South Korean stocks opened lower Thursday, led by losses in large-cap semiconductor shares, as investors remained cautious over the Korean won’s weakness and Federal Reserve Chair Jerome Powell’s comments on the “highly valued” stock market.

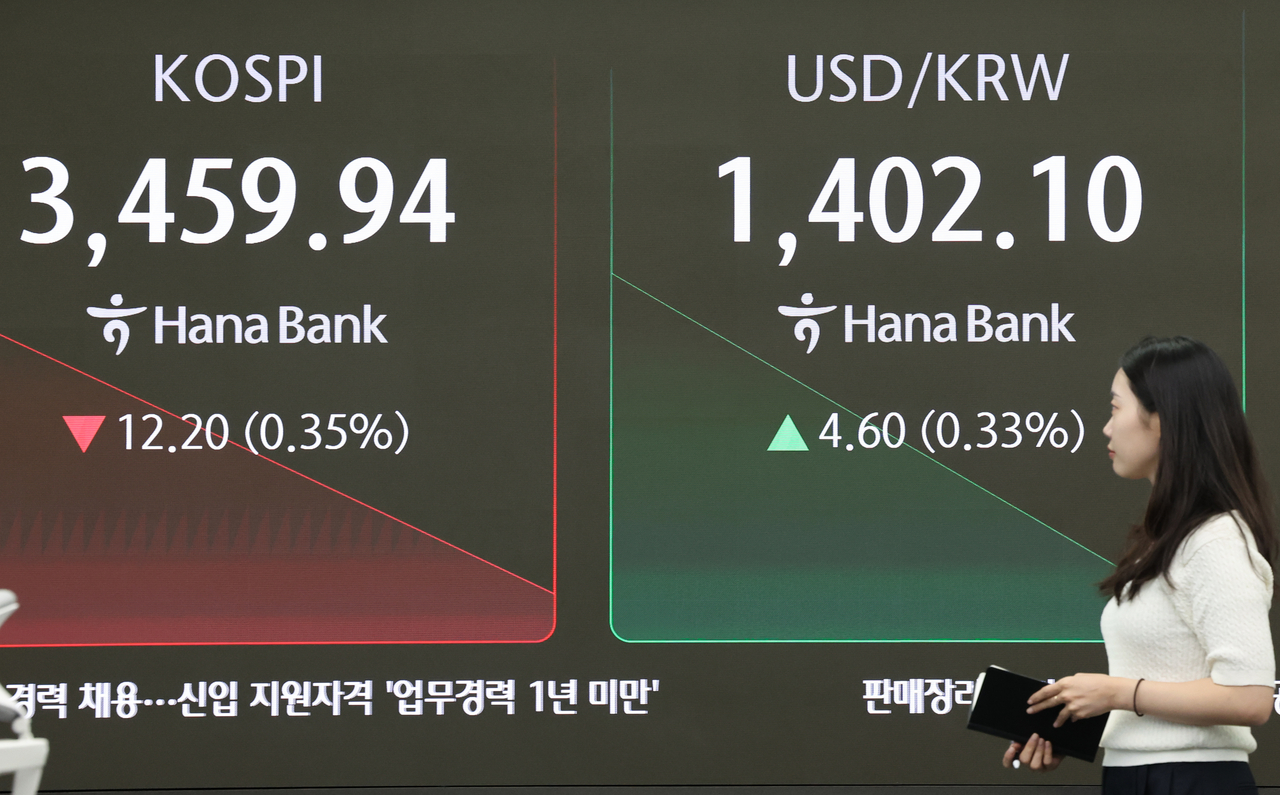

The benchmark Korea Composite Stock Price Index shed 13.34 points, or 0.38 percent, to 3,458.8 in the first 15 minutes of trading.

Overnight, Wall Street finished lower following recent gains, after Powell said “equity prices are fairly highly valued” and the Fed is watching the impact of its policies on the overall financial conditions.

The Dow Jones Industrial Average fell 0.37 percent, the tech-heavy Nasdaq Composite went down 0.33 percent, and the S&P 500 shed 0.28 percent.

The local currency slumped to a 4-month low against the US dollar Wednesday.

In Seoul, top-cap shares opened mixed.

Market bellwether Samsung Electronics fell 1.17 percent, and chip giant SK hynix sank 1.89 percent.

But leading battery maker LG Energy Solution advanced 1.15 percent, and defense giant Hanwha Aerospace surged 2.65 percent.

Leading bio company Samsung Biologics went down 1.24 percent, but Celltrion climbed 0.62 percent.

Automakers opened lower. Top automaker Hyundai Motor shed 0.46 percent, and its sister affiliate Kia skid 0.49 percent.

But shipbuilders gathered ground. Leading shipbuilder HD Hyundai Heavy surged 2.2 percent, and its rival Hanwha Ocean added 0.27 percent.

Power plant manufacturer Doosan Enerbility retreated 0.91 percent, while leading steelmaker POSCO Holdings increased 0.36 percent.

The local currency was trading at 1,401.85 won against the greenback at 9:15 a.m., down 4.35 won from the previous session. (Yonhap)