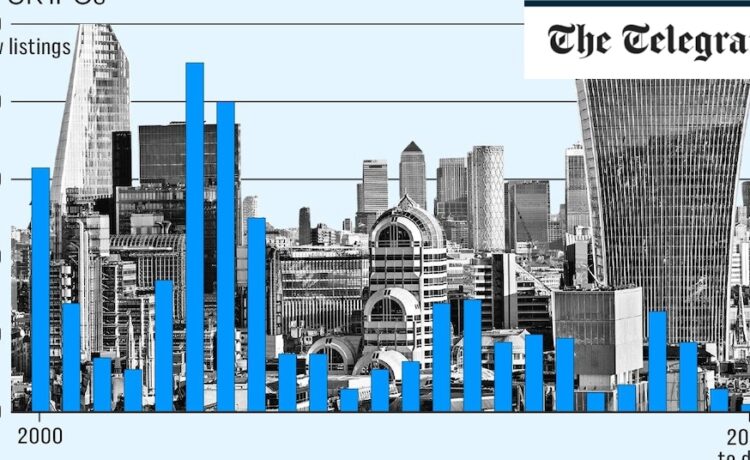

However City fund manager Gervais Williams, who heads equities at Premier Miton, said a string of IPO duds had left many sceptical about the quality of new listings.

“We’ve had a series of pretty rubbish IPOs,” he said.

“Whatever reason it isn’t working as well as it could do, especially given that supposedly we’re high grading the IPOs, given there aren’t that many of them.”

Significant IPOs in the London market, such as CAB Payments, have burned many fund managers. The stock, seen as a possible catalyst for a listing revival last year, has fallen 60pc since floating.

Looking ahead, the prospects of London attracting significant IPOs in future looks uncertain.

The possible listing of Unilever’s ice cream division could be a candidate for London, but chief executive Hein Schumacher recently said that Amsterdam was in the lead for any listing.

CVC, the private equity firm behind the Six Nations rugby tournament, is also set to list in Amsterdam rather than London in another major blow for the capital.

Flutter Entertainment is due to change its primary listing to New York from London following similar moves from companies including TUI, which shifted its main listing to Frankfurt.

Alongside this, a drumbeat of other candidates could follow.

Last week analysts at Deutsche Bank said FTSE 100 commodity trading giant Glencore could be the next company to up sticks from London and transfer to New York.

The group had already planned to spin out its coal unit and list this in New York rather than London, prompting speculation that the whole business could up sticks from London.

However, Mr Williams said there was still fund manager demand for good companies, citing the possible float of Raspberry Pi as a possible catalyst for more issues.

“I don’t think the market is entirely closed at all,” he said. “Clearly you’ve got to have some great issues and I think if you get two or three good issues then the market will open up again.”