(Bloomberg) — The US dollar curbed its losses after the Federal Reserve reduced the number of projected interest-rate cuts this year to just one.

Most Read from Bloomberg

The Bloomberg Dollar Spot Index fell 0.3%, after dropping as much as 0.6% earlier in the session. The decline, sparked by cooler-than-expected US inflation, was trimmed after the Fed dialed back its expectations to only one rate cut this year, from three, and left its benchmark rate unchanged, as expected.

The US central bank’s rate-path view was at odds with the markets that still see two reductions.

“It seems like the Fed that doesn’t want to overreact to today’s good CPI number,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi, US. “Had it not been for a good inflation number, the markets would’ve been under pressure by the hawkish slant of the Fed.”

The swings in foreign-exchange markets come as traders continue seeing potential for lower US borrowing costs as soon as September thanks to data that showed price pressures ebbed in May. The markets have been pouring over indicators on the world’s biggest economy for clues on the timing of the Fed’s easing cycle. Just last week, the Bank of Canada and European Central Bank became the first Group-of-Seven economies to begin lowering interest rates.

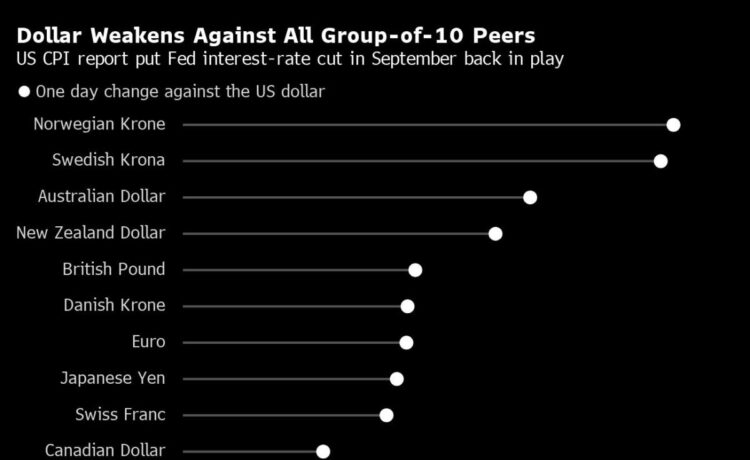

The weaker greenback helped Europe’s common currency to surge by more than 1% to 1.085 against the greenback, the most in about six months. It later curbed gains to 1.082 after the Fed decision. The British pound advanced as much as 0.9%, the highest since March, before paring gains. All currencies in the Group of 10 were stronger against the greenback.

–With assistance from David Finnerty and Cristin Flanagan.

(Updates with Fed decision, forecasts.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.