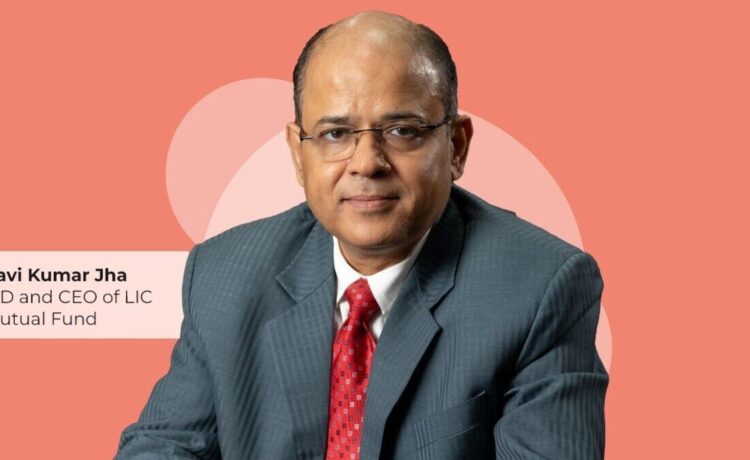

In an interview with MintGenie, Ravi Kumar Jha, MD and CEO of LIC Mutual Fund, who started as an LIC Assistant Administrative Officer in 1989, talks about his plans for digital expansion, branch network growth, and integrating LIC agents into a broader financial services model.

Edited Excerpts:

Could you share a bit about your career and how it’s prepared you for your role as MD and CEO of LIC Mutual Fund?

I began my career with LIC in 1989 as an Assistant Administrative Officer. Throughout the years, I have held various positions, including roles in marketing and investment. Notably, I previously served as the Chief Marketing Officer (CMO) at LIC Mutual Fund. My diverse experience, particularly my time as CMO at LIC Mutual Fund, has provided me with a comprehensive perspective that has prepared me to effectively lead LIC Mutual Fund.

Considering the limited time before your retirement, how do you plan to impact LIC Mutual Fund?

The focus is on quality rather than the quantity of time. Despite having a relatively shorter timeframe, I’m blessed with a strong team and support system in place. We’re implementing various strategic changes to expand services, enhance digital offerings, and increase our branch network. The goal is to further strengthen our vision “To be a trusted partner in wealth creation and a mutual fund of choice” for our investors.

What specific initiatives are you leading to drive this growth?

We’re running several initiatives: first, focus on performance; second, increase investor awareness to educate potential investors on the benefits of mutual funds; and third, strengthen our digital infrastructure. This includes launching a mobile app, revamping our website for a better user experience, and planning a distributor app to enhance our sales and distribution network.

With the rise of digital platforms, how important are physical branches to your strategy?

I have had the opportunity to visit several cities, including Udaipur, Jodhpur, Hyderabad, Jamshedpur, and Ranchi. Throughout my travels, one common theme emerged: the presence of physical branches significantly boosts the confidence of both mutual fund distributors and investors.

It is the small gestures, such as providing a space for people to drop in for a casual conversation, that truly make a difference. The ability to address concerns in person fosters a deeper level of commitment and engagement from our clients.

Taking this valuable feedback into consideration, we have set our sights on an ambitious goal: to establish more branches within the next five years. While this plan may be challenging, we are enthusiastic about the opportunity it presents to further connect with our investors and distributors on a more personal level.

Considering the large community of LIC agents, are there plans to engage them more actively as mutual fund distributors (MFDs) to broaden financial services, despite the potential challenges in convincing them due to the different commission structures between selling insurance and mutual funds?

Yes, we’re actively working to incorporate LIC agents into our network of mutual fund distributors, leveraging this vast community to offer a wider range of financial services. A significant number of our distributors already come from the LIC agent community. We encourage our branches to engage more LIC agents, promoting a comprehensive financial service model where agents can provide both LIC policies and mutual fund investments. We’re aware of the initial hesitations agents might have due to the different reward structures between selling insurance and mutual funds.

However, we address these concerns by highlighting the benefits of offering a diversified portfolio. This approach not only retains clients who might seek mutual fund investments elsewhere but also enhances the agent’s role as a full-service financial distributor. Our experience shows that, with proper understanding and support, many agents come to see the value in this model and embrace the opportunity to expand their offerings, benefiting themselves and their clients over the long term.

What marketing strategies are in place to attract more investors?

We are focusing on both traditional marketing and digital marketing strategies to grow our AUM. We are increasing our tie-ups with various banks, and national distributors to distribute our products. We have also empanelled good number of MFDs and are regularly in touch with them to focus on sale of SIPs and Lumpsum contribution in our schemes. In digital marketing, we run social media campaigns, create content like authored articles and blogs. We have also created a lot of content like videos, leaflets in 10 regional languages so that we can reach the hinterland of the country. This helps expand our investor base and increase our assets under management.

Looking ahead, how do you plan to enhance LIC Mutual Fund’s position in the equity and debt market segments?

Historically, our focus was predominantly on the debt segment, but over the past five years, we’ve shifted our emphasis towards equity funds and their Assets under Management (AUM). Impressively, in this period, our equity AUM has surged ~3 times. Consequently, we’re further intensifying our efforts in the equity segment, aiming to increase our AUM through targeted marketing campaigns.

Regarding New Fund Offerings (NFOs), after the schemes of IDBI Mutual Fund merged with us on 29th July 2023, which brought 20 schemes under our umbrella, the merger nearly filled our product basket, as outlined by SEBI circular on fund categorization, leaving us with limited room for new launches. Our immediate focus was on integrating and optimising the IDBI Mutual Fund schemes and adjusting portfolios to align with our investment strategies.

This year, we’ve held off on launching the NFO of active funds to concentrate on boosting assets in the existing equity funds. However, we did venture into the passive investment space with the launch of ETF NFO. However, we are positive that we’ll launch more active and passive funds in the near future as per the market requirements.

Padmaja Choudhury is a freelance financial content writer. You can reach out to her at [email protected].

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!