According to Bank of America, falling interest rates are set to benefit the communications infrastructure sector, particularly towers.

In their research note, the investment bank highlights how lower rates could enhance the performance of stocks within this sector.

They explain that the second quarter of 2024 saw several communications infrastructure companies report strong earnings, reflecting a robust demand for data centers and a promising outlook for future growth.

“Data center demand remains strong for both ‘traditional’ and AI use cases,” BofA notes.

Despite this positive trend, the sector’s immediate focus is on the impact of declining interest rates, with towers expected to see the most significant benefits.

As BofA explains, the potential for lower rates is poised to act as a catalyst for the tower segment, even though domestic tower activity remains subdued.

“Management teams remained optimistic about carriers eventually returning to higher levels of activity,” the bank states.

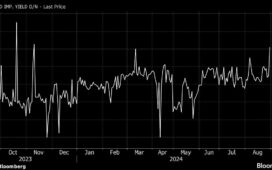

With an increased probability of interest rate cuts in the latter half of 2024—now estimated at over 100% for September and December—towers are anticipated to outperform data centers and other REIT sectors.

BofA says this anticipated rate relief is expected to reduce refinancing burdens for tower companies and drive higher Adjusted Funds From Operations (AFFO) per share growth.

In contrast, while data centers continue to enjoy strong demand, particularly driven by AI developments, the sector is seen as a more crowded trade.

Data centers are facing more crowded trade dynamics due to the “AI ‘hype cycle’,” BofA observes. Nevertheless, they state that the underlying strength in data center fundamentals remains robust, bolstered by global power procurement issues and pricing power.

Overall, the falling interest rates present a favorable environment for communications infrastructure stocks, with towers poised to gain the most from this trend.