- US business activity fell in August as the manufacturing sector contracted.

- Powell confirmed that the Fed will likely cut rates in September.

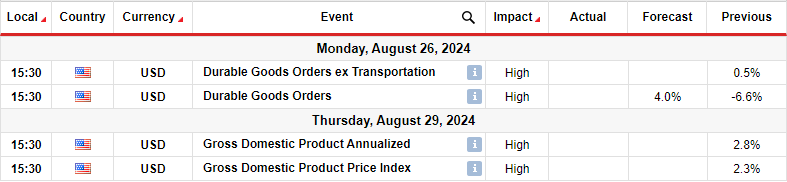

- Next week, investors will focus on US core durable goods orders and the Gross Domestic Product.

The AUD/USD weekly forecast is bullish. The Australian dollar has strengthened against the dollar following Powell’s confirmation of a September rate cut.

Ups and downs of AUD/USD

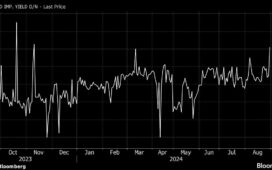

The Aussie had a bullish week as the dollar plunged amid an increase in Fed rate cut expectations. The Fed minutes on Wednesday revealed that some policymakers were confident enough to start cutting interest rates at the last meeting. However, the majority decided to hold and wait for September. Moreover, data during the week showed further weakness in the US economy. Business activity fell in August as the manufacturing sector contracted. This slowdown was evidence that high interest rates were hurting demand.

-Are you interested in learning about forex live calendar? Click here for details-

On Friday, the dollar plummeted after Powell confirmed that the Fed will likely cut rates in September. According to the Fed chair, the upside risks to inflation have fallen while the downside risks to employment have increased.

Next week’s key events for AUD/USD

Next week, investors will focus on US core durable goods orders and the Gross Domestic Product. The core durable goods orders will show the state of demand. The previous report showed orders falling by 6.6%. However, economists predict a 4.0% increase in orders this month.

Meanwhile, the GDP report will significantly shape the outlook for Fed rate cuts as it will show how the economy is faring. A growing economy will further ease recession fears and give the Fed time to lower interest rates gradually. On the other hand, a weak economy might prompt the Fed to consider more significant rate cuts, further weighing on the US dollar.

AUD/USD weekly technical forecast: Bulls approach the 0.6700 resistance

On the technical side, the AUD/USD price has made a bullish engulfing candle after breaking above and retesting the 0.6550 key level. This is a sign that the bulls are in the lead. Moreover, the price sits far above the 22-SMA, with the RSI nearly overbought.

-Are you interested in learning about forex signals? Click here for details-

However, bulls are facing the 0.6700 solid resistance level. A break above will strengthen the bullish bias. Moreover, it will allow the price to revisit the 0.6800 critical psychological level. On the other hand, if the level holds firm, the price might retest the 22-SMA before continuing on its uptrend or breaking below.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money