FOREX was relatively quiet on Monday, a City holiday (summer banking Holliday), and the Euro was the most vulnerable currency, losing 0.3% against the Dollar (to 1.1160), the Swiss Franc (-0.35% to 94.55) and the Canadian Dollar (-0.45%).

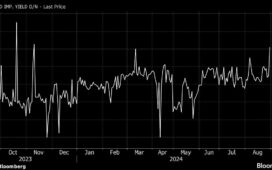

The ‘Dollar Index’ continues to hold at 100.65/100.70, clawing back 0.2% towards 100.90: however, it remains on a razor’s edge, awaiting the release of the ‘PCE’ on Friday, and retail sales figures mid-week.

Meanwhile, US durable goods orders in July rebounded by +9.9% last month, according to the Commerce Department, following a -6.9% fall in June.

However, excluding the usually erratic transportation sector (mainly aeronautics), whose orders this time climbed by 34.8%, US durable goods orders contracted by 0.2% in July on a sequential basis.

These contrasting performances have not altered the perception of a still robust US economy that is slowly slowing down.

The dollar has not lost any ground since Powell’s speech (Friday August 23), which left no room for ambiguity as to the start of a rate-cutting cycle at the end of the Fed’s September 18/19 meeting.

The only suspense lies in the extent of the 1st move, which will be -25Pts (according to 70% of operators) or -50Pts (for 30% of those polled) if US economic parameters suddenly deteriorate.

The euro was weakened by the decline in German business sentiment: according to the IFO index, business climate deteriorated from 87 points in July to 86.6 points in August, demonstrating that ‘the German economy is sinking deeper and deeper into crisis’.

The Munich-based research institute reports that companies felt that their current situation had worsened, and that their expectations were more pessimistic, with both the current situation and outlook sub-indices declining.

In Spain, the annual rate of change of the Spanish general industrial price index (IPRI) stood at -1.4% for July, 1.8 points higher than that observed in June (-3.2%), according to the national statistics institute.

Copyright (c) 2024 CercleFinance.com. All rights reserved.