For decades, the US dollar has served as the ultimate refuge during market turmoil. Emerging markets suffered currency depreciation and capital outflows when risk aversion spiked. Today, the opposite is happening. Capital is diversifying away from its long-standing dollar bias during periods of stress – a remarkable shift after decades of US asset dominance – creating new and unfamiliar challenges that are rippling through the global financial system.

Has the US dollar peaked?

As we’ve noted in recent articles this year, cracks in US exceptionalism are widening (see US exceptionalism falters as markets tumble, March 17). The US Dollar Index (DXY) plunged from 109 to 98 in under four months – a decline typically seen only during major crises. US stocks, bonds and the dollar fell in unison, breaking historical correlations amid growing recession fears and China’s AI advances (see Has the US dollar peaked, April 28). Trump’s aggressive tariffs, unpredictability, erratic and whimsical policies and threats to replace Fed Chair Powell have further undermined the greenback’s safe-haven status.

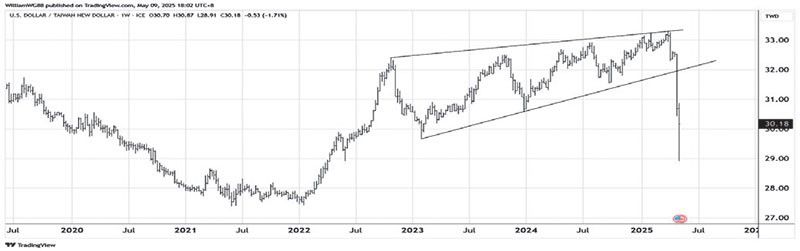

Taiwan dollar’s surge exposes vulnerabilities

Taiwan’s currency experienced its steepest appreciation since March 1988, climbing nearly 10 percent against the dollar in just two days and briefly hitting a three-year high. Exporters and insurers – traditionally heavy holders of unhedged dollar positions and US Treasuries – were caught unprepared.

Semiconductor firms like TSMC, which earn in dollars but pay expenses locally, now face margin compression. It recently disclosed that each one percent appreciation in the Taiwanese dollar reduces its operating margin by 0.4 percentage points. Meanwhile, Taiwanese insurers, managing 1.1 trillion dollars in assets, are grappling with sharp FX losses and have been forced to hastily hedge or unwind Treasury holdings at unfavorable rates, compounding the financial strain.

Strong peso dilemma

Philippine corporations, pension funds, insurers and endowments that are accustomed to a stable and appreciating dollar are also exposed. Many have maintained unhedged dollar positions, relying on the greenback’s historical strength to protect the value of their assets. But with the peso appreciating more than six percent from the recent 59-level, these institutions now face valuation losses and funding mismatches, particularly for firms with dollar revenues but peso-denominated expenses.

Emerging markets navigate unexpected terrain

Across emerging markets, the dollar’s weakness has flipped traditional currency dynamics. Central banks long focused on preventing depreciation now face the unfamiliar challenge of sharp appreciation. Hong Kong’s monetary authority sold a record 60.5 billion Hong Kong dollars to stem currency appreciation and maintain its dollar trading band. Central banks throughout developing economies are being forced to reverse course – abruptly shifting from supporting weak currencies to containing rapid strengthening.

Asian dollar hoard, a potential risk

A Bloomberg report cites Eurizon SLJ Capital strategists Stephen Jen and Joana Freire, who estimate that Asian economies have accumulated $2.5 trillion in dollar assets from years of trade surpluses with the United States. They warn that deepening trade tensions could trigger an “avalanche” of selling. Asian exporters and institutional investors might accelerate repatriation of funds or increase hedging against further dollar weakness – potentially accelerating the greenback’s decline.

Adding to this trend, some of Asia’s wealthiest families and family offices have started cutting exposure to US assets. Many are shifting capital toward Asia and Europe, especially into Hong Kong and mainland China, protecting themselves from a full-blown trade war and its repercussions.

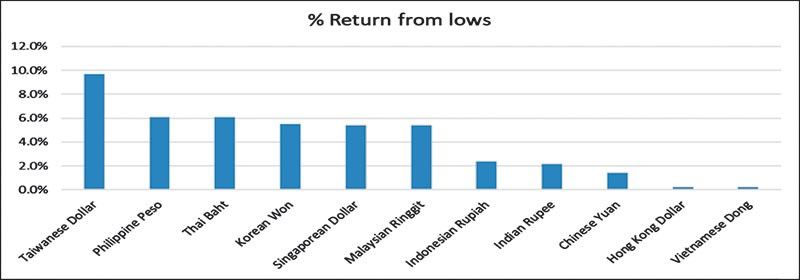

Asian currencies rally as dollar retreats

The US dollar’s slide has sparked significant gains across Asian currencies, with Taiwan’s dollar leading regional performers – surging 9.7 percent from recent lows. Other export powerhouses aren’t far behind as South Korea’s won and Singapore’s dollar have climbed 5.5 percent and 5.4 percent respectively. This synchronized rally threatens export competitiveness across Asia’s manufacturing hubs. Tourism-reliant Thailand’s baht and the Philippines’ peso have both advanced 6.1 percent, with Manila benefiting from its relative insulation from Trump’s tariff measures.

Reserve currency status: challenged but intact

Investors have long relied on dollar strength as their default refuge during uncertainty. This decades-old safe-haven playbook – where capital flees to US assets during crises – is now shifting as US exceptionalism faces unprecedented challenges. Rising US debt ($33 trillion), coordinated de-dollarization efforts by China, Russia and BRICS nations threaten the dollar’s long-term dominance. Still, the greenback remains the de-facto global reserve currency, accounting for 88 percent of global transactions and making up about 60 percent of reserves. No rival yet is even close to matching its scale and depth.

But for Asia, stronger currencies carry a cost – eroding competitiveness, pressuring margins and exposing unhedged risks. It’s a challenge the region cannot afford to ignore. It’s part of a changing investment landscape that investors should prepare for.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email.