The US dollar is down big again this week, but will it last into next week?

Find out in today’s Weekly Forex Forecast and get the latest on the DXY, EURUSD, GBPUSD, USDJPY, and AUDUSD.

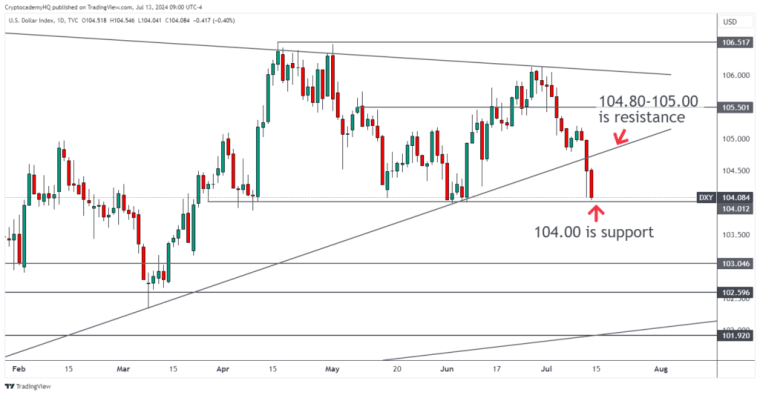

US Dollar Index (DXY) Forecast

The DXY has dropped significantly over the last two weeks, now trading below the December trend line near 104.80.

That will be a massive hurdle for dollar bulls next week.

However, the dollar index is also still above 104.00 support, making USD shorts risky at current levels.

If the DXY drops below 104.00 on a daily closing basis it would expose 103.00.

On the other hand, a reclaim of the December trend line near 104.80 would be bullish for the DXY and open up levels like 105.10.

Get the NEW Trading Course + Access to the Real-Time Trading Community!

Join our elite trading program and save 90% on lifetime access! Sale ends soon!

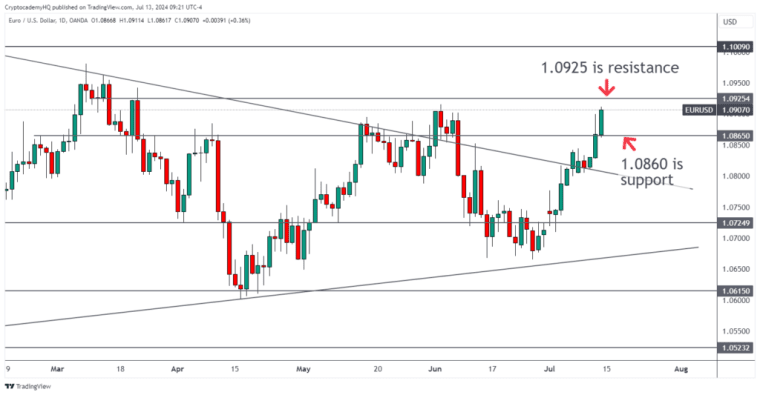

EURUSD Forecast

EURUSD is breaking out this week from a consolidation pattern that began in 2021.

This will be the first (convincing) weekly close above the 2021 trend line since it began, and certainly within the consolidation since last July.

If euro bulls can hold the pair above 1.0860 into today’s close, that area should flip to new support next week.

Key resistance from here includes 1.0925 and 1.1000.

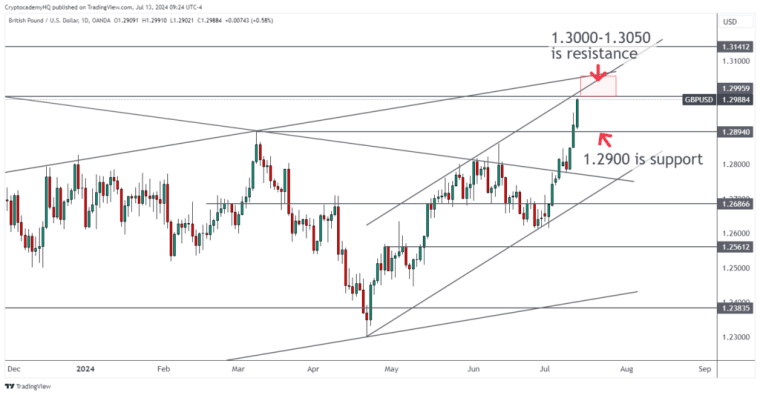

GBPUSD Forecast

GBPUSD is up a staggering 300 pips in just two weeks following last week’s breakout from the 2021 trend line.

It seems we have our answer as to which way this multi-year consolidation will break, especially now that the pound has cleared 1.2900.

As long as GBPUSD can stay above 1.2900, areas like 1.3000 and even 1.3140 are exposed.

However, if the pound loses 1.2900, specifically 1.2860, it would represent a bearish turn toward the 1.2800 highs.

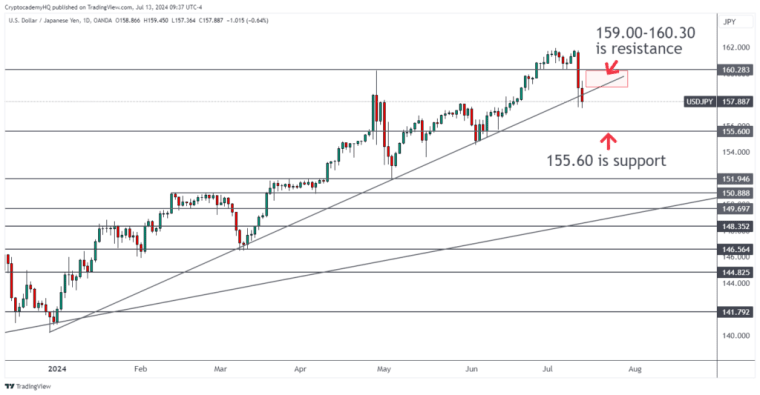

USDJPY Forecast

USDJPY is at risk of breaking down following Thursday’s sub 160.30 close.

The daily close back below 160.30 represents a confirmed failed breakout (fakeout) above the level, which is a bearish structure.

If USDJPY closes a day below its January trend line at 158.10, it would represent yet another breakdown and open up lower levels like 155.60.

The 155.60 level is being respected on a weekly closing basis, but it’s still one to watch.

There’s even a chance we see a retest of the 2022 ascending trend line closer to 152.00, something we haven’t seen since the start of the year.

Alternatively, a sustained break above 160.30 on the high time frames would be bullish.

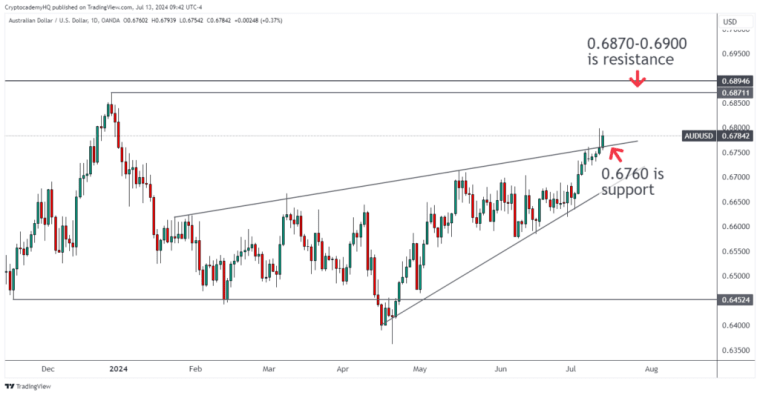

AUDUSD Forecast

AUDUSD is breaking out from an ascending trend line this week on the back of a much weaker US dollar.

However, pairs like AUDUSD and NZDUSD have struggled against their peers due to US large-cap stocks, which have been relatively weak lately.

If the Australian dollar can hold above 0.6760 today and into next week, then areas like 0.6860-0.6890 could come into play.

On the flip side, a failure to hold above 0.6760 next week would represent a failed breakout and open up the April trend line near 0.6700.

Get the NEW Trading Course + Access to the Real-Time Trading Community!

Join our elite trading program and save 90% on lifetime access! Sale ends soon!