Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market faced challenges in the Q1 of 2025 and showed limited recovery throughout most of April. This downturn aligned with a broader market pullback affecting multiple asset classes. Toward the end of the month, however, digital assets began to regain momentum. Bitcoin (BTC), in particular, re-entered the spotlight with its renewed push toward the $100,000 mark.

As broader financial markets also started to record gains, investor sentiment shifted, sparking renewed interest in crypto. Market participants are now actively evaluating tokens with strong fundamentals, growth, or recent technical developments. This overview explores the top cryptocurrencies to invest in now.

Top Cryptocurrencies to Invest in Now

Aave USDC, a yield-bearing variant of the USDC stablecoin, has gained compatibility with the MetaMask Card, expanding its usability within the decentralized finance (DeFi) ecosystem. LDO has maintained a trading price around $0.8461, reflecting steady gains.

Meanwhile, Best Wallet Token is approaching the $12 million mark in its ongoing ICO. In other news, Bitcoin has regained upward momentum, pushing past the $95,000 level and reinforcing expectations of a continued bullish trend.

1. Aave (AAVE)

Aave is a decentralized finance (DeFi) protocol allowing users to borrow cryptocurrencies through a shared liquidity pool model. Lenders deposit assets into pools, which other users can borrow from by providing collateral. The interest rates for borrowing and lending adjust automatically depending on how much of the pool is used at a given time.

Furthermore, the token introduced several innovations to the DeFi space, such as flash loans, stable interest rates, and tokenized deposit positions called aTokens, which accrue interest over time. Aave’s governance transitioned from its original LEND token to the AAVE token, giving holders the ability to propose and vote on protocol changes.

More recently, Aave USDC, a yield-generating form of the USDC stablecoin, became compatible with the MetaMask Card. This integration enables users to spend from their interest-bearing positions directly, offering a bridge between DeFi holdings and everyday transactions. It marks a step forward in making crypto assets more usable within traditional financial tools.

eUSDe May expiry PT tokens can now be used as collateral on the Ethereum Core market.

They represent the principal from @ethena_labs eUSDe deposits on @pendle_fi. pic.twitter.com/Qf0i0NyA1D

— Aave (@aave) April 30, 2025

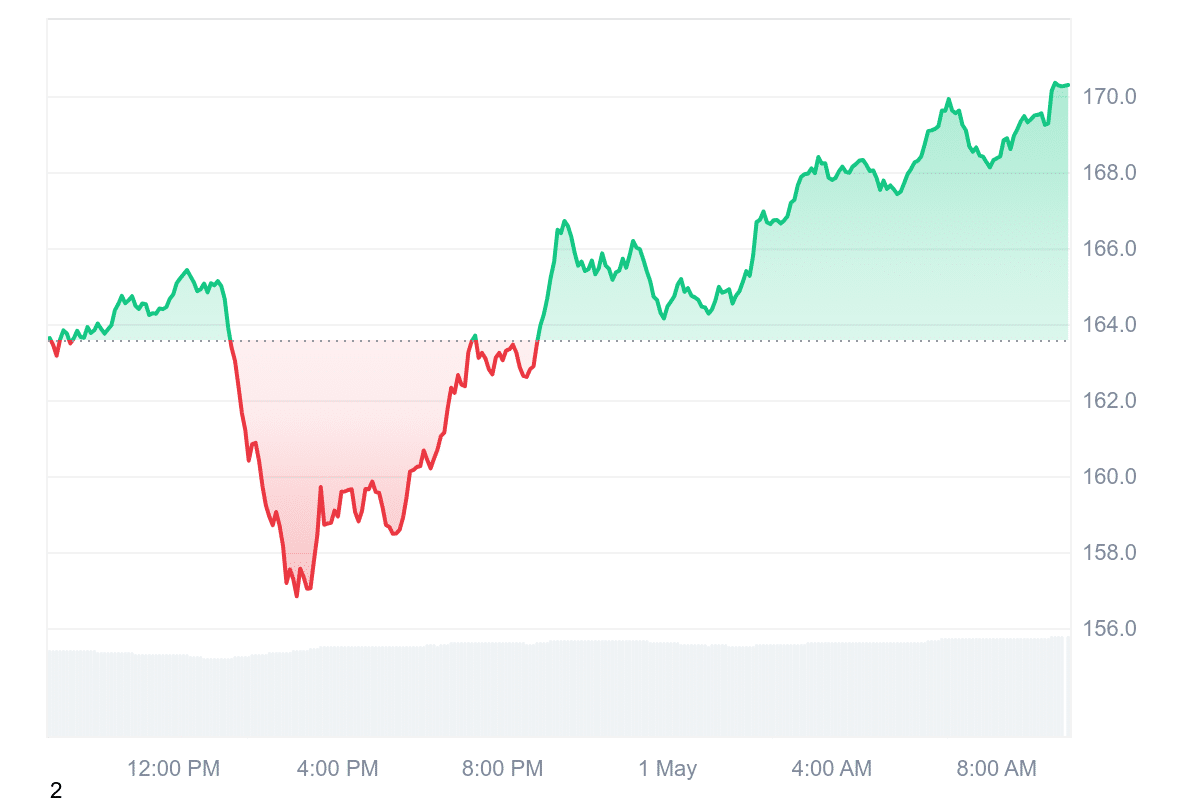

Currently, AAVE trades at $170.61, with a 24-hour trading volume of $432.34 million and a market cap of $2.58 billion. The asset showed moderate liquidity, with a volume-to-market cap ratio of 0.1674. Technical indicators like the 14-day Relative Strength Index (RSI) at 52.73 suggest a neutral trend.

2. Lido DAO (LDO)

Lido is a decentralized protocol that simplifies the staking process on Ethereum. Instead of requiring users to lock up their ETH and run complex infrastructure, Lido allows them to stake their tokens and maintain liquidity. When users stake through Lido, they receive stETH tokens representing their original ETH plus any rewards earned. These tokens can be used across DeFi platforms, making it possible to earn rewards while keeping funds accessible.

The protocol gained traction following Ethereum’s transition to a Proof of Stake model, known as The Merge. Since then, Lido has grown into the largest liquid staking platform, managing over 9 million ETH. This approach appeals to users who prefer a more flexible and transparent option compared to staking on centralized exchanges.

Lido V3 Testnet is here

Starting today, builders can create tailored staking solutions using Lido stVaults on the Hoodi Ethereum Testnet. https://t.co/rJ3qSuuaA6

— Lido (@LidoFinance) April 28, 2025

Lido is governed by a decentralized autonomous organization (DAO), meaning LDO token holders can vote on key decisions such as changes in governance, new integrations, or system upgrades. The governance structure also helps maintain decentralization and oversight within the protocol.

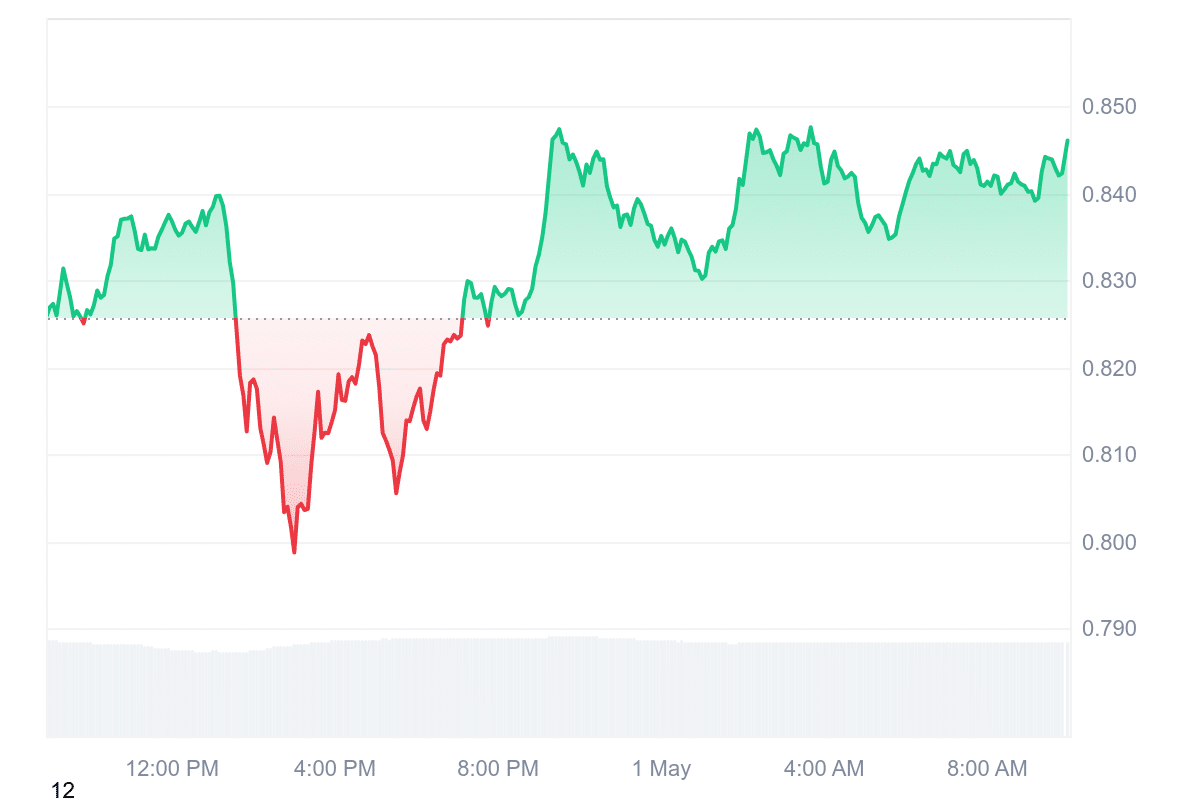

Meanwhile, the LDO token trades at $0.8461, showing modest gains over the past day and week. Its trading volume and market cap indicate relatively high liquidity, supported by a volume-to-market-cap ratio of 0.1690. The 14-day Relative Strength Index sits at 57.80, suggesting the token is in a neutral zone and may not see strong momentum in either direction in the short term.

3. Quant (QNT)

Quant (QNT) is a blockchain-focused project designed to address interoperability. Most blockchains operate in isolation, making it difficult for data and value to move freely between different networks. Quant addresses this by introducing Overledger, an operating system that acts as a bridge between various blockchains.

This allows developers to build decentralized applications (dApps) that can access and interact with multiple blockchains simultaneously, including linking applications within the same network, such as Ethereum.

The project’s approach doesn’t rely on creating a new blockchain, but instead focuses on making existing ones more connected. This design helps maintain performance while enhancing the ability of networks to work together. Overledger functions similarly to how the internet connects different computers and systems without requiring them all to run on the same platform.

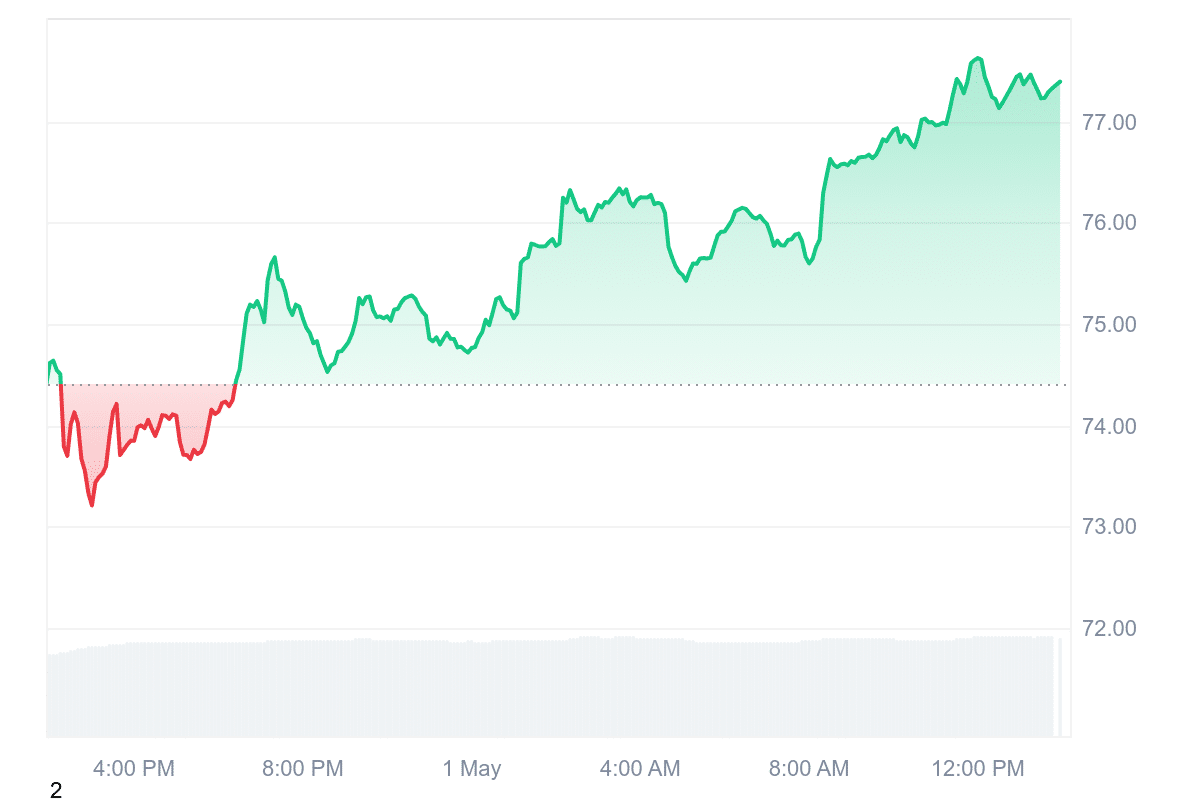

Currently, the QNT token is priced at $77.39, reflecting a 3.90% gain over the past 24 hours and an 8.39% increase over the last week. Over the past month, the token has shown a 9.05% rise. With a Relative Strength Index (RSI) of 53.94, QNT is trading in a neutral zone, suggesting that the market does not view it as either overbought or oversold.

Sentiment remains neutral, and performance remains positive when compared to its original token sale price. Quant’s technical focus and consistent development suggest it is positioned as a utility-driven asset within the broader blockchain ecosystem.

4. Best Wallet Token (BEST)

Best Wallet Token (BEST) represents a growing effort to streamline access to Web3 services through a single mobile platform. At its core, Best Wallet serves as a non-custodial cryptocurrency wallet, meaning users retain full control over their private keys and funds.

The platform’s native token, BEST, plays a central role in the ecosystem. Token holders gain early access to certain crypto presales, allowing them to invest before projects reach the broader market. This can help users explore investment opportunities with less friction. The wallet also includes tools aimed at improving trade timing and minimizing transaction costs, features that may appeal to more active market participants.

Furthermore, Best Wallet Token has raised nearly $12 million through its initial coin offering (ICO), indicating strong investor interest. At the current token price of $0.024925, the BEST price is set to increase soon, suggesting a sense of urgency among buyers.

Your feedback means everything to us! ⭐

Over the past few weeks, many of you have suggested adding a vesting schedule — to help protect the token price and build a stronger, long-term community.

That’s why we’re launching a poll to gather your thoughts on implementing a light… pic.twitter.com/GKedseIcYk

— Best Wallet (@BestWalletHQ) April 29, 2025

Moreover, Best Wallet plans to launch a crypto debit card known as “Best Card.” This addition would allow users to spend their crypto holdings for everyday purchases, providing a real-world use case and bridging a common gap in DeFi applications.

With over 212 million BEST tokens currently staked, Best Wallet continues to demonstrate strong community participation. The platform estimates an annual return of approximately 125% in staking rewards, signaling potentially high incentives for long-term holders.

Visit Best Wallet Token Presale

5. Optimism (OP)

Optimism is a layer-two solution built on top of the Ethereum blockchain, designed to improve transaction speed and reduce costs without compromising Ethereum’s core security. The project follows a minimalist and practical design approach. It reuses much of Ethereum’s existing code and tools instead of developing completely new systems.

The project’s team focuses on gradual improvements based on actual user needs rather than speculative features. One of its goals is full compatibility with Ethereum’s Virtual Machine (EVM), which would enable developers to deploy their applications on both networks with minimal changes.

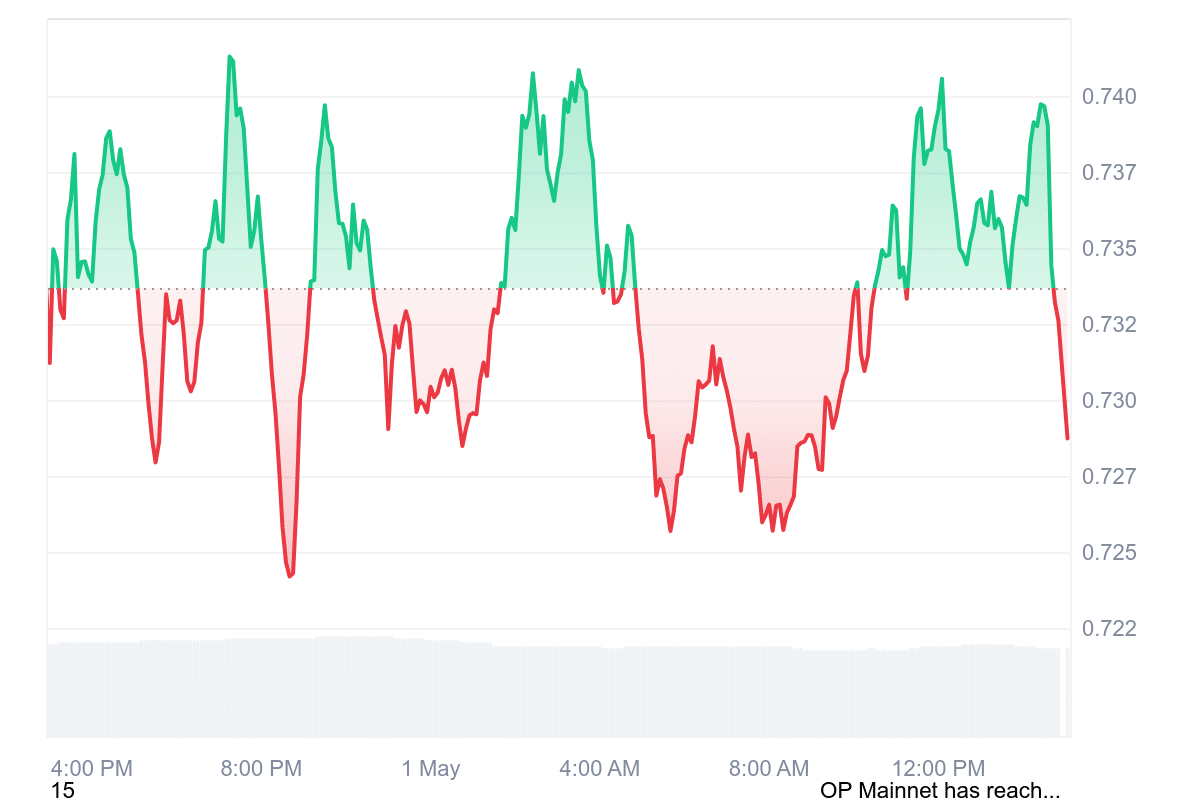

Per market performance, Optimism (OP) is currently priced at $0.7295. Its trading activity indicates decent liquidity, with a 24-hour volume-to-market cap ratio of 0.1664. The token has had 16 positive trading days in the past month, showing moderate stability. Furthermore, the token’s 14-day RSI is 48.63, suggesting i is neither overbought nor oversold, pointing to a neutral trend.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage