Investing in Halozyme Therapeutics is a compelling way to gain exposure to the broader healthcare and biotechnology industries.

Over the last three months, the S&P 500 healthcare sector has risen 13%, compared to the broader S&P 500 index’s 7% increase.

However, one stock that hasn’t matched its sector’s returns is Halozyme Therapeutics (HALO +0.60%). Down 9% over the last few months, here’s why Halozyme is a great buy right now.

Today’s Change

(0.60%) $0.38

Current Price

$63.33

Key Data Points

Market Cap

$7B

Day’s Range

$62.59 – $63.98

52wk Range

$46.26 – $79.50

Volume

1.6M

Avg Vol

2.2M

Gross Margin

78.83%

Dividend Yield

N/A

Halozyme keeps building upon its dominance

Halozyme is the “go-to” solution for subcutaneous (SC) drug delivery thanks to its ENHANZE technology. With over 1 million patients served, Halozyme enables the SC delivery of drugs and fluids that would otherwise require an intravenous infusion. This SC delivery method often reduces the process from hours to minutes, saving time for 97% of its patients.

Image source: Getty Images.

Naturally, this success means the company is partnered with a who’s-who list of pharma giants, as evidenced by Halozyme’s 38% annualized sales growth rate over the last decade.

That said, the company’s core ENHANZE patents expire in the United States in 2027 and in the European Union in 2029. Hence, the market continues to rein in the stock’s valuation due to this overhang.

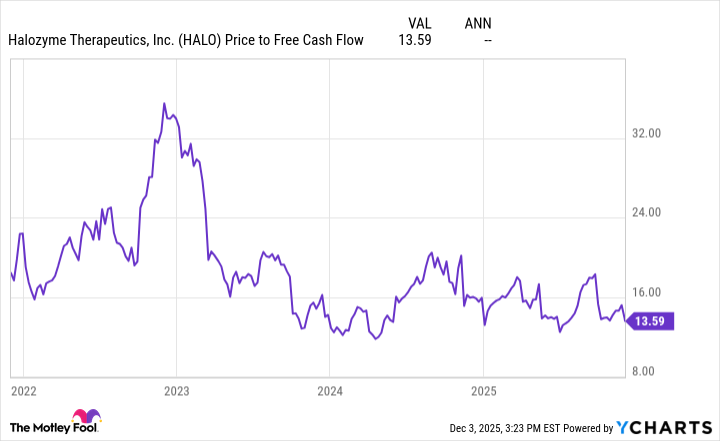

HALO Price to Free Cash Flow data by YCharts

However, I believe the company has done a great job diversifying away from its reliance upon ENHANZE.

First, Halozyme recently closed its $750 million acquisition of Elektrofi, rounding out its offerings in the drug delivery space. Elektrofi’s best-in-class Hypercon offering complements Halozyme’s products well, as it enables ultra-concentrated formulations via SC delivery. Hypercon’s intellectual property extends until 2040, rejuvenating the company’s growth trajectory.

Similarly, Halozyme acquired Antares Pharma in 2022 for $960 million, adding the latter’s autoinjector technology and further diversifying the company’s offerings, which in some cases allow for at-home, self-administered therapies.

Sporting a cash return on invested capital of 31%, Halozyme has proven exceptional at allocating its ample free cash flow (FCF) to new acquisitions, while repurchasing shares at a discount.

With the shares trading at just 14 times FCF, I believe Halozyme is a good bet to survive the patent cliff it faces in 2027 and 2029, as it continues to profitably diversify.