The question is which one to choose for your foreign spending when you’re travelling abroad. As debit cards take money out of your bank account instantly (a wrong, or worse, fraudulent, swipe can incur losses and stress when you are travelling abroad, no matter when the refunds come), we’re ruling it out straightaway. However, debit cards can be used to withdraw cash abroad from ATMs. This helps in using currency, especially at outlets that do not have a card machine.

What remains is a face-off between forex cards and credit cards.

Forex card or credit card?

Expense breakdown

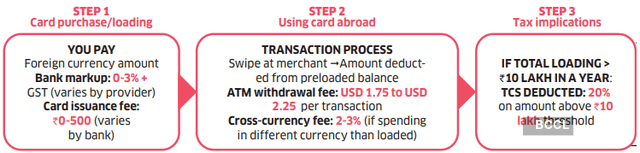

Forex card

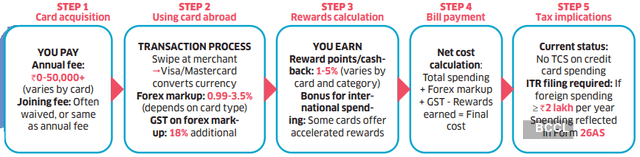

Credit card

Forex cards

Also called prepaid cards, they load your chosen foreign currency (up to 22 currencies, depending on the bank you use) up to a specified amount.

Remember: The Reserve Bank of India (RBI) rules permit you to carry a maximum of US$250,000 (approximately Rs.2.15 crore) per financial year. But different banks have their per-trip limits on the amount you can load online or through a bank branch.

Every time you swipe your forex card at a shop or restaurant, the balance keeps diminishing. HDFC Bank offers 22 currencies on its forex cards, IDFC FIRST Bank provides 14 foreign currencies, ICICI Bank allows 15 currencies on their forex cards, and so on. These days, forex cards come in multicurrency variants, which means you can load more than one currency on them. This is particularly useful if you are, for example, having a halt en route to your final destination, such as a stop in Dubai, Amsterdam, or London on the way to the US.

Then there’s BookMyForex.com, a popular forex marketplace and fintech firm that offers forex cards in 14 currencies. Its card comes with zero mark-up, as it provides foreign exchange at live interbank rates— unlike banks, says Sudarshan Motwani, CEO & Co-Founder, BookMyForex.com. Typically, banks charge a small markup over the interbank rates when loading your forex card with foreign currency.

When purchasing a forex card from a bank, compare the rates across different banks and online portals. Banks typically charge a mark-up, known to be as high as 3% plus GST, over the inter-bank rate. This is usually slightly cheaper than buying cash from your bank because digital loading is less expensive for banks than handling physical cash. So, check with your bank. Leverage your long-term relationship with the bank to get a reasonable rate. Many banks also charge card issuance charges, which again, BookMyForex.com doesn’t. There are also other zero-mark-up forex cards available.

That doesn’t mean using a forex card doesn’t come with hidden costs. Some of these are reload charges and cross-currency fees, for example, if you have USD loaded onto your foreign currency card but make a payment in Euros. Here again, all these charges are waived at BookMyForex.com, making it one of the few actual zero-mark-up forex cards.

Credit cards

If you want to get more out of your foreign spending, consider using a credit card. While forex cards do not earn you any rewards, credit cards do

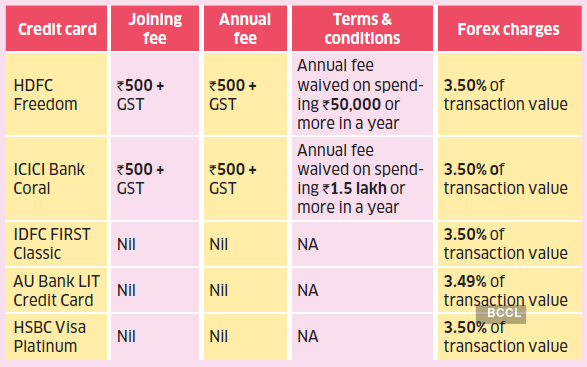

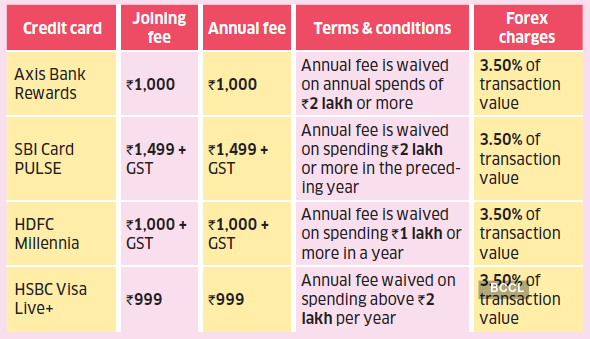

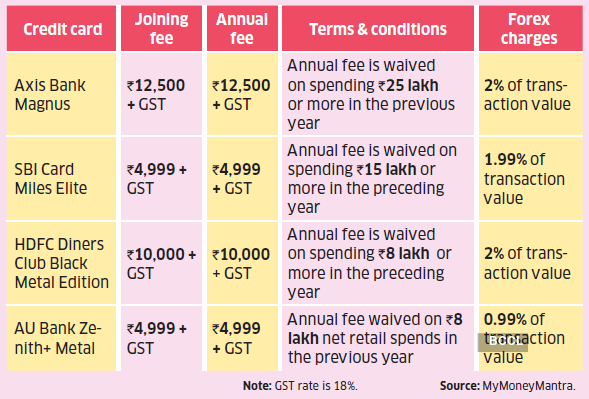

Here, there are lots of varieties. Many credit cards charge a foreign exchange (forex) mark-up of up to 3.5% (plus GST) on all your international transactions. However, there are mid-range cards that charge a lower rate, around 2%. Then, there are high-end premium cards that charge rates as low as 0.99% to 1.99% for foreign exchange markup. Nowadays, you can also obtain cards issued by fintech firms in collaboration with certain banks, which come with zero foreign exchange mark-up charges, such as the Scapia Federal Credit Card and the RBL World Safari Credit Card, as per data provided to us by MyMoneyMantra. The flip side: Zero foreign exchange mark-up charge cards typically do not offer any reward points for foreign spending.

The trick is to see if your card earns a positive return after deducting the foreign exchange markup. Aly Hajiani, founder of www.rewardpoints.club, a repository that compares and helps you buy the right card, points us out to the HDFC Infinia credit card as an example. Here, you earn five reward points (RP) on every Rs.150 spent. Since 1 RP is equivalent to Rs.1 on most conversion options the card offers, you effectively earn a 3.33% return. The card charges a 2% foreign currency markup. That’s a return of 1.33%. “Premium cards give positive returns,” says Hajiani, who laments that even high-net-worth individuals use forex cards without realising how much their credit cards can give them back.

Here’s where it gets more interesting. Kashif Ansari, an avid credit card enthusiast and professor of personal finance and taxation at the Jindal School of Banking & Finance, notes that certain cards offer accelerated reward points for international spending. He cites the example of the Axis Bank Olympus Credit Card. Here, its customers earn one EDGE mile (that’s what its reward points are called) for every Rs.100 spent on domestic spend. But they earn two EDGE miles on every Rs.100 spent on international transactions. The catch? “These benefits are, however, offered on certain travel-focused cards, generally in the affluent to HNI segments. These cards do have higher fees and stringent eligibility criteria, hence might not be accessible to all,” says Arnika Dixit, President & Head of Cards, Payments and Wealth Management, Axis Bank.

“Credit cards are safe to use as opposed to carrying cash abroad, which can get stolen. Credit cards also score over forex cards. If there is a false charge on your forex card, the money gets debited first. You must, then, file a claim, and it can take a considerable amount of time to receive your money back. However, on your credit card, you can dispute the charge before receiving the final bill,” says Ansari. His picks: Axis Olympus, HDFC Infinia, HDFC Diners Club Black and Axis Magnum Burgundy.

Credit cards tailored for travel

Basic/entry level credit cards

Medium level credit cards

High-end/Premium credit cards

“Credit cards are easier to use than forex cards, assuming you already have a credit card. To obtain a forex card, you need to apply, submit the required documents, and follow the necessary steps. A credit card is something you already have, and you can just start spending it. But make sure your international spending feature is turned on,” says Raj Khosla, Managing Director, MyMoneyMantra.

TCS on forex cards

When you spend more than Rs.10 lakh abroad, you need to pay a TCS (Tax Collected at Source) of 20%. Before Budget 2025, this threshold was Rs.7 lakh. Before 30 September 2023, TCS was 5%. The government introduced TCS in October 2020 to enhance tax compliance, ensuring that individuals who spend abroad and fail to file their tax returns still pay tax commensurate with their spending, which should align with their income. However, certain vital expenses, such as those incurred for a child’s education and medical expenses, are subject to a lower TCS.

Forex cards come under the ambit of TCS. For instance, if you load your forex card with Rs.12 lakh, your foreign exchange dealer or bank would deduct 20% TCS on Rs.2 lakh (Rs.12 lakh minus Rs.10 lakh, the threshold amount as per Budget 2025). So far, credit cards have been out of the TCS ambit because banks have expressed their difficulties in levying TCS since people have multiple credit cards.

If you buy an overseas tour package worth up to Rs.10 lakh, you pay a 5% TCS. For tour packages costing over Rs.10 lakh, a 20% TCS is applicable.

This is also why tour operators and foreign exchange dealers either deduct TCS upfront or make you sign a declaration that your foreign spending in an entire year is within limits that do not attract TCS. Chartered accountant Nitesh Buddhadev, Founder of Nimit Consultancy, shares a hack for those planning to fly abroad on a tour. Instead of buying a tour package, which attracts TCS no matter how much you spend, book flights and hotels separately. “That way, if your overall foreign spend in a year is under Rs.10 lakh, you do not pay TCS,” says Buddhadev.

Although TCS is not yet levied on credit cards, Buddhadev says your international spends are reflected in your Form 26AS. Here’s the catch: if you spend Rs.2 lakh or more on foreign travel for yourself or another person during a financial year, you must file an Income Tax Return (ITR). Excessive spending through credit cards abroad in a single financial year might come under the income tax purview, says Buddhadev.

How to choose?

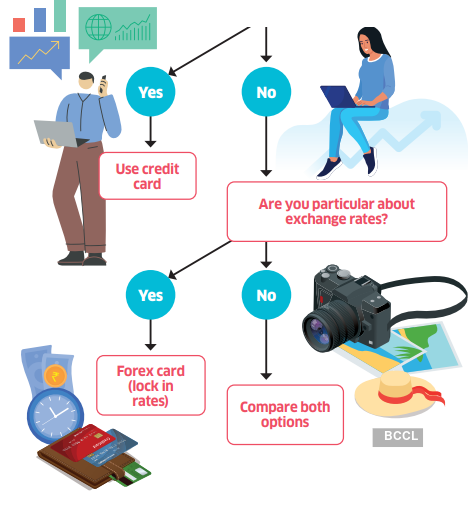

Credit cards are subject to exchange rate fluctuations; you pay for currency conversion on the day you swipe your card abroad. Whereas a forex card is preloaded. If you are particular about your exchange rate, consider a forex card.

Forex cards are also suited for those who wish to travel on a fixed budget. “If you have a fairly good idea of how much you will spend, and want to make sure that you do not cross the limit, a forex card works best, because you can only spend as much as it is loaded up for. Whereas credit cards let you spend as much as your limit allows,” says Frederick D’Souza, President & Business Head-Credit Cards, Kotak Mahindra Bank.

D’Souza says forex cards are often issued by employers for corporate employees travelling abroad for work, as they help track expenses. They’re also useful for parents who want to monitor their children’s spending while studying overseas.

Credit cards work best when either the foreign exchange mark-up is low or you get rewards or preferably a combination of both. If you get accelerated rewards for foreign spending, that’s an added bonus. Or in cases like, say an American Express Platinum Travel card, where your reward points do not ever expire, despite a steep 3.5% foreign exchange conversion fee.

Tip: When travelling abroad, should you pay in local currency or Indian Rupee? Always pay in local currency. Pay in US dollars when in the United States, in Euros when in Europe, in Yen when in Japan, and so on.

Many merchants will offer you a choice between paying in local currency or Indian rupees. This is called ‘Dynamic Currency Conversion’ or DCC. If you choose to pay in rupees, the merchant’s payment processor will apply its own exchange rate, rather than the standard Visa/Mastercard conversion rate. While Visa and Mastercard rates are close to interbank rates, the DCC markup can be 3-5% or even higher. This means you’ll pay significantly more than if you had simply paid in local currency and let your Indian bank handle the conversion.