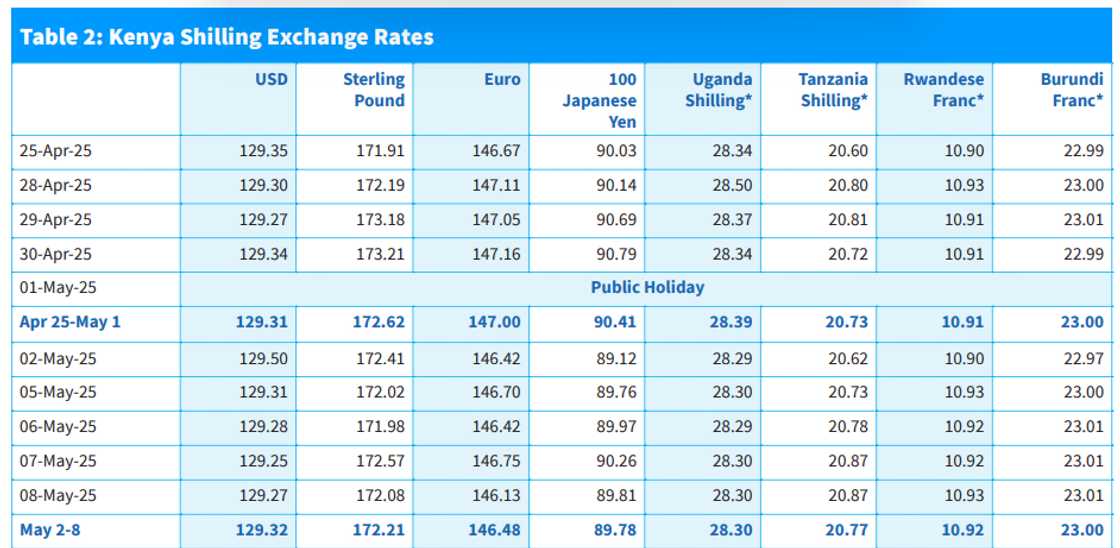

- The Kenya Shilling slightly appreciated to KSh 129.27 per US dollar on May 8, 2025, from KSh 129.34 on April 30

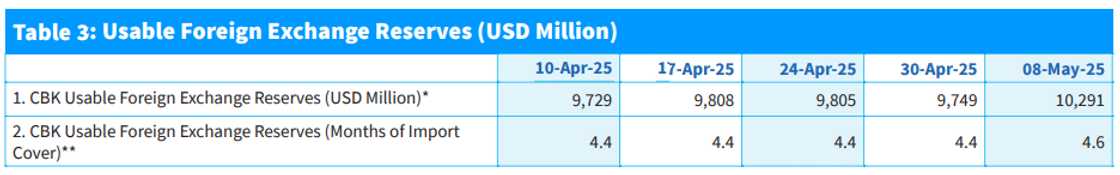

- Kenya’s usable foreign exchange reserves rose to USD 10.29 billion (KSh 1.33 trillion), equivalent to 4.6 months of import cover

- The Central Bank of Kenya has been consistently boosting forex reserves over recent months, reinforcing the country’s buffer against external shocks

Search option is now available at TUKO! Feel free to search the content on topics/people you enjoy reading about in the top right corner 😉

Elijah Ntongai, a journalist at TUKO.co.ke, has over four years of financial, business, and technology research and reporting experience, providing insights into Kenyan and global trends.

The Kenya Shilling held firm against the US dollar in the week ending May 8, 2025, as CBK increased the US dollar forex reserves.

Source: UGC

According to data from the Central Bank of Kenya (CBK), the shilling traded at KSh 129.27 per US dollar on May 8, showing a slight appreciation from KSh 129.34 on April 30.

The local currency also remained stable against other major international and regional currencies.

Search option is now available at TUKO! Feel free to search the content on topics/people you enjoy reading about in the top right corner 😉

“The Kenya Shilling remained stable against major international and regional currencies during the week ending May 8, 2025. It exchanged at KSh 129.27 per US dollar on May 8, compared to KSh 129.34 per US dollar on April 30,” CBK stated in the weekly bulletin.

Source: UGC

How much is Kenya’s forex reserves?

Meanwhile, the country’s usable foreign exchange reserves stood at USD 10.29 billion, equivalent to approximately KSh 1.33 trillion, providing 4.6 months of import cover.

This level surpasses the CBK’s statutory threshold of four months, reaffirming the country’s buffer against short-term external shocks.

“The usable foreign exchange reserves remained adequate at USD 10,291 million (KSh 1.33 trillion) (4.6 months of import cover) as of May 8, 2025. This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover,” CBK reported.

Notably, the CBK has been increasing forex reserves over the past months, as shown below.

Source: UGC

Kenya’s economic growth

Meanwhile, the CBK also reported that Kenya’s economic growth slowed to 4.7% in 2024, down from 5.7% in 2023, mainly due to contractions in the construction, mining, and quarrying sectors, as well as a general slowdown across most industries.

Growth was only sustained in sectors such as manufacturing, wholesale and retail trade, public administration, education, health, and taxes on products.

Agriculture grew by 4.6% in 2024, a drop from 6.6% in 2023, buoyed by increased production of sugarcane, tea, and coffee, but constrained by lower maize and potato yields.

The services sector remained relatively strong, expanding by 6.0%, though slower than the 7.0% growth recorded in 2023, supported by financial services, transport, real estate, ICT, and trade.

Industrial growth, however, dropped sharply to 0.8% from 2.0%, weighed down by declines in construction and extractive industries in 2024.

East African single currency

In other news, governors of central banks from East African Community (EAC) member states, including Kenya, agreed during the 28th Monetary Affairs Committee meeting in Mombasa to introduce a single regional currency by 2031.

Chaired by CBK Governor Kamau Thugge, the meeting noted significant progress in harmonising monetary and exchange rate policies, aligning legal frameworks, and improving risk management and IT infrastructure.

The committee also adopted a master plan for enhancing the East African Payments System (EAPS), aiming for more efficient, secure, and inclusive cross-border transactions.

Source: TUKO.co.ke