Explore in-depth USD/JPY trade setups and expert forecasts here.

AUD/USD: Housing Data and RBA Policy in Focus

For the Australian dollar, home loan data will spotlight the AUD/USD pair. Economists expect home loans to rise 0.6% quarter-on-quarter in Q4 2024, up from 0.1% in Q3 2024. Additionally, economists predict investment lending for homes will rebound in Q4 2024.

Rising home loans signal tighter housing inventories and stronger consumer spending. Tighter housing inventories may drive house prices and rentals higher, fueling housing services inflation. A pickup in consumer spending may also drive inflationary pressures. Under this scenario, investors may lower expectations of multiple RBA rate cuts in H1 2025.

Conversely, weaker home loans and investment loan data may indicate a softer housing market. House prices and rentals could fall, impacting consumer spending and cooling inflationary pressures.

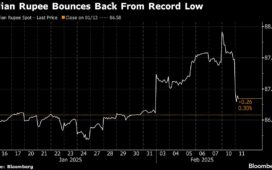

Rising bets on multiple H1 2025 RBA rate cuts may pull the AUD/USD pair toward the $0.62 level. However, a more hawkish RBA rate path may lift the pair above the 50-day EMA, targeting the $0.63623 resistance level.

For a comprehensive analysis of AUD/USD trends and trade data insights, visit our detailed reports here.

Australian Dollar Daily Chart

Turning to the US session, hotter-than-expected inflation figures would indicate a more hawkish Fed policy stance. Fading bets on an H1 2025 Fed rate cut may widen the US-Australia interest rate differential in favor of the US dollar. A more hawkish Fed could drag the AUD/USD pair toward the crucial $0.62 support level. A break below $0.62 may bring the upper trend line of the descending channel into play.

Conversely, a softer core CPI reading may narrow the interest rate differential, potentially lifting the pair above the 50-day EMA. A breakout from the 50-day EMA could enable the bulls to target the 200-day EMA next.

Meanwhile, US tariffs and the threat of a full-blown US-China trade war remain an Aussie dollar headwind.