The just hit its weakest level since January against the , catching currency traders off guard. Wall Street’s top research desks predicted it would strengthen. The models said it should strengthen. So what went wrong?

Everything, if you’ve been using the same currency playbook since 1995.

For three decades, currency traders relied on one elegant principle: interest rate parity. If US are higher than European rates, the dollar should weaken to offset that advantage. Investors get the higher yield, but pay for it in currency depreciation. It’s been the foundation of every international portfolio hedging strategy.

In 2025, that rule stopped working.

By traditional models based on interest rate differentials, the euro should be trading around 1.08-1.10 against the US dollar. Instead, it’s trading at 1.1558, roughly 5 cents higher than what interest rate parity would predict.

The Federal Reserve’s target rate of 3.75-4.00% remains well above the ECB’s 2.00% deposit rate, creating a roughly 2-percentage-point yield advantage for the dollar. Yet the dollar weakened 10% in the first half of 2025, marking its worst first-half performance since 1980.

This matters because billions in currency derivatives, pension fund hedges, and international investment decisions are built on the assumption that interest rates drive currencies. If that assumption is broken, your portfolio hedging strategy might be dangerously wrong.

How the 30-Year Model Dominated Finance

Interest rate parity became the backbone of currency forecasting because it was elegant, theoretically sound, and quite accurate for three decades. The logic is that higher interest rates attract foreign capital. More demand for dollars means a stronger currency. The stronger dollar offsets the interest rate advantage. Therefore, interest rate differentials mean future currency movements.

This theory dominated from the mid-1990s through 2020. Pension funds set international hedging ratios based on it. Hedge funds have built billions in leverage assuming the model would eventually correct mispricings. Every finance textbook made it a core requirement.

The evidence really seemed brassbound. In 2015, when the ECB cut rates deeper than the Fed, the euro weakened as predicted. In 2018, when the Fed hiked, the dollar strengthened as expected. From 1998 to 2002, when Japanese rates were near zero while US rates were elevated, the consistently weakened.

By 2024, interest rate parity was so embedded that most participants didn’t even realize they were using it. It was simply “how currencies work.”

Then came 2025.

What Broke: The Evidence

The relationship between interest rates and currency movements decoupled sharply:

The Interest Rate Differential:

- US Fed funds rate: 3.75-4.00%

- ECB deposit rate: 2.00%

- Differential: ≈ 2% favoring the US

What the Model Predicted: The US Dollar should strengthen

What Actually Happened: Dollar weakened to 1.1558

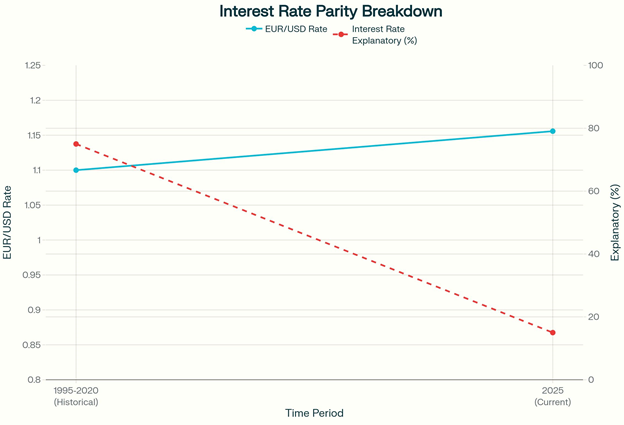

ClearBridge strategists noted that “currency models that focus on interest-rate differentials have broken down recently.” J.P. Morgan’s research team confirmed that “rate spreads now explain only about 15% of EUR/USD moves.”

A model that explained three-quarters of currency movement dropped to explaining one-quarter. This was a structural collapse, not noise.

The April 2025 currency shock proved it. Even when markets panicked and volatility spiked (when higher yields should attract capital) the dollar fell. Foreign investors didn’t flee US assets because of lower rates. Instead, they hedged their dollar exposure through currency derivatives, depressing the dollar through financial mechanics rather than asset sales.

Meanwhile, foreign investors continued buying US Treasuries at a record pace ($147 billion in May 2025 alone). But they simultaneously hedged 80% of their US equity ETF inflows, up from 20% at the start of the year.

The paradox was that foreigners want US assets; however, they’re just unwilling to take unhedged currency risk. Interest rate models can’t explain this.

Interest rate differentials now explain only 15% of EUR/USD movements, down from 75% historically: Despite a 2% yield advantage for the dollar, the euro strengthened to 1.1558 in 2025.

The Four Factors That Actually Drive Currencies Now

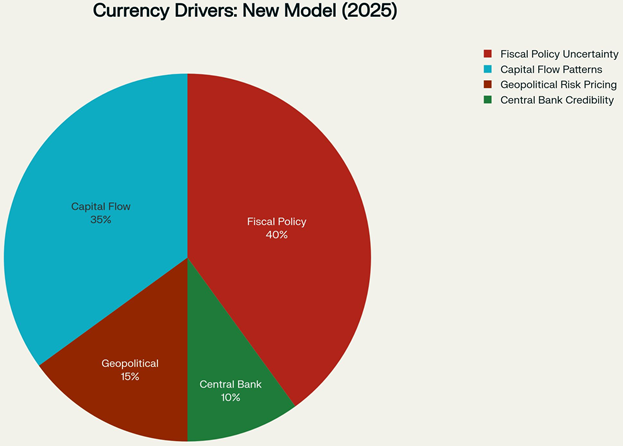

The fundamental assumption of interest rate parity was that capital flows freely and currencies adjust smoothly. Neither happened in 2025. Instead, four factors now dominate:

1. Fiscal Policy Uncertainty (40% of currency moves)

US deficit concerns make long-term USD assets risky. European fiscal stability looks better, even with lower rates. And when the fiscal trajectory looks unsustainable, no amount of higher yields compensates for long-term currency risk. Investors take lower yields and stable policy over high yields and fiscal chaos.

2. Capital Flow Patterns (35% of currency moves)

Foreign investors reduce dollar exposure through hedging, not asset sales. Cross-currency basis spreads (the cost of swapping one currency for another) widened significantly. When hedging is expensive, nervous money signals it’s reducing exposure. That pushes currencies down.

3. Geopolitical Risk Pricing (15% of currency moves)

Currency strength also reflects confidence in the rule of law and policy stability. Policy uncertainty (and not interest rate uncertainty) drives expectations. Headlines about constant negotiations created capital flow volatility independent of Fed moves.

4. Central Bank Credibility (10% of currency moves)

When Fed Chair Powell said the next rate cut is “not a foregone conclusion,” markets repriced, but not as interest rate theory predicted. Investors were already hedged, so guidance didn’t shift capital flows as the old model would suggest.

Fiscal policy is now the dominant force behind major currency moves, accounting for 40% of all changes: Capital flow patterns, not interest rates, drive 35% of currency action in 2025.

What This Means for Your Money

If your international hedging is built on interest rate parity, it’s subtly wrong.

Scenario 1: Pension Fund

You assumed US rates stay 50 basis points higher, keeping the dollar strong. You hedged 70% of international equity exposure. Fiscal concerns pushed the dollar down anyway. You’re now over-hedged, dampening returns while not protecting against real risks, sudden foreign capital reallocation, and policy uncertainty. You hedged the wrong thing.

Scenario 2: Carry Trade

Borrow in yen (0% rates), invest in US Treasuries (4.5% rates). The yen should weaken to offset the advantage. Instead, it strengthened. Capital flows dominated interest differentials. Leveraged funds suffered massive losses believing in outdated theory.

Scenario 3: Corporate Treasurer

Your euro exposure was supposed to hedge itself based on rate differentials. But EUR/USD is now driven by capital flows and fiscal policy. You’re exposed to currency moves your old models never accounted for.

Traditional risk models are now blind to currency tail risk. Currency volatility could spike for reasons unrelated to interest rates, and your hedges won’t protect you.

What Replaces Interest Rate Parity?

Successful currency managers in 2025 focus on four things:

Monitor Fiscal Health — Track deficit trends, debt-to-GDP, and reform likelihood. US fiscal deterioration is a structural currency headwind. This is now your primary currency indicator.

Track Capital Flows — Monitor Treasury data, hedge fund positioning, and basis spreads. Expensive hedging means foreigners are defensive on the currency.

Price Geopolitical Risk — Currency strength reflects policy stability. Uncertain governance trades weaker than fundamentals suggest, regardless of rates.

Assess Central Bank Credibility — Does the Fed follow through? Is the ECB credible? Credibility now matters more than rates.

What You Should Do Now

Avoid using historical interest rate models. Any forecast built on 1995-2020 data is outdated.

Build a fiscal health dashboard. Track debt-to-GDP and deficit trends. Make this your primary currency indicator, not Fed rates.

Monitor foreign investor positioning. Track Treasury International Capital data. When foreigners reduce hedging ratios, dollar weakness typically follows.

Make hedges dynamic. Stop static 10% currency hedges. If foreigners are 80% hedged versus 20% a year ago, that’s a regime shift requiring rebalancing.

Stress test capital flow reversals. Model what happens if foreigners reduce US equity holdings by 20%. That’s your real risk.

The Bigger Picture

Interest rate parity breaking down signals structural geopolitical fragmentation. In the old world, capital flowed smoothly to highest yields. Currencies adjusted frictionlessly based on rate differentials.

In 2025, that’s gone. Capital flows are increasingly geopolitical. Currency movements reflect policy uncertainty more than rates. Hedging is expensive. Central banks are no longer neutral.

This suggests a decade where currency volatility is structurally higher, where currency diversification works less reliably, and where geopolitical events move currencies dramatically.

The traders and portfolio managers who build models around fiscal sustainability, capital flows, and policy credibility will have a structural advantage for the next five years. Those using the old playbook will be flying blind.

Key Takeaways

- Interest rates no longer predict currency moves at past levels of accuracy. In 2020, they explained about 75%; now about 15%.

- Fiscal policy is now a dominant driver. US deficits can outweigh higher yields.

- Foreign investors are buying US assets while hedging the dollar. They want exposure to assets, not the currency.

- The new model: capital flows, fiscal health, and policy credibility. Rate differentials now take a backseat to these factors