Image © Adobe Images

The Dollar is on a charge, backed by consensus-beating U.S. data that means the U.S. Federal Reserve will likely cut interest rates after the Bank of England and European Central Bank.

The Pound to Dollar exchange rate fell to 1.2544, the lowest level since February, after the U.S. ISM manufacturing PMI rose to 50.3 in March from 47.8 in February, comfortably beating expectations for a figure at 48.4.

The report also suggested that inflationary pressures facing U.S. companies were increasing again, with the prices paid component of the report shooting higher to 55.8, exceeding estimates for 52.6.

Market expectations for a June Federal Reserve rate cut declined following the data release, boosting U.S. yields and the Dollar.

The USD strengthened on the strong ISM Index, says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank; “strong US growth may allow the Fed to keep the federal funds rate at its current high level for longer than the market has previously assumed.”

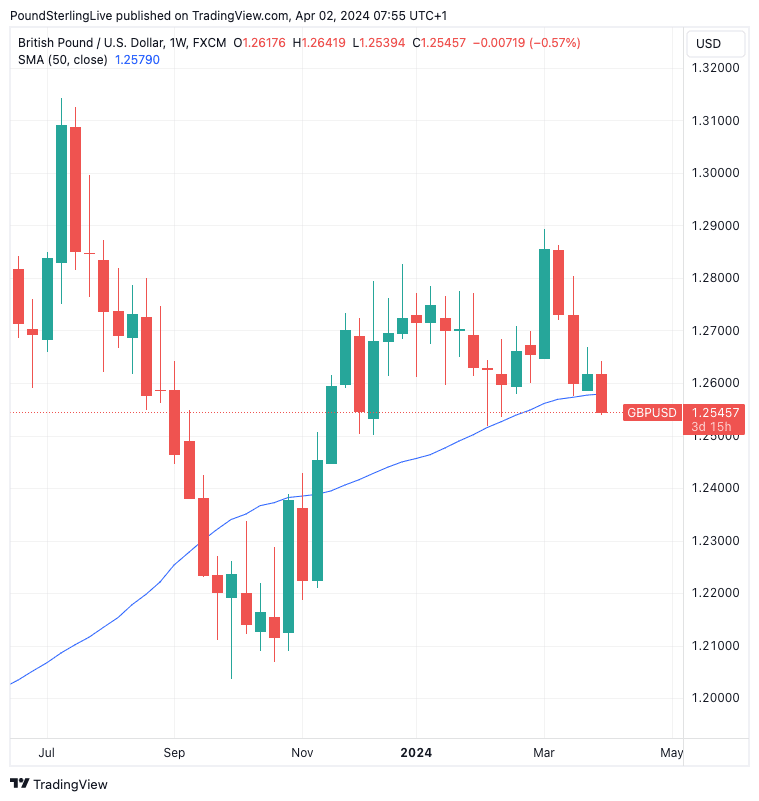

The development reinforces a growing downtrend in the Pound-Dollar exchange rate which has now broken below its 50-week moving average:

Above: GBP/USD at weekly intervals showing a test of ~1.25 could be on the cards. Track GBP/USD with your own custom rate alerts. Set Up Here

The above chart suggests the 50-week MA was offering support to Pound-Dollar, and we are now on notice that a more protracted downtrend might be brewing.

That said, daily support comes in at the February lows at approximately 1.2517, which is the level we are watching in the coming week.

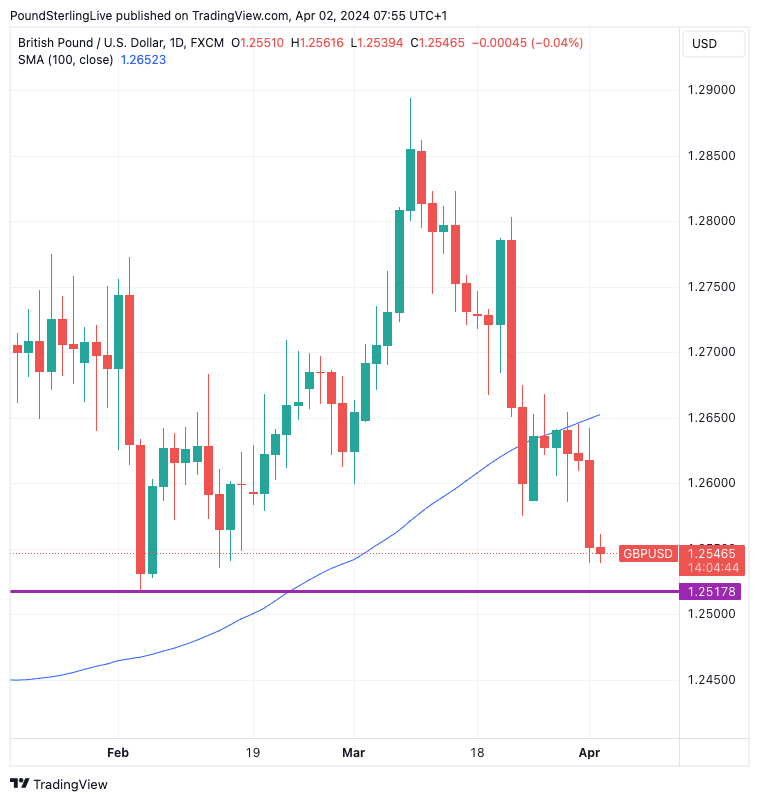

Near-term upside will be capped by the 100-day moving average, currently located at 1.2652, which has limited Pound Sterling’s upside potential since March 22.

Above: GBP/USD at daily intervals.

“Amidst the stronger US data at the start of the week, the British pound has broken below some key moving averages against the US dollar in a bearish move which signals the potential for a deeper drop in GBP/USD in the short term,” says George Vessey, Lead FX Strategist at Convera.

“The currency pair has fallen almost 3% from its 7-month high recorded in early March and is close to testing its 2024 lows nearer $1.25. Hopes for $1.30 trading this spring are fast evaporating,” he adds.

Looking ahead to this week’s agenda, the ISM services PMI, job openings and the non-farm payrolls report will be closely watched, as will a number of Fed officials.

It is worth noting that April is typically favourable for the British Pound, and analysts say that the currency can yet appreciate against the Euro and Dollar.

“April ranks among the best months of the year for the pound thanks to the repatriation by corporates of overseas FX for dividend payments. The average percentage monthly gain of the last ten years in April is 0.8%. The standard deviation is 2.2%,” says Kenneth Broux, a foreign exchange analyst at Société Générale.

Kamal Sharma, FX Strategist at Bank of America, says, “April is the sweet spot for GBP. If history is any guide, a test of $1.30 in GBP/USD is likely.”

However, past performance is by no means a fixed guide to future developments, and there is a risk that April 2024 will be a down month owing to the booming U.S. economy and elevated odds that the Bank of England will cut interest rates before the Fed does.