By Saurabh Jain

Indian equities have hit several all-time highs since the start of Q4 2023. The Nifty

The below five-step framework could act as guardrails for investors to navigate markets.

Have a disciplined approach to investing

In bullish markets, it is normal to see a certain segment or theme having a ridiculous run-up in prices. This creates a sense of FOMO (Fear of Missing Out) among investors with greed and envy taking over, making them chase the trend to possibly disastrous results. Investors can avoid succumbing to FOMO by adopting a disciplined approach to investing through (i) a clear investment plan that defines your objectives, (ii) periodically reviewing and rebalancing your portfolio to stay close to your initial target asset allocation and (iii) investing systematically and using rupee cost averaging to spread out your investments across different periods to mitigate the fear of investing at the wrong time. As investors, a disciplined approach can help us avoid distractions that result in emotional buying and selling.

Build a diversified foundation portfolio

Historically, no asset class consistently performs the best from year to year. Hence, investing in a diversified foundation portfolio is critical for investors to generate stable and consistent long-term returns. Diversification can be done in three broad ways – (i) allocating across different assets classes like equity, bonds, commodities, alternates based on one’s asset allocation and risk profile, (ii) allocating to international markets to avoid single-market bias and (iii) spreading your investments within an asset class, like across market segments and styles for equity and similarly diversifying one’s bond portfolio considering duration, credit, and interest-rate sensitivity.

Understand relationship between risk & return

Investors should consider the risk-return trade-off of their different investments across portfolios. Riskier investments may present the possibility of superior returns, but higher risks are no guarantee for good performance. Another key risk is illiquidity, and an investor needs to assess whether the expected return from an investment option compensates adequately for the lack of liquidity. In bull markets, investors make the mistake of chasing higher returns without proper assessment of illiquidity risk. A well-diversified foundation portfolio across differing assets with varying degrees of risk and correlation with each other’s returns will effectively minimise risk.

Reset your return expectations

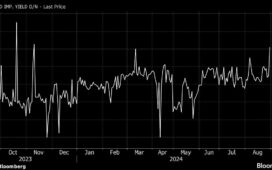

As investors, we tend to give more importance to short-term performance and extrapolate recent returns into the future. We believe investors need to reset their equity market return expectations lower albeit with higher volatility on three factors. First, compared to previous cycles, equity valuations are elevated today. Second, history suggests equity market returns are high single or low double-digit at these valuation levels. Third, limited policy easing by the RBI

Account for evolving macro environment

Asset markets follow cycles heavily influenced by the macro backdrop. However, as investors, we tend to put a disproportionate focus on the microenvironment overlooking the changing macro environment which has a large impact on our investments. Volatility in markets is usually triggered by changes in the macro environment with history showing most equity market drawdowns (index fall of 15% or more) occurring around changes in key macro-economic variables. Further, the business cycle and policy environment could drive substantial changes among sectors and investment trends and help identify structural multi-year and decadal themes.

Saurabh Jain, head, Wealth Management, Standard Chartered Bank, India