Amid the Federal Reserve’s nuanced approach to monetary policy, high-yield bond mutual funds are emerging as attractive investment avenues, offering a blend of risk and return that appeals to a broad spectrum of investors. Unlike their investment-grade counterparts, these bonds, often associated with smaller companies in less stable financial situations, stand to benefit significantly as the economy strengthens. This narrative is particularly relevant as the Federal Reserve signals a potential slowdown in its aggressive rate hikes, casting a favorable light on the high-yield bond market.

Understanding High-Yield Bonds

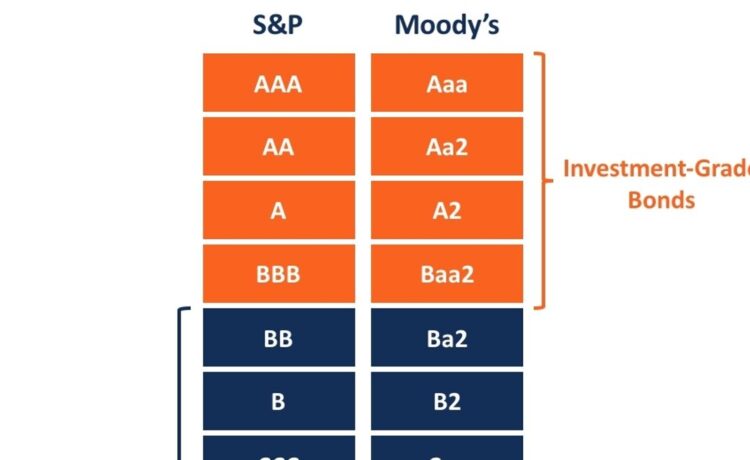

High-yield bonds, with their substantial holdings in smaller, financially weaker companies, behave more akin to stocks than to investment-grade bonds. This characteristic makes them less susceptible to interest rate risks but more exposed to credit risk. However, their differentiated return source has kept them in the spotlight, especially with the Federal Reserve’s recent hints at moderating its pace of monetary tightening. This shift has rejuvenated interest in high-yield bond mutual funds, such as the Fidelity Advisor Floating Rate High Income FFRAX, Payden High Income PYHRX, and American Funds American High-Income AHITX, each boasting a Zacks Mutual Fund Rank 1 (Strong Buy).

Spotlight on Top Performers

The Fidelity Advisor Floating Rate High Income fund focuses its investments on a mix of domestic and foreign debt securities of lower quality, alongside floating-rate securities and money-market instruments. With a strategic emphasis on fundamental analysis, including financial condition and market position, FFRAX has delivered a three-year annualized return of 5.3%, holding 62.1% of its assets in miscellaneous bonds as of October 2023.

Meanwhile, the Payden High Income fund diversifies its assets across various debt instruments and income-producing securities, primarily in corporate debts rated below investment grade. With an expense ratio significantly lower than the category average, PYHRX has managed a three-year annualized return of 3.3%, demonstrating its efficiency and performance prowess.

The American Funds American High-Income fund invests predominantly in high-yielding, low-quality debt securities of both domestic and foreign issuers. Managed by Tara L. Torrens since May 2015, AHITX has shown a consistent performance with a three-year annualized return of 2.9%, reflecting the fund’s strategic investment choices and risk management capabilities.

Looking Ahead

As the financial landscape evolves with the Federal Reserve’s monetary policy adjustments, high-yield bond mutual funds stand out as compelling options for investors seeking to balance risk and reward. Fidelity Advisor Floating Rate High Income, Payden High Income, and American Funds American High-Income funds exemplify the potential of high-yield bonds to offer differentiated returns, particularly in a recovering economy. With their strong performance records and strategic investment approaches, these funds are poised for continued success in 2024, offering investors a robust platform to enhance their portfolios amidst uncertain times.