Chicago, United States, April 10th, 2025, FinanceWire

Jack Truong, a forward-thinking executive and business leader, has presented a compelling case for cryptocurrency, particularly Bitcoin, as a superior store of value compared to traditional real estate in today’s rapidly evolving economy. With shifting work dynamics, rising interest rates, and declining purchasing power, Truong argues that digital assets may offer a more practical solution for wealth preservation.

The Decline of Real Estate as a Universal Investment

For decades, homeownership has been a cornerstone of middle-class wealth-building. However, Truong highlights how remote work and increased mobility have disrupted this model.

“Previous generations bought homes and stayed in them long-term, benefiting from appreciation and tax advantages,” he explains. “But today’s workforce is more mobile. If you don’t stay in a home for an extended period, the return on investment diminishes.”

Compounding the issue, high mortgage rates that is currently around 7%, have discouraged homeowners from selling, creating stagnation in the housing market.

“Selling now often means taking on a costlier mortgage, making real estate less liquid and less attractive as a short- or medium-term investment,” Truong notes.

The Purchasing Power Crisis

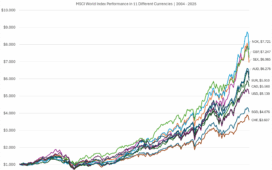

Truong emphasizes that the core economic challenge is not inflation alone but a severe decline in purchasing power. Since 2019, the U.S. money supply (M2) has surged by 42%, eroding the value of the dollar. To illustrate, he compares real estate, gold, and Bitcoin:

In 2020, a $330,000 home required 186 ounces of gold or 16.5 Bitcoins.

By 2023, the same home will cost $420,000 but only 160 ounces of gold or 6 Bitcoins.

“Gold preserved value better than dollars, but Bitcoin outperformed both,” says Truong. “Its digital nature makes it a natural evolution in the history of money, from barter to coins, paper, credit, and now decentralized assets.”

Bitcoin as a Global Hedge

Truong also points to Bitcoin’s utility in geopolitical instability. “Imagine a person in Kyiv who lost physical assets overnight due to war. With Bitcoin, wealth can be stored digitally and moved across borders instantly,” he states. Unlike gold, which is impractical for daily transactions, Bitcoin offers both a store of value and a medium of exchange.

Strategic Investments

While Truong doesn’t dismiss real estate entirely, especially for long-term homeowners, he advises diversification. “Rental properties or frequent home changes may no longer be optimal. Allocating a portion of one’s portfolio to Bitcoin could help protect against purchasing power erosion,” he suggests.

As economic uncertainty grows, Truong’s insights challenge conventional investment wisdom, urging individuals to rethink wealth preservation in a digital age.

About Jack Truong

Jack Truong is a seasoned executive with a track record of transformative leadership. His analysis blends macroeconomic trends with practical investment strategies, offering a fresh perspective on modern finance.

Contact

Jack Troung

[email protected]