Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US retail sales boosts sentiment

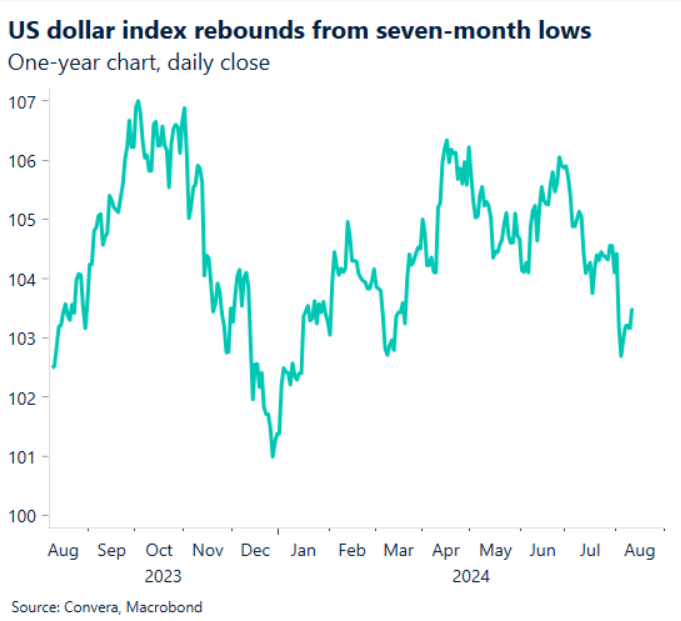

The US dollar was strongly higher, recovering from recent lows, after a bumper retail sales report and drop in weekly unemployment claims saw investors turn more positive on the US economy.

US retail sales in July jumped by 1.0% versus expectations of 0.4% and a big gain versus the 0.2% fall seen in June.

The initial jobless claims number was also better than expectations – falling to 227k versus the 235k expected.

The US dollar saw a sharp rebound, climbing from levels near seven-month lows, with the USD index up 0.5%.

The stronger US dollar saw the NZD/USD extend this week’s losses, down 0.2%, while the Aussie performed better, with the AUD/USD up 0.2% after a stronger than expected jobs report yesterday.

The Australian July jobs found 58.2k new jobs added – higher than the 20.0k forecast, but the unemployment rate climbed from 4.1% to 4.2%.

The Aussie will remain in focus with RBA governor Michele Bullock due to testify to parliament at 9.30am AEST.

USD rebounds from lows across Asia

The US dollar’s most notable moves came in Asia with a big recovery in the USD/JPY. The pair was up 1.4%. The gain saw USD/JPY back at two-week highs, but the market remains almost 8.0% below last month’s highs.

The JPY was weaker in most other markets with the AUD/JPY up 1.7% and back near key resistance at 100.00.

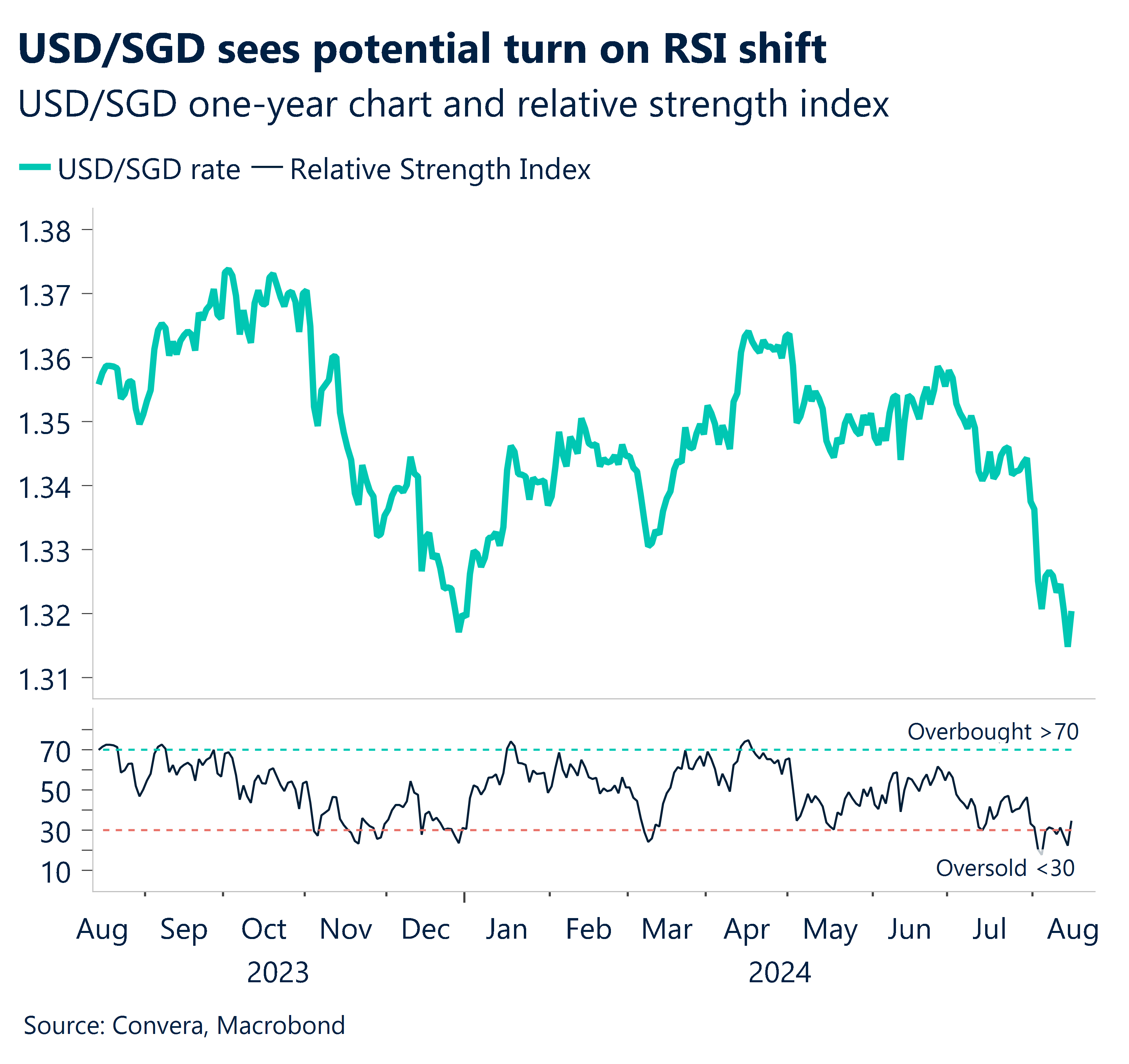

In USD/SGD, a sharp rebound from the 18-month lows signalled that the recent weakness in this pair might be nearing an end. A shift in the relative strength index, a key measure of momentum, also suggest this pair might look to turn higher.

The USD/CNH was also higher as it moved back towards two-week highs near 7.2000, with the CNH lower after yesterday’s key monthly data mostly disappointed. Industrial production and fixed asset investment were both below forecasts, while unemployment was higher than expected at 5.2%. Retail sales managed to moderately beat forecasts.

Euro lower after reversal from 2024 highs

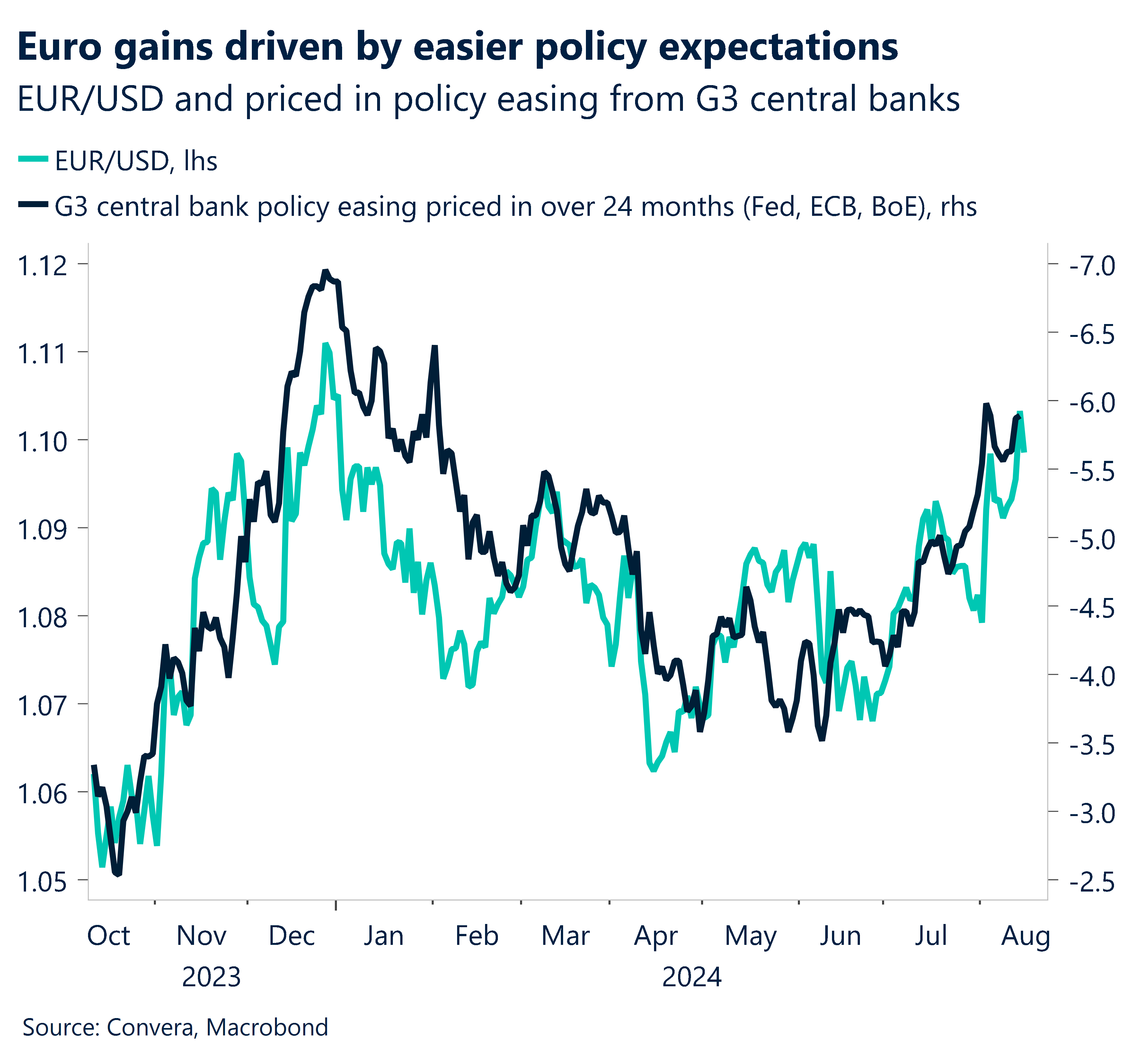

The euro was one of the strongest performers up until last night with the EUR outperforming all G10 currencies apart from the Norwegian krone over the last week.

The euro has outperformed as markets become more positive on hopes for central bank easing with the EUR/USD’s price action closely tied to expectations of policy easing. That said, the EUR/USD has turned sharply over the last 24 hours, with the pair rejecting the 1.1000 level near the 2024 highs. This level has seen the EUR/USD previously find resistance and could be a sign the EUR’s recent strength might be due for a pause.

US dollar rebounds in Asia

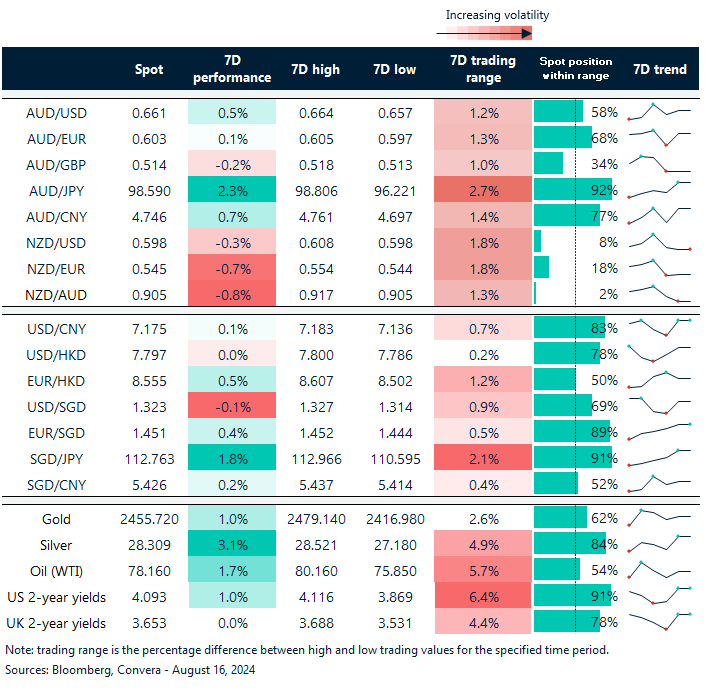

Table: seven-day rolling currency trends and trading ranges

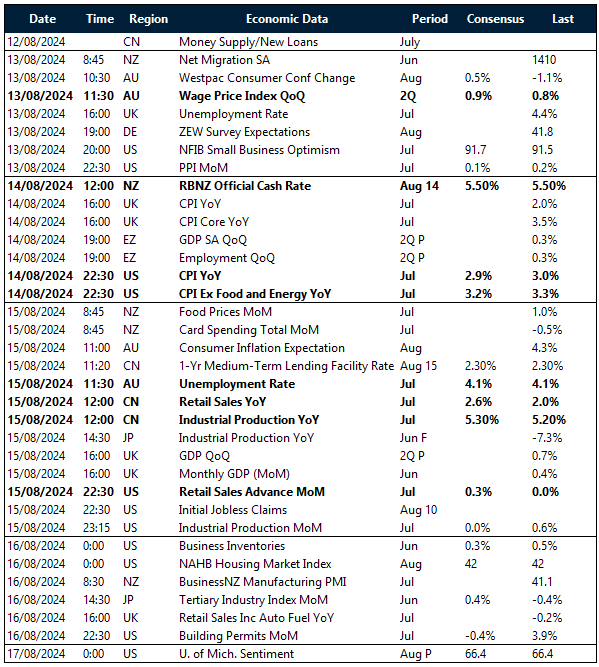

Key global risk events

Calendar: 12 – 17 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]