DXY continues its rebound as the world restocks US assets.

AUD is holding support.

Lead boots too.

Advertisement

Gold look very shaky. Thankfully, so does oil.

Metals are nervous about growth.

Miners meh.

Advertisement

EM is shit. But non-China EM is worth a look.

Junk’s got some spunk.

Advertisement

Yields are a pest. Any higher and the rally will hit turbulence.

BTFD!

Advertisement

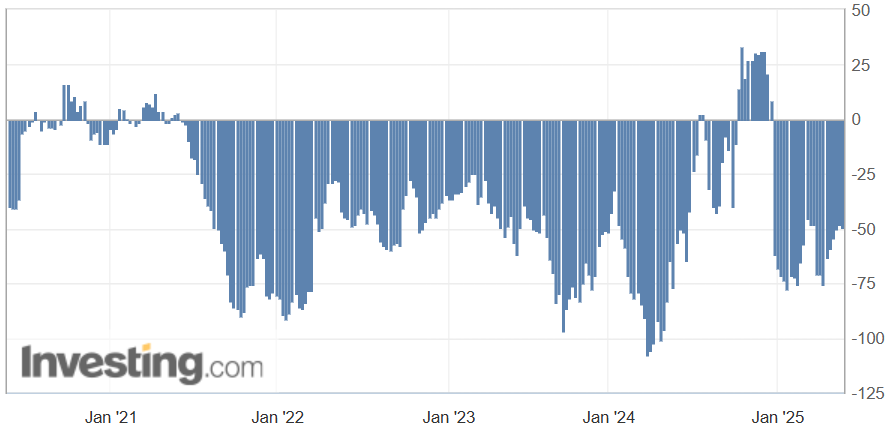

AUD bears are still moderately in control.

My personal view is that this rally is not yet over. Trump’s given himself 90 days to bluff the market.

However, once we get through the period of dead cat bouncery, I do still think that a very serious blow has been delivered to the credibility of US assets.

Advertisement

Moreover, for their to be repair to that credibility, macro rhetoric will need to match macro policy and right now it does not. Deutsche.

It is simple. The US cannot close its very large current account deficit unless it close sits fiscal deficit too. But over the last few days we are learning something very important: the US appears unwilling to do that. The emerging reconciliation bill from the US Congress points to ever-wide fiscal deficits above 6%.

The US-China trade accord effectively signals a very low pain threshold on taxing (tariffing) the US consumer. In all, even if we account for the (now diminished) revenues from tariffs the US budget deficit will keep growing. The current account deficit will likely keep widening in this scenario too.

The significance of this conclusion cannot be over-estimated. We have been arguing over the last few months that the market is reducing its willingness to fund US twin deficits. This is arguably entirely reasonable given the expressed US desire to reduce them. But actions speak louder than words: the newsflow over the last few days aligns with the opposite outcome. We worry this is brewing a major problem for the dollar and potentially the US bond market too.

This is the Liz Truss problem. Supply-side whackos think growing the economic pie via tax cuts will close fiscal deficit, but it never does. The tax take falls and private spending booms, blowing out both fiscal and trade deficits.

It is easy to fix a current account deficit. You just pull fiscal spending into a surplus until you get a private sector recession that corrects the trade deficit.

Advertisement

But it’s not politically or socially attractive to do it.

The child president wants all things all at once. But he cannot have them. Bond markets have already slapped him once for trying. Whether they do so again will probably hang on oil and whether it can reactivate the Fed.

Bottom line, Deutsche is right. The US dollar is not in a strong position in these conditions.

Advertisement

For the time being, it is being supported by the post-tariff relief rally, but when that ends, DXY is likely to resume falling. I suspect this time, along with yields (let’s hope so), oil does the heavy lifting of liberating the Fed.

For now, the AUD is one of the most hated currencies in the world, but I do not expect this to last as DXY resumes its tumble.