What’s going on here?

Kenya’s shilling is projected to strengthen against the dollar this week, driven by remittances and offshore dollar inflows targeting government bonds.

What does this mean?

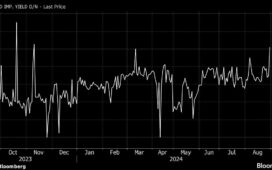

Commercial banks are optimistic, quoting the shilling at 128.50/129.50 per dollar, an improvement from last week’s 129.00/130.00. This boost is propelled by Kenya’s central bank offering infrastructure bonds worth 50 billion shillings, expected to attract substantial foreign investment. In contrast, Ghana’s cedi remains stable at 15.54 to the dollar, although upcoming bond coupon payments could apply pressure. Meanwhile, Nigeria’s naira settled around 1,580 to the dollar following a central bank intervention, and Zambia’s kwacha is steady due to improved dollar inflows. Uganda’s shilling might dip slightly after an interest rate cut by the Bank of Uganda, projected at 3,725/3,735 to the dollar.

Why should I care?

For markets: Investment inflows drive currency stability.

Kenya’s shilling is gaining strength thanks to solid remittances and attractive government bond returns, signaling increased investor confidence. This trend enhances the appeal for foreign investment, potentially leading to a more stable economic environment. Conversely, mixed performances in currencies like Ghana’s cedi and Uganda’s shilling reflect varied regional economic pressures, impacting overall market sentiment.

The bigger picture: African currencies reflect diverse economic landscapes.

The fluctuations in African currencies showcase the continent’s diverse economic challenges and opportunities. While Kenya leverages bond inflows for currency strength, countries like Uganda and Ghana navigate internal fiscal pressures and investor sentiment. Understanding these dynamics offers insights into regional economic strategies and wider implications for global investors eyeing Africa.