What’s going on here?

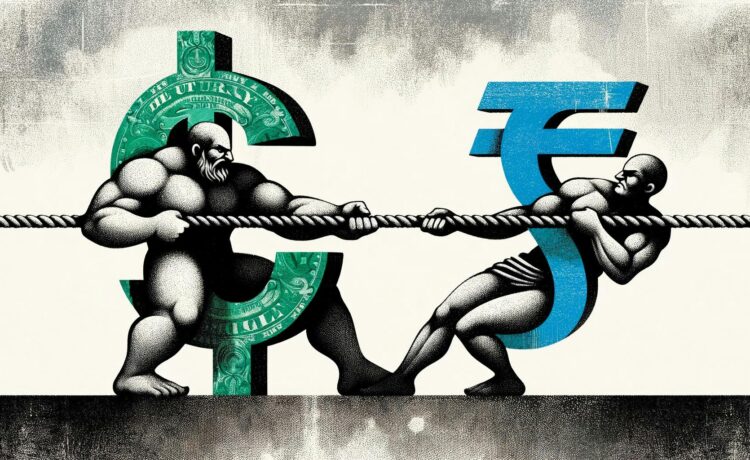

The Indian rupee is expected to weaken as the US dollar hits a two-and-a-half-month high, spurred by Federal Reserve rate forecasts and increasing prospects of Trump’s election success.

What does this mean?

The US dollar’s unexpected strength is causing global tremors, putting the Indian rupee under pressure. Anticipation of a mild rate cut by the Federal Reserve has buoyed the dollar, coupled with Trump’s candidacy which investors often see as a dollar positive. Though the rupee briefly surged past the 84-mark amidst low volatility, it struggled against the dollar’s momentum. The situation worsened as the British pound slipped after weak UK inflation reports, further fueling the dollar’s ascent. This global currency interplay underscores the rupee’s precarious stance in these shifting patterns.

Why should I care?

For markets: Global ripple effects.

The US dollar’s ascent is triggering worldwide repercussions. Signs like the one-month non-deliverable forward rate for the rupee at 84.1250, alongside a 10.5 paisa onshore forward premium, hint at tough times for emerging market currencies. With Brent crude priced at $74.4 per barrel and US Treasury yields at 4.03%, investors are reassessing risks. Foreign investors withdrawing $182.4 million from Indian equities and $10.3 million from bonds further reflect the cautious sentiment stirred by currency swings.

The bigger picture: Economic echoes across continents.

Currency changes are not just about numbers – they’re indicative of broader economic moods. From the pound’s drop due to sluggish UK inflation to political factors in the US possibly boosting the dollar, these events impact global finance. As investors adjust, domestic economies feel the strain, highlighting the need for solid fiscal policies and sharp market insight to navigate these unpredictable waters.