consistency and research-driven portfolio construction, enabling it to remain resilient even in turbulent market phases.

#3 Invesco India Midcap Fund

Invesco India Midcap Fund, which is renowned for its consistent generation of alpha and rigorous risk management style.

The fund aims to invest in mid-sized companies with sustainable competitive advantages, scalable business models, and robust balance sheets, seeking superior returns over the long term with reduced volatility.

Unlike several peers which might place concentrated bets, Invesco India Midcap Fund operates on a well-diversified, bottom-up style of investment, merging growth, and value ideas.

This style enables it to spot opportunities across sectors with a thorough emphasis on fundamentals and valuation discipline.

In the period of the last five years, the fund has produced a rolling CAGR of 30.95% with a modest standard deviation and robust Sharpe ratio, demonstrating its potential to outperform the benchmark on a risk-adjusted return basis.

The fund’s steady compounding has been aided by its selective exposure to high-potential sectors such as financials (21.14%), healthcare (18.34%), and retailing (14%), where mid-sized firms benefit from domestic economic expansion and rising consumption.

As of September 2025, the fund manages an AUM of Rs 85.18 bn, with over 70% exposure to mid-cap stocks, alongside limited allocations to largecaps for liquidity and smallcaps for tactical growth.

Key portfolio holdings include Swiggy (5.14%), AU Small Finance Bank (5.09%), and L&T Finance (4.9%), representing a thoughtful balance of cyclical and structural growth plays.

Conclusion

In an environment where investors are oscillating between optimism and fear, risk-adjusted performance is the real measure of a fund’s strength.

The mid-cap space continues to present interesting opportunities, but investors must be able to distinguish between funds that deliver high returns by virtue of being aggressively positioned and those that combine growth with stability.

Disciplined risk management, quality stock selection, and conviction over the long run could lead to wealth creation without subjecting investors to excessive volatility.

While historical returns are never an indicator of future outcomes, a robust risk-adjusted performance history tends to show that the fund manager is adept at taking advantage of shifting market cycles.

For investors contemplating exposure to mid-caps in 2025 and beyond, it should not be about chasing top-performing midcap funds but about those that meet one’s investment horizon, risk tolerance, and financial objectives.

Table Note: Data as of October 13, 2025

The securities quoted are for illustration only and are not recommendatory

Past performance is not an indicator for future returns.

Returns are on rolling CAGR basis and in %. Direct Plan-Growth option.

Those depicted over 1-Yr are compounded annualised.

Risk ratios are calculated over a 3-year period assuming a risk-free rate of 6% p.a.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.