- Markets are fully pricing in a 25-bps September Fed rate cut after dovish FOMC meeting minutes.

- Oil prices fell on Wednesday amid growing concerns about China’s economy.

- Investors moved to fully price another Bank of Canada rate cut in September.

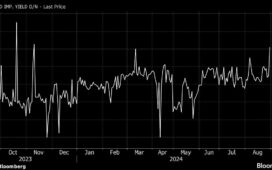

The USD/CAD forecast leans bearish, with the dollar on the back foot after dovish FOMC meeting minutes. Investors are more convinced that the Fed will implement the first rate cut in September. At the same time, Canada’s inflation data has raised the likelihood of a Bank of Canada rate cut in September.

-Are you interested in learning about the forex signals telegram group? Click here for details-

Fed minutes released on Wednesday showed that policymakers were ready to lower borrowing costs in September if data came in as expected. It clearly indicated confidence that inflation will reach the 2% target. Since inflation met expectations in July, investors are convinced policymakers will vote to cut rates next month. As a result, markets are fully pricing in a 25-bps rate cut.

The focus now shifts to Powell’s speech tomorrow. If he signals a rate cut, the dollar might continue falling, benefiting the Canadian dollar. The CAD has strengthened significantly this week despite a drop in oil prices and easing inflation in Canada.

Notably, oil fell on Wednesday amid growing concerns about China’s economy. China’s fragile recovery has clouded the outlook for oil demand, and most experts have downgraded their forecasts for global demand. Nevertheless, the loonie gained amid the US dollar’s weakness.

Meanwhile, data on Tuesday revealed that Canada’s July inflation dropped to a 40-month low of 2.5%. After the report, investors moved to fully price another Bank of Canada rate cut in September. However, investors have already priced this outcome. Consequently, the data had little impact.

USD/CAD key events today

- Unemployment Claims

- Flash Manufacturing PMI

- Flash Services PMI

USD/CAD technical forecast: Price gets oversold below 1.3601

On the technical side, the USD/CAD price is in freefall and recently broke below the 1.3601 support level. Since bears took over when the bullish trend peaked, the price has traded below the 30-SMA. At the same time, the RSI has traded below 50, supporting bearish momentum.

-If you are interested in forex day trading then have a read of our guide to getting started-

At the moment, the RSI is in the oversold region, indicating extreme bearish momentum. Since USD/CAD is oversold, bulls might resurface for a pullback to retest the 30-SMA. However, the price might reach the 1.3550 key level before that happens.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.