Written by Convera’s Market Insights team

Fed cuts are coming until proven otherwise

Boris Kovacevic – Global Macro Strategist

Investors continue to favor equities and are taking the opportunity of stabilizing bond yields to rotate capital into stock markets before Jackson Hole. The S&P 500 rose for an eight day and is now on its longest winning streak of the year, after having recorded its best week in 2024 so far. The US dollar entered the trading session against the backdrop of continued selling pressure and is on track to fall for a fifth straight week.

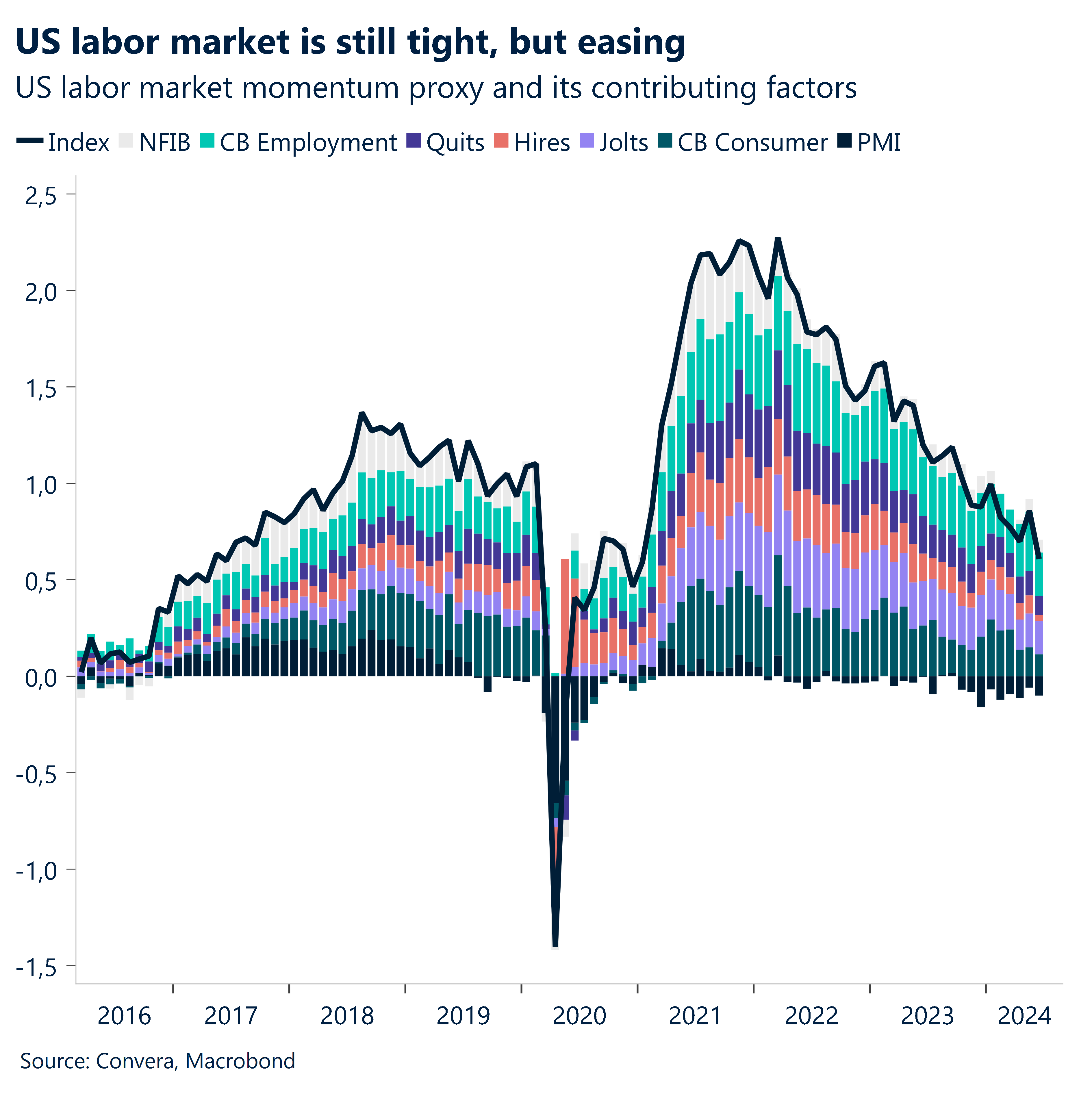

The totality of the data continues to add to policy makers confidence to lower interest rates to a more neutral level. Inflation is easing and the labor market is cooling off. Both have been welcomed by investors as the pace has been fast enough to justify rate cuts without raising recession risks materially.

Regarding the FOMC meeting in September, the question has shifted from asking if the Fed will cut rates to how much they are willing to cut. The recent macro data favors a 25 basis point over a half-point rate cut. This assumption will need verbal confirmation from Fed Chair Jerome Powell to convince investors fully and to strengthen the conviction for higher equity prices going forward. The next opportunity to do just that will be his scheduled speech during the Jackson Hole Symposium on Friday.

It is important to remember that the upcoming meeting in four weeks will be accompanied by the Summary of Economic Projections (SEP). The FOMC will likely revise down its June dot-plot for 2024 from one to two or even three rate cuts. The magnitude of the revision is expected to depend on the next job report due September 6th. Since the unemployment rate has started picking up, labor market data has replaced inflation figures as the main volatility catalyst and Fed pricing determinant.

Sterling on track to retest July peak

Ruta Prieskienyte – Lead FX Strategist

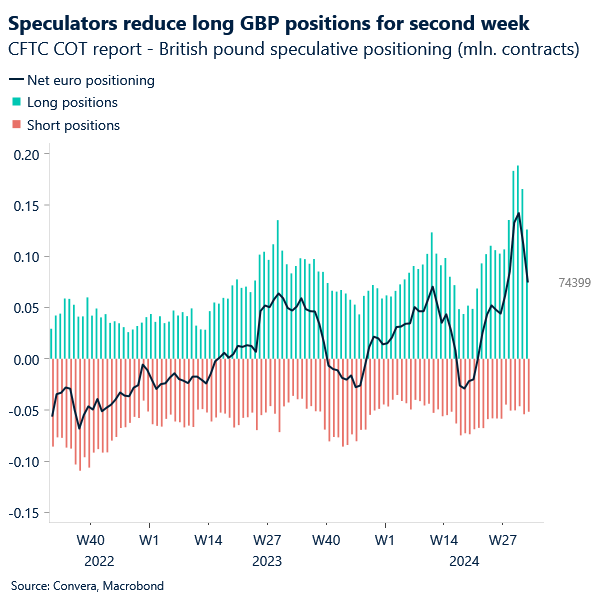

The British pound strengthened to a one-month high above $1.299, as sterling continues to benefit from the US dollar’s bearish outlook, particularly given its robust performance this year. GBP is currently up approximately 2.0% year-to-date against the Greenback, making it the biggest winner among the G10 currencies. It now appears poised to retest the year’s high of $1.3045 as broad dollar weakness dominates global FX markets.

Support for the pound stems from rate differentials and an improving economic outlook for the UK. Market expectations suggest that the Bank of England will adopt a more gradual approach to interest-rate cuts compared to the Federal Reserve. Even though the BoE may begin its easing cycle ahead of the Fed, markets are pricing in over 90 basis points of easing from the Fed by year-end, compared to around 40 basis points from the BoE.

This week, attention turns to the Fed’s Jackson Hole Symposium, where Jerome Powell and Bank of England Governor Andrew Bailey are scheduled to speak on Friday. In terms of data releases, investors are awaiting PMI readings and the GfK Consumer Confidence survey. While this week’s PMIs will be significant, the near-term outlook hinges largely on what Powell says at the conference on Friday.

Euro prints a fresh 2024 high

Ruta Prieskienyte – Lead FX Strategist

European stocks opened the week in the green, erasing the month-to-date losses, while performance across the bond market was mixed and price action remained muted. EUR/USD printed a new 2024 high above $1.107 before losing traction. With the Jackson Hole Symposium approaching, there is a strong rationale for investors to adopt a wait-and-see approach until the latter half of the week.

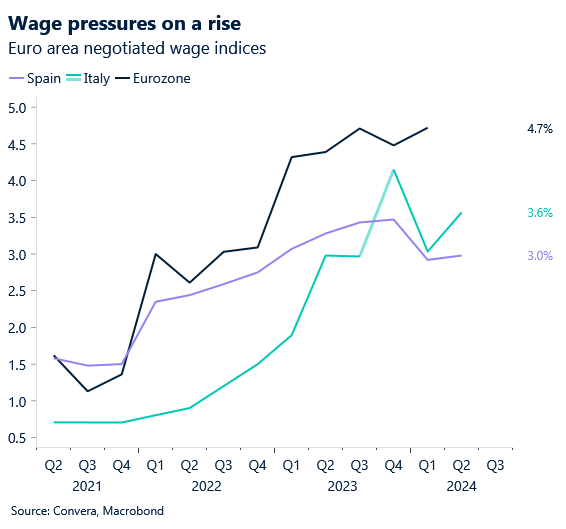

Traders have kept their expectations for ECB rate cuts this year largely unchanged, pricing in 65 basis points of further easing by year-end and 156 basis points by the end of 2025. The current focus has shifted to whether the ECB might accelerate its rate cuts if the Fed cuts rates rapidly. We do not believe this is necessarily the case, as the ECB remains more concerned with the Euro-area’s economic and inflation outlook. Today’s wage growth data may test this view, as wage growth has been identified as a critical metric for the Governing Council when considering future rate cuts. Last week’s data from Italy showed persistent upward wage pressures, and if this trend is reflected in broader Eurozone figures, there is a risk that the more hawkish members of the Governing Council could use the high Q2 wage data to argue against cutting rates in September. That said, the ECB is unlikely to be overly concerned about high wage growth driven by one-off factors, as long as the outlook continues to suggest moderating wage pressures in the longer term.

In the foreign exchange market, the prevailing narrative suggests that EUR/USD will remain within its $1.05-$1.11 range, which has dominated the pair over the past 18 months. The currency pair may continue to trade above the $1.10 level, as daily indicators point to sustained momentum for now, and one-week risk reversals have turned the most bullish in 2024. Meanwhile, overnight volatility in EUR/SEK increased ahead of today’s Riksbank policy decision, where traders expect the world’s oldest central bank to cut interest rates by 25 basis points. Renewed forward guidance for gradual easing into year-end and beyond could weigh on the Swedish currency.

Stock kick off the week in green

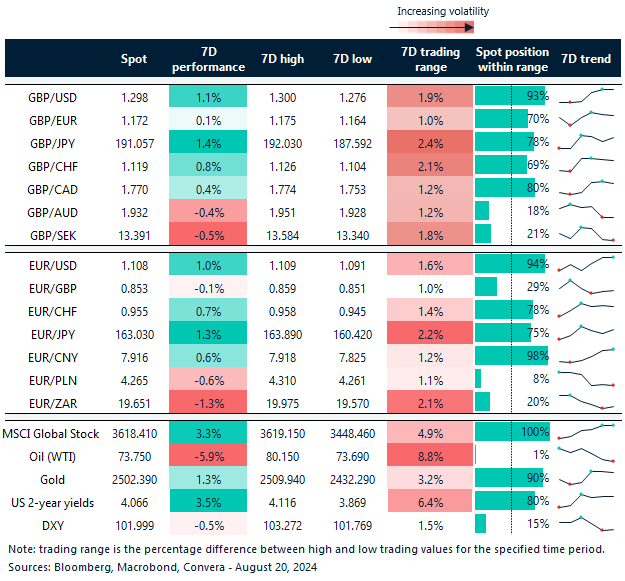

Table: 7-day currency trends and trading ranges

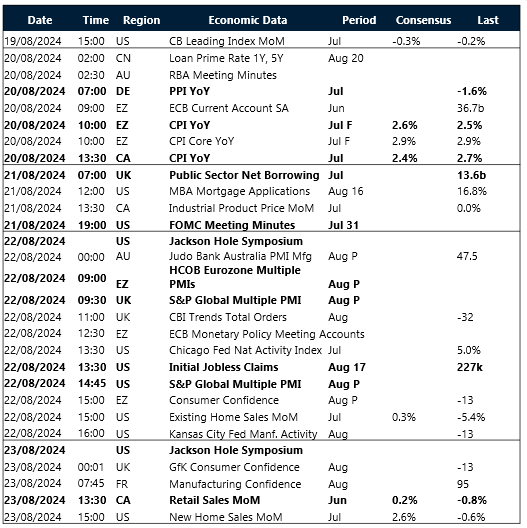

Key global risk events

Calendar: August 19-23

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.