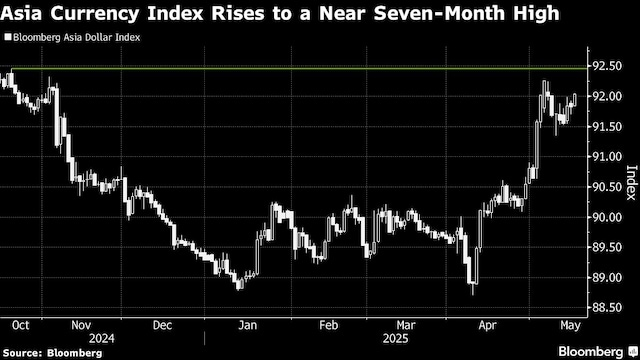

First, the likelihood of US President reaching trade deals with multiple countries he’s imposed tariffs on has raised the risk appetite in the market for other currencies considered less safe than the greenback. At the same time, the slump in the US economy has increased the odds of interest rate cuts by the US Fed. Will these trends continue? If yes, for how long?

“I would still expect there to be some, at least, you know, risk and uncertainty hanging over those Asian currency markets as that that situation on tariffs and what will the US eventually roll out? I think that will still weigh over those currency markets. Having said that, our forecast has for a long time been that, if you look at, say, a three year period, we expect most Asian currencies to strengthen against the US dollar,” Louis Kuijs, Chief Economist APAC at S&P Global Ratings, told CNBC-TV18.

Mitul Kotecha, Head of FX & EM Macro Strategy Asia at Barclays, shares a similar view. “I think if you could see a big repatriation of this money coming back into Asia, yes, there could be some severe strength, significant strength, in Asian currencies,” he added while warning against cyclical forces acting against the tide intermittently.

Essentially, while the rationale for the weakening of the dollar is clear, it isn’t certain that it would be a one way ride up for Asian currencies. The fear of volatility is still very strong in the market despite Trump’s stated position that he wants the dollar to be weaker so that it can make American products more competitive in the global markets.

For the first time in 15 years, the correlation between the US dollar and a widely-watched gauge of volatility in Group-of-10 currencies fell to the lowest level in seven years this week, according to Bloomberg data. It shows that the market is preparing for wilder swings in the currency markets.

The market isn’t betting one way because other governments have similar wishes of their own. Both Japan and South Korea are reportedly in talks, hoping to convince Scott Bessent, the US Secretary for Treasury, that they may let the currency strengthen but not by too much.

Despite the thaw between the US and China, it isn’t clear if Xi Jinping will allow the yuan to appreciate at the cost of the Chinese economy. “Our view is still that we will see some depreciation of the yuan in the months ahead. We think that the currency is still one of the release valves of economic pressure, along with more fiscal stimulus and more monetary stimulus,” Kotecha explained.

Similarly, the Reserve Bank of India may also not allow an unhinged rally in the value of the rupee against the dollar. “I think we’re finding a sort of base around this sort of 85 level for dollar rupee. You know, we have seen some improvement in competitiveness more in the last few months,” Kotecha added.

India, too, in on the path to lower interest rates, which would weigh on the rupee. Kuijs expects the RBI to lower the repo rate by another 75 basis points before March 2026. That would take the benchmark lending rate to the lowest since August 2022.

For the entire discussion, watch the accompanying video