- The Central Bank of Kenya (CBK) reduced the base lending rate from 11.25% to 10.75% in February 2025

- CBK said the easing of the monetary policy stance was aimed at enhancing economic activities and ensuring the exchange rate stability

- Data from the regulator showed the average exchange rate for Kenya shilling at KSh 129.19 per US dollar in the first week of February

- Speaking exclusively to TUKO.co.ke, market analyst at FXPesa Rufas Kamau noted that the exchange rate outlook is stable on reducing CBK interest rates

TUKO.co.ke journalist Wycliffe Musalia has over six years of experience in financial, business, technology, and climate reporting, which offers deep insights into Kenyan and global economic trends.

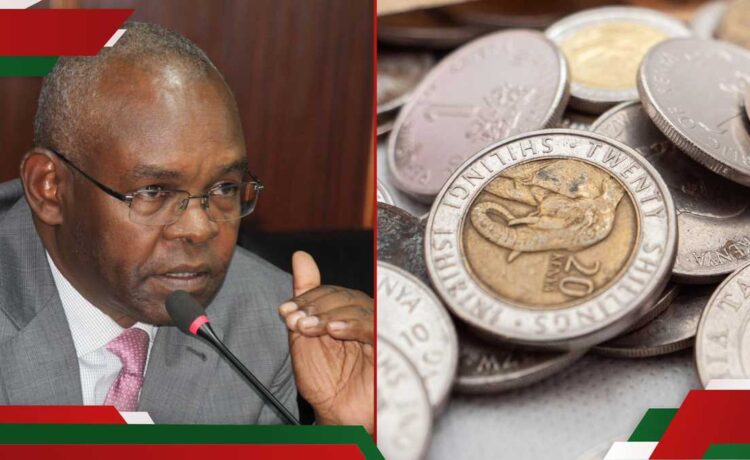

The Central Bank of Kenya (CBK) remains hopeful of a stable exchange rate in the coming months.

Source: Facebook

CBK data showed Kenya shilling exchanged at an average of KSh 129.19 per US dollar in the first week of February 2025.

Read also

CBK projects growth in Kenya’s economy to 5.4% in 2025 on improved credit, strong shilling

Why Kenya shilling remains strong

This is compared to KSh 129.25 per US dollar, reported during the week ending January 30, 2025.

CBK governor Kamau Thugge said the shilling will remain stable on strong foreign currency reserves supported by increased diaspora remittances.

“The shilling has remained strong due to the strong current account, in particular remittances,” said Thugge during the Monetary policy Committee (MPC) meeting on Thursdy, February 6.

The regulator registered a significant increase in the foreign currency reserves during the week ending Thursday, February 6.

The reserves grew from $8,877,000,000 (KSh 1.15 trillion) in the previous month to $9,219,000,000 (KSh 1.195 trillion).

Thugge said this supports up to four (4) months of import cover, indicating the stability of the shilling.

“The usable foreign exchange reserves remained adequate at USD 9,219 million (4.7 months of import cover) as of February 6. This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover,” said Thugge.

Speaking exclusively to TUKO.co.ke, market analyst at FXPesa Rufas Kamau explained that the reduction in CBK base rate by 50 basis points will ignite economic growth, thus enhancing the exchange rate stability.

“Kenya shilling remains steady, and its outlook seems stable. The CBK reduction of interest rates by 50 basis points to 10.75% is a welcome move in support of economic activities, which will revive the economy that was heading for a recession,” Kamau explained.

What’s the new CBK interest rate?

The Central Bank of Kenya (CBK) reduced the base lending rate from 11.25% to 10.75% in February 2025

CBK said the easing of the monetary policy stance was aimed at enhancing economic activities and ensuring the exchange rate stability

The regulator warned commercial banks to lower their interest rates accordingly or face penalties.

The banking regulator’s decision sparked debate among Kenyans, who shared their experiences in accessing credit from their banks.

What to know about Kenya shilling stability

Source: TUKO.co.ke