- Ethiopia is facing sharp disparities with the birr trading at around 124 birr per dollar at the state bank, 130–134 birr at private banks, and over 150 birr at forex bureaus

- The National Bank of Ethiopia (NBE) introduced bi-weekly US dollar auctions which began on April 1, 2025, to increase dollar supply and curb the widening exchange rate gap

- Economist Daniel Kathali explained that the exchange rate disparities hurt businesses reliant on imports and promote unfair market advantages for those with access to official rates

Elijah Ntongai, a journalist at TUKO.co.ke, has over four years of financial, business, and technology research and reporting experience, providing insights into Kenyan and global trends.

Ethiopia is grappling with stark disparities in exchange rates nearly a year after the decision to float its currency.

Source: Twitter

The Ethiopian birr has been undergoing a turbulent transformation since the National Bank of Ethiopia (NBE) abandoned its long-standing fixed-rate regime in July 2024 for a market-driven exchange system.

The move aimed to address severe foreign currency shortages that had stifled investments in the country.

As of mid-May, the US dollar exchanged for around 124 birr at the state-owned Commercial Bank of Ethiopia, between 130 and 134 birr at commercial banks, and exceeded 150 birr at exchange bureaus, highlighting a broader foreign exchange divide in the country.

This divide highlights Ethiopia’s ongoing struggle to align its official and parallel market rates. It also indicates that the decision to float the birr is yet to yield the intended results by increasing foreign currency supply in the economy and harmonising rates.

Ethiopia to auction US dollars

In response to the widening divide between the official and parallel markets, the NBE launched bi-weekly foreign exchange auctions in an effort to increase US dollar supply in the parallel markets.

The auctions, which began on April 1, 2025, aim to provide banks with access to USD in order to manage liquidity.

The latest auction, held on May 7, 2025, saw 16 banks secure $60 million at a weighted average rate of 132.96 birr per USD. The NBE aims to bring down the exchange rates in the parallel markets by increasing the supply of US dollars at a lower rate.

What is the impact of forex divide?

Speaking to TUKO.co.ke, Daniel Kathali, an economist, said that the disparities in exchange rates create significant challenges for businesses and individuals who have to depend on the forex bureaus to access US dollars.

“Companies and businesses that are reliant on imports, such as manufacturers and retailers, face substantially higher costs if they are forced to rely on exchange bureaus for foreign currency. In contrast, those who have access to the state bank’s lower rates enjoy a significant advantage, which broadens inequalities and creates unfair competition in the market.

Additionally, he explained that the forex divide deepens the currency crisis by creating arbitrage opportunities where those who manage to secure dollars at the official rate can resell them in the parallel market for a profit.

Such practices risk further destabilising the Ethiopian birr, which has already been weakened by years of forex shortages, political instability, and economic mismanagement.

Source: Getty Images

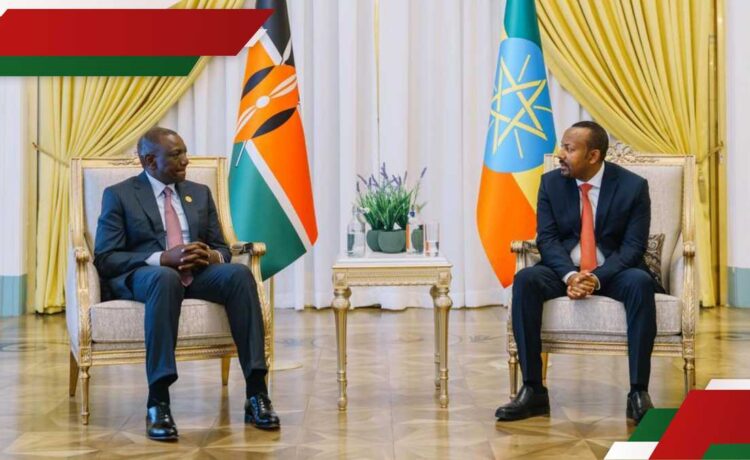

Kenya’s stable currency and strong reserve

In sharp contrast to Ethiopia’s forex volatility, Kenya has seen its currency remain relatively stable, holding firm against the US dollar as reported earlier on TUKO.co.ke.

The Central Bank of Kenya (CBK) has managed to maintain the stability of the shilling with the US dollar exchange ranging between KSh 128 and KSh 130 at the CBK, commercial banks and forex bureaus.

The CBK has been gradually increasing its foreign exchange reserves, which stood at USD 10.29 billion (approximately KSh 1.33 trillion), providing 4.6 months of import cover as of May 12.

This stable reserve level surpasses the CBK’s statutory threshold of maintaining at least four months of import cover, offering a significant buffer against short-term external shocks that would lead to high volatility in exchange rates.

Source: TUKO.co.ke