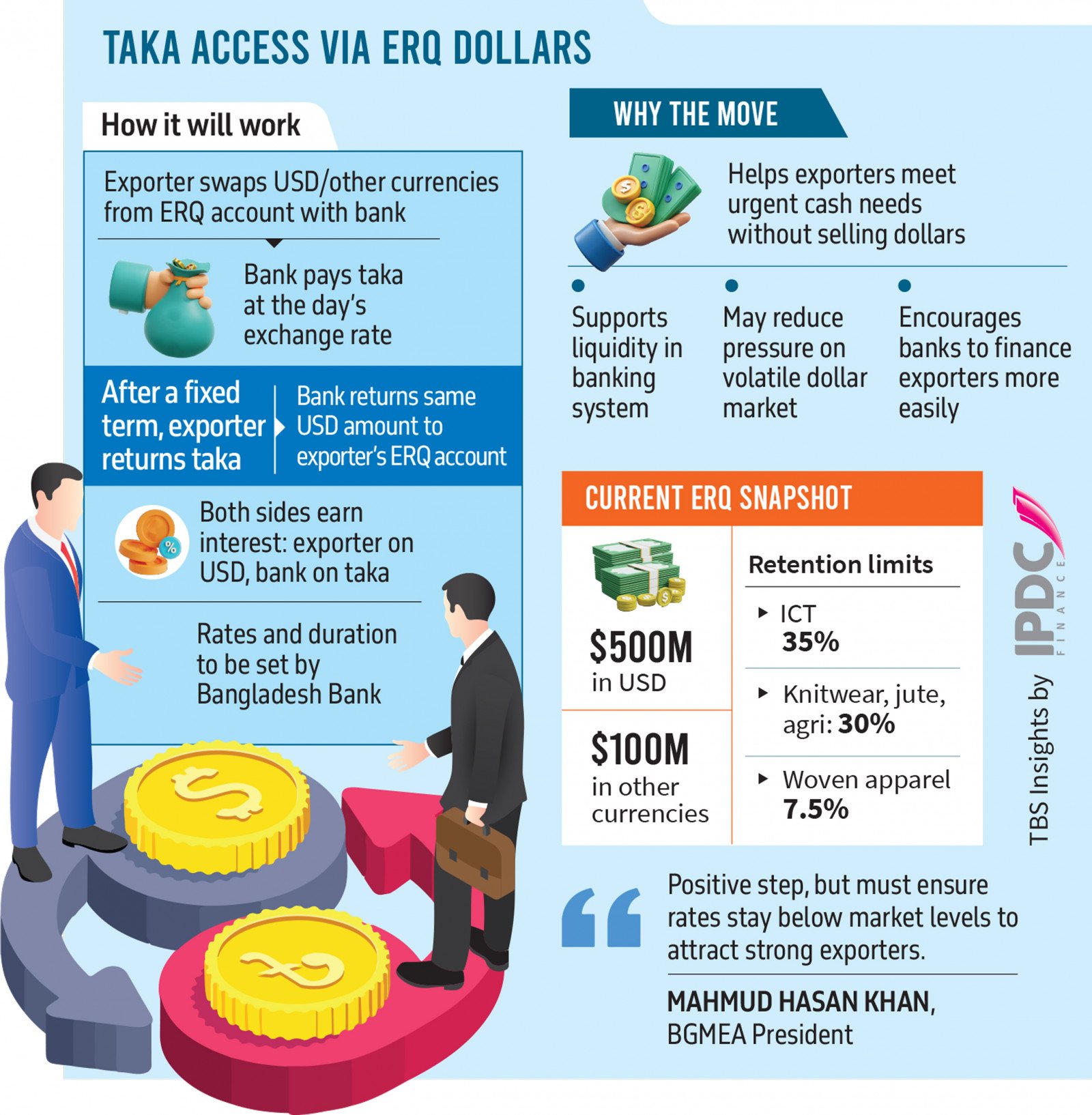

Under the proposed system, exporters will be able to obtain taka against their ERQ-held foreign currency for a fixed term and later receive the same amount of foreign currency back after returning the taka

TBS Illustration

“>

TBS Illustration

Highlights:

- Bangladesh Bank to launch currency swap for exporters’ ERQ funds

- Exporters can temporarily exchange foreign currency for taka liquidity

- Move aims to ease cash pressure and stabilise forex market

- Interest rates, swap durations pending; circular to be issued soon

- Business leaders welcome move, calling it timely and practical

- Success hinges on fair interest rates and simple implementation

The central bank is set to introduce a currency swap facility allowing exporters to temporarily exchange foreign currency from their Exporters’ Retention Quota (ERQ) accounts for local currency to meet urgent cash needs.

Under the proposed system, exporters will be able to obtain taka against their ERQ-held foreign currency for a fixed term and later receive the same amount of foreign currency back after returning the taka.

A senior Bangladesh Bank official told The Business Standard that the move aims to ease liquidity pressure for exporters and stabilise foreign exchange supply in the banking system. A circular outlining the terms is expected soon.

He said many exporters keep foreign currency in their ERQ accounts for future import payments or in anticipation of dollar appreciation but often face cash shortages. “The swap arrangement will help them access funds easily while encouraging banks to finance exporters,” he added.

Explaining the process, the official said, “If an exporter swaps one dollar with a bank for a month, the bank will pay them the equivalent in taka at the day’s rate. After one month, the dollar will be returned to the exporter’s account, and they will repay the taka.”

Infograph: TBS

“>

Infograph: TBS

Separate interest rates will apply for both currencies, with banks earning interest on taka and exporters on dollars.

The rates and swap durations have not yet been finalised, but the Bangladesh Bank will soon issue a detailed circular specifying them.

Business leaders and analysts have welcomed the initiative, saying it could ease exporters’ cash constraints and reduce pressure on the volatile dollar market.

“The dollar market has been unstable for a long time, with the exchange rate rising steadily,” said an analyst. “Given the IMF’s conditions for exchange rate flexibility and potential import pressure after the national election, this move seems timely.”

Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) President Mohammad Hatem also described the move as timely, saying it would help exporters meet immediate cash demands amid difficulties in securing short-term bank loans.

What is an ERQ account

According to the central bank, the ERQ account is a special foreign currency account where exporters can retain a portion of their export earnings. The retention rate varies by sector: up to 35% for ICT exporters, 30% for knitwear, agriculture, and jute exporters, and 7.5% for woven apparel.

These accounts can hold currencies such as the US dollar, pound sterling, euro, or yen. Given that most Bangladeshi exports are settled in dollars, the bulk of ERQ deposits are dollar-denominated.

Currently, exporters hold about $500 million in their ERQ accounts, alongside another $100 million in other foreign currencies.

Officials said the need for this measure has grown since the Bangladesh Bank discontinued its Tk5,000 crore pre-shipment refinance scheme in March this year. The fund, introduced during the pandemic, had provided exporters with crucial liquidity support.

‘Success depends on interest rates’

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told TBS that exporters currently have to relinquish full ownership of their foreign currency to access taka. “Under the swap system, they can get funds without giving up that ownership. It’s a new financing avenue for exporters,” he said.

However, he noted that the scheme’s success will depend on interest rates and operational simplicity. “The dollar rate is relatively stable now, so if the interest rate is too high, exporters may not be interested.”

BKMEA’s Mohammad Hatem said the interest rate must be rational. “The rate gap between dollar and taka should not exceed 2%, and repayment should be flexible, possibly through monthly instalments.”

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Mahmud Hasan Khan said the interest rate remains below prevailing market rates as funds in ERQ accounts typically belong to financially strong exporters, who are unlikely to engage in dollar swaps at higher rates.

A BGMEA director said, “The ERQ dollar swap system could be very effective for exporters facing cash flow stress, but the process must be simple and affordable to ensure participation.”

A senior executive at a state-owned bank, speaking on condition of anonymity, said determining swap tenures and rates could be complex. “It may pose new challenges for banks in managing their assets and liabilities,” he said.