Brandon Bell

While Dollar General’s (NYSE:DG) stock rallied +30% over the last two months (still down ~15% pre-2Q’23 earnings though), the business is not quite out of the woods yet.

Here are some highlights from Thursday’s call.

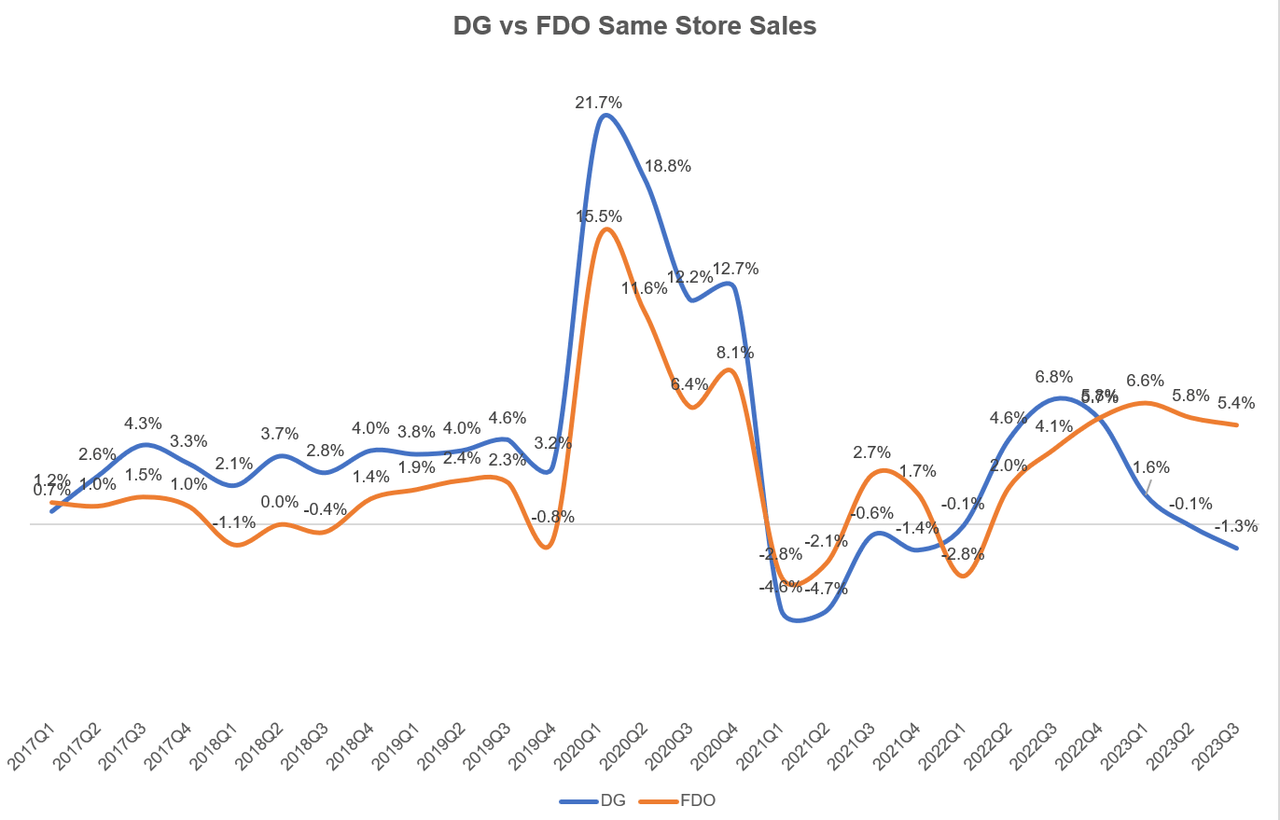

Same Store Sales (SSS)

For the two consecutive quarters, SSS is negative for DG whereas Family Dollar (FDO), DG’s primary competitor, maintained its Mid-Single Digit (MSD) SSS growth during the same time.

Thankfully, management mentioned traffic finally turned positive this quarter; so the SSS decline was driven by average ticket:

… customer traffic was positive in Q3. After starting the quarter slightly negative, traffic turned positive in the middle period and improved sequentially each period of the quarter…. Customer traffic and same-store sales continue to improve in November. (MBI Note: DG’s third quarter ended on November 3rd and hence sequential improvement in November is not reflected)

Company Filings, MBI Deep Dives, Daloopa

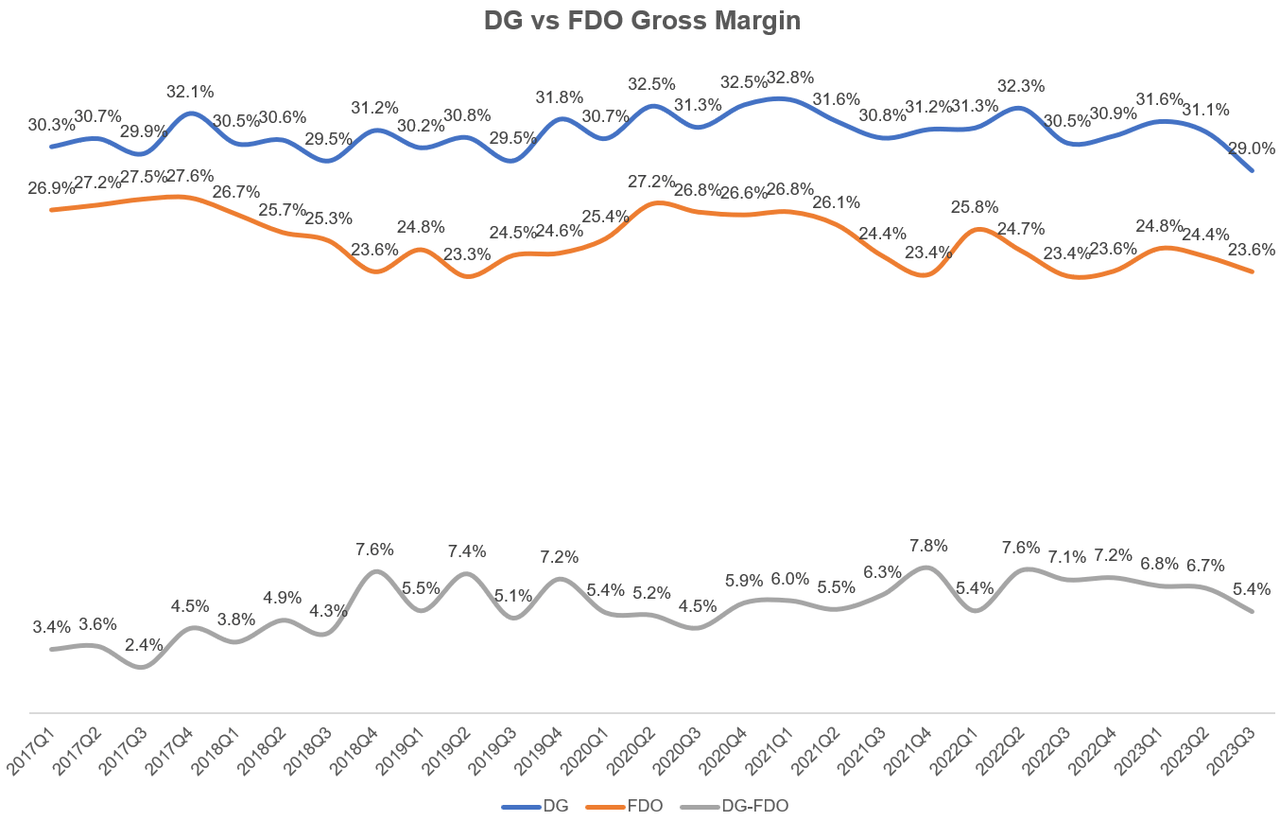

Gross Margin

Only the consumables segment grew YoY and since consumables is a relatively lower margin segment compared to other segments, gross margin declined ~147 bps YoY.

Management also mentioned an increase in shrink, lower inventory markups and increased markdowns for gross margin decline (partially offset by decreases in LIFO and transportation costs):

Shrink is actually 100 basis point headwind for us. And then as we moved into Q3, it’s actually running just a little bit higher than that. And so certainly a pressure near term for us, something that we’re looking to hopefully- we’re mitigating along the way, and it’ll show up in the financial results later in 2024.

Company Filings, MBI Deep Dives, Daloopa

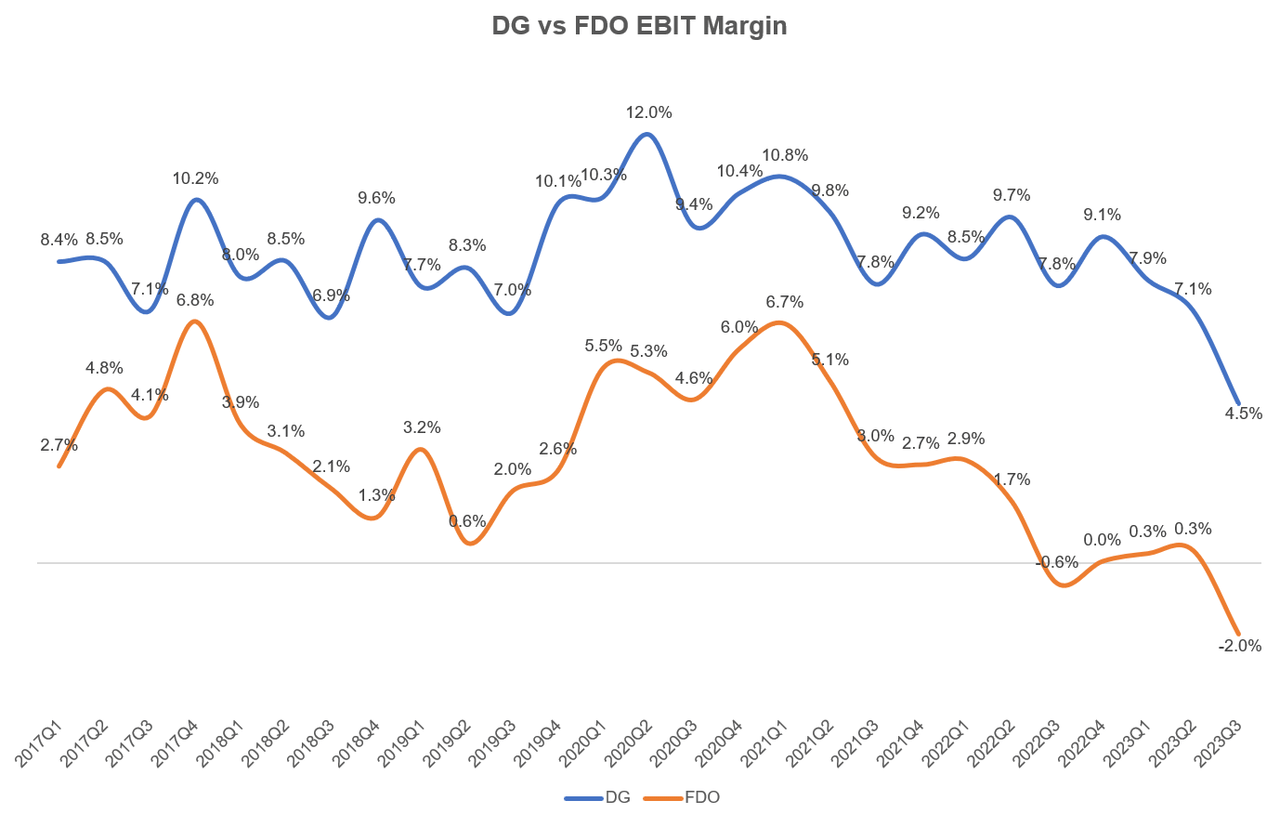

Operating margin

While FDO seems to be gaining traffic share and somewhat narrowed the gap in gross margins, it continued to struggle to generate profits. Both discount retailers struggled last quarter.

DG posted their lowest ever quarterly operating margins in the last decade (possibly longer, but I looked at data since 2013 and their lowest operating margin quarter before this quarter was +6.9%).

Company Filings, MBI Deep Dives, Daloopa

“New” management made some changes (TBD whether these lead to margin improvement over time):

… we have made the decision to redeploy labor hours away from smart teams and instead more directly to our store teams and a greater emphasis on customer service and store-level inventory management activities. (Note: Smart teams used to be prior management’s idea which is basically groups of employees that move between multiple stores to organize excess inventory.)

Inventory

Inventory was +3% YoY and -1.8% on a per store basis. Non-consumables inventory was -15% YoY and -19% on a per store basis.

Management expects they have the opportunity to take out a “meaningful number of SKUs” to further rationalize inventories (currently they have ~11-12k total SKUs per store)

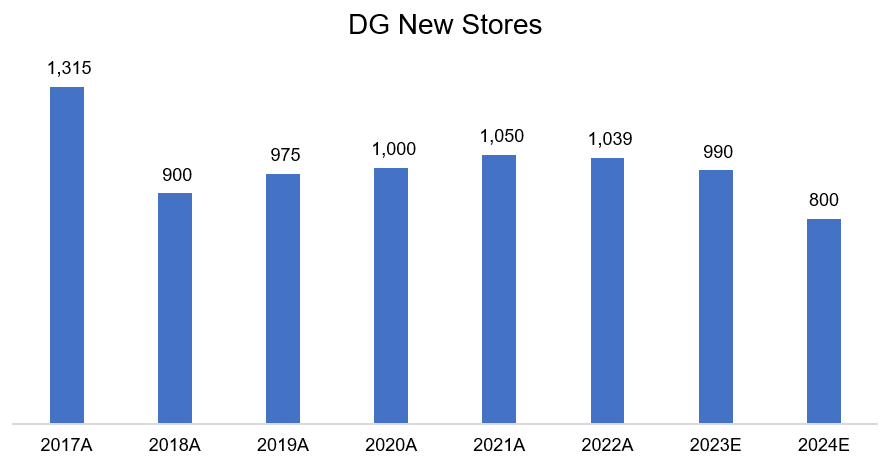

Store expansion

DG guided to 800 new stores expansion in 2024 which will be the lowest since 2015.

Company Filings, MBI Deep Dives, Daloopa

While management thinks slightly slower expansion is more prudent given macro and current context of DG, they remain optimistic about store expansion plans:

we monitor the following 5 metrics of our new store portfolio, including performance against pro forma sales expectations; new store productivity compared to the mature store base; cannibalization, which overall has remained consistent and predictable; cash payback, which we continue to expect in 2 years or less; and new store returns, which we expect to be approximately 18% on average in 2024. I want to note that our expectations for new store returns, while still very strong, are down modestly from our historical target of 20%-plus. We are placing a heavier emphasis on rural stores in 2024 with more than 80% of our new stores planned in rural communities where we believe we can have the most significant and positive impact for our customers

The costs of opening new stores is also likely exerting pressure on DG to open stores slower than in recent years:

the initial opening of our 8,500 square foot store has increased more than 30% since we began rolling out the larger format in 2022. Additionally, nonresidential construction costs have increased significantly since pre-COVID.

Outlook

2023 outlook is unchanged from what DG shared a couple of months ago. 2023 EPS guidance is $7.35 (mid-point) which implies the stock is currently trading at ~18x P/E.

For investors to make decent money in DG, the real debate is whether they can increase their operating margin from ~6.5% (9M’23) to ~8.5% (historical average) over the next couple of years. That debate remains far from settled.

Thank you for reading.

Disclosure: I own shares of Dollar General

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.