TOKYO (Kyodo) — Japanese Finance Minister Satsuki Katayama on Friday warned against “extremely one-sided, rapid moves” in the foreign exchange market following the yen’s fall against the U.S. dollar as expectations for near-term interest rate hikes by the Bank of Japan waned.

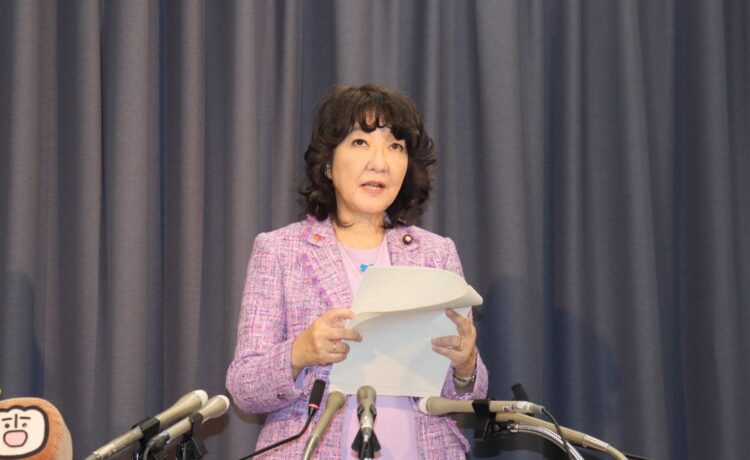

It is important for currencies to move in a stable manner, reflecting economic fundamentals, Katayama, who assumed her post in new Prime Minister Sanae Takaichi’s Cabinet last week, told a news conference.

“The government is closely monitoring excessive fluctuations and disorderly movements in the market, including those driven by speculators, with a heightened sense of urgency,” she added.

The yen fell to an around nine-month low at the 154 level against the dollar on Thursday, after the central bank decided to maintain its benchmark rate at its policy meeting.

Yen-selling also intensified as BOJ chief Kazuo Ueda said following the gathering that more economic data must be assessed before resuming rate hikes, a remark that market players took as a sign of caution against an imminent policy shift.

“Judging from various current factors, it was a very reasonable decision,” Katayama said regarding the outcome of the BOJ’s meeting, without elaborating.

The yen has been under pressure since Takaichi, known for her support of monetary easing, was elected as the ruling Liberal Democratic Party’s leader in early October, fueling views that the BOJ would find it difficult to pursue a rate hike path.