Written by Convera’s Market Insights team

Dollar finds some respite

George Vessey – Lead FX Strategist

It was a slow day in markets yesterday as traders braced for Nvidia’s earnings report. Stocks fell as the revenue forecast from the chipmaker at the heart of the artificial intelligence failed to top the highest expectations. Risk appetite was tempered and the US dollar’s rebound gained traction to hover close to 101 on Thursday after testing 13-month lows earlier in the week.

Investors continue to position for incoming rate cuts by the Federal Reserve (Fed) following Chair Powell’s dovish rhetoric in his Jackson Hole speech, with swap prices reflecting a consensus of around 100 basis points in rate cuts by the central bank in its three remaining decisions this year. This means markets are expecting at least one jumbo cut of 50 basis points. However, indications of some level of robustness in US growth, lastly evidenced by a sharp rebound in durable goods orders, sparked some doubt on the magnitude of total rate cuts in the incoming loosening cycle. Given the high bar for a further dovish repricing, another major USD leg lower may require markets to fully embrace the possibility of a US recession. Hence, the lack of tier-one US data this week is probably good news for the dollar, although initial jobless claims may get more attention today as the US labour market appears to have become the new benchmark by which the market will estimate the Fed’s easing scope and pace.

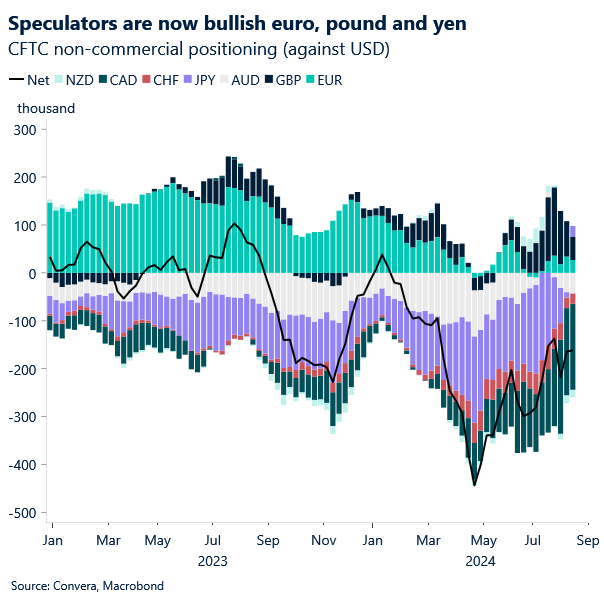

The overall Fed narrative is obviously negative for the dollar and attributed to the expectations of aggressive policy easing by the Fed, rightly or wrongly. We see this shift in the recent positioning data too, where speculators have turned bullish on the euro, pound, and yen simultaneously versus the dollar for the first time since early 2021.

Pound holds its grip on key levels

George Vessey – Lead FX Strategist

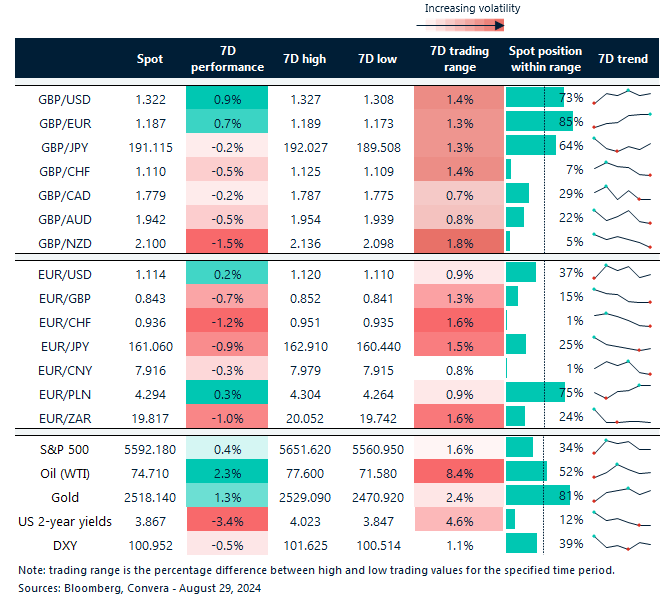

The lack of top-tier economic data from the UK leaves sterling exposed to global risk sentiment, but the UK currency has held up well despite the modest rise in risk aversion across financial markets this week. GBP/USD retains its grip on $1.32, a level it’s only been above for four days out of the past two years. GBP/EUR is close to €1.19 – a level its only been above for 16 days over the past two years.

Earlier in August, the Bank of England (BoE) cut its main rate by 25 basis points to 5%, with markets currently expecting another 40 basis points of cuts by year-end. However, better-than-expected UK economic data and cautious remarks from BoE Governor Andrew Bailey on further rate reductions have tempered these expectations. As such, both 2-year and 10-year UK gilt yields have risen back above 4%, providing the pound with a stronger yield advantage versus most major peers. A further weakening of sterling in the short-term is possible, but we note that GBP/USD has already eased out of overbought territory on the daily timeframe due to this period of consolidation.

Meanwhile, moving from monetary to fiscal policy, UK Prime Minister Keir Starmer has highlighted the long road ahead to address issues he attributes to the previous Conservative government, warning that conditions may worsen before they improve. As the Autumn budget looms, as does a series of tax hikes, which taints the UK’s growth outlook somewhat.

Euro extends week’s losses

Ruta Prieskienyte – Lead FX Strategist

European markets experienced a welcome period of calm, with investors globally fixated on Nvidia’s Q2 earnings results. European stocks recovered their early-week losses, though the pace of gains since the start of August has slowed, with buyer fatigue setting in ahead of a historically challenging performance season. Short-end Bunds outperformed US Treasuries, marginally widening the spread compared to the previous trading day, as traders anxiously await Eurozone CPI reports.

In Germany, annual inflation is expected to decrease to 2.1% in August, the lowest since April 2021. Eurozone inflation figures, due tomorrow, are anticipated to show a slowdown to 2.2% year-on-year, the lowest in over three years, down from 2.6% in July. Despite expectations of gradual rate cuts, market predictions for ECB easing remained steady. Traders are holding ECB rate-cut wagers steady, pricing in 25bps of cuts next month, 65bps by year-end, and 157bps by the end of 2025.

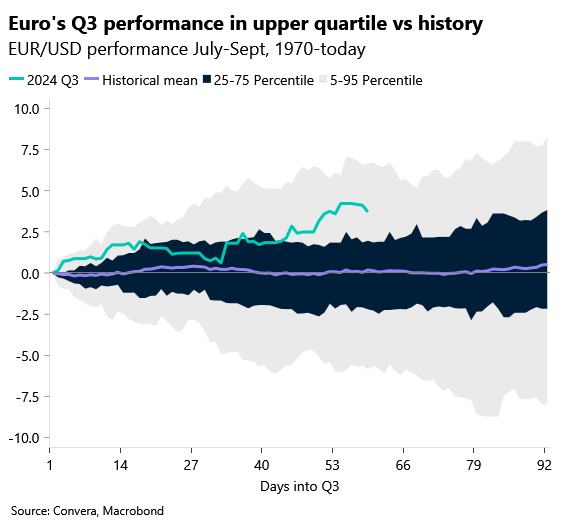

The EUR/USD retreated to a three-session low of around $1.112, adding to the week-to-date losses. The pair has surrendered approximately 0.7% from its recent peak but remains nearly 3% higher month-to-date. Given that the market is pricing in the bottom of the dollar smile scenario, the lack of top-tier US data this week is favourable for the dollar. As a result, EUR/USD may struggle to move back closer to $1.120, with a retest of the $1.110 support level likely.

Safe haven Swiss franc dominates FX space

Table: 7-day currency trends and trading ranges

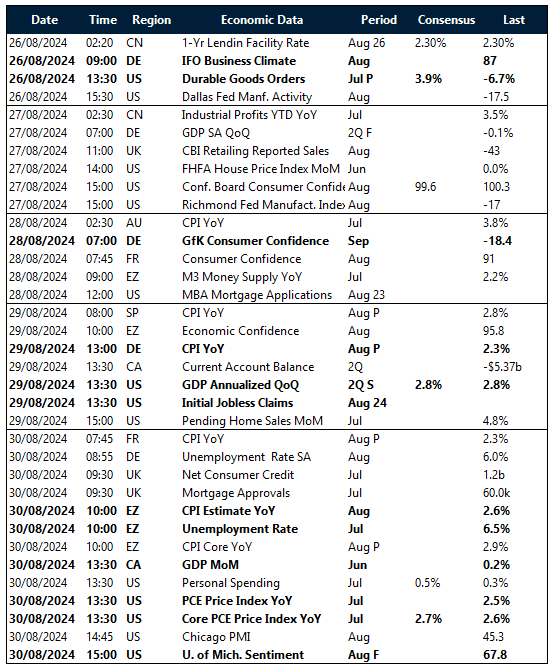

Key global risk events

Calendar: August 26-30

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.