Dollar mounted a significant comeback overnight, demonstrating resilience amidst surge in risk-on sentiment that propelled the three major US stock indexes to record highs. The greenback continued to extend gains in Asian session, surpassing pre-FOMC highs against European majors.

The shift in sentiment came in wake of SNB’s unexpected rate cut yesterday and dovish voting pattern from BoE. These events could have led investors to realize that there are realistic risks that Fed could start cutting interest rates later other major counterparts like ECB.

Currently, Dollar stands as the week’s strongest currency, outperforming trailed by Canadian Dollar and Euro. On the other end of the spectrum, Swiss Franc languishes as the week’s weakest performer, with Japanese Yen not faring much better. New Zealand Dollar and British Pound are also under pressure, whereas Australian Dollar occupies a neutral position within the currency mix.

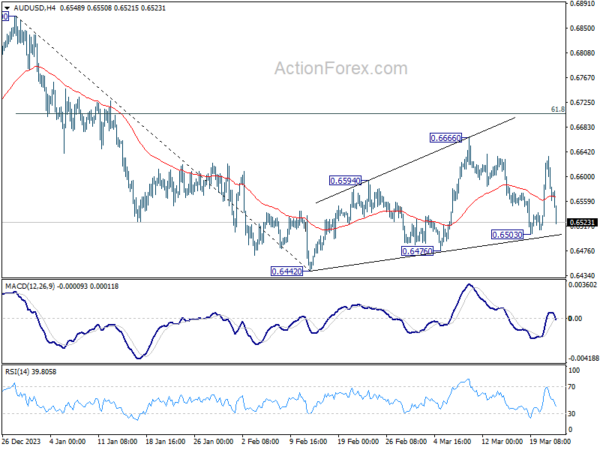

Technically, focus is back on 0.6503 support in AUD/USD with current steep decline. Firm break there will revive that case that corrective rise from 0.6442 has completed at 0.6666. Larger fall from 0.6870 should then be ready to resume through 0.6442 low.

In Asia, at the time of writing, Nikkei is up 0.22%. Hong Kong HSI is down -3.04%. China Shanghai SSE is down -1.41%. Singapore Strait Times is down -0.29%. Overnight, DOW rose 0.68%. S&P 500 rose 0.32%. NASDAQ rose 0.20%. 10-year yield fell -0.002 to 4.271.

Japan CPI core rises to 2.8% in Feb, above BoJ’s target for 23rd month

Japan’s CPI core (ex-fresh food) rises from 2.0% yoy to 2.8% yoy in February, matched expectations. This increase marks the first acceleration in four months and maintains the index above BoJ’s 2% target for the 23rd consecutive month.

The uptick in the core CPI was primarily due to a less pronounced decline in energy prices, reflecting diminishing impact of government subsidies introduced to mitigate energy costs. Specifically, energy prices saw a decrease of -1.7% yoy, a significant moderation from -12.1% yoy drop recorded in January.

The overall headline CPI also showed an uptick, accelerating from 2.2% yoy to 2.8%yoy. However, when examining CPI core-core, which excludes both food and energy, there was a slight slowdown from 3.5% yoy to 3.2% yoy.

New Zealand’s goods exports rises 16% yoy in Feb, imports up 3.3% yoy

In February, New Zealand’s goods exports leaped by 16% yoy to NZD 5.9B. This surge contrasts with a more modest 3.3% yoy increase in goods imports, totaling NZD 6.1B. Consequently, monthly trade deficit narrowed significantly to NZD -218m, far exceeding market expectations of a shortfall of NZD -825m.

Exports to China, New Zealand’s largest trading partner, increased by 10% yoy, contributing an additional NZD 154m. US saw a remarkable 52% yoy jump in exports, adding NZD 305m, while EU and Australia also recorded increases in New Zealand exports by 7.9% yoy and 5.9% yoy, respectively. However, trade with Japan contracted, with exports declining by -10% yoy.

On the import front, China and South Korea marked significant increases of 7.1% yoy and 42% yoy, respectively, indicating robust demand for goods from these economies. Conversely, imports from US and EU saw downturns, declining by 20% yoy and 7% yoy.

Looking ahead

Uk retail sales and German Ifo busienss climate are the main focuses in European session. Later in the day, Canada will release retail sales.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2605; (P) 1.2704; (R1) 1.2757; More…

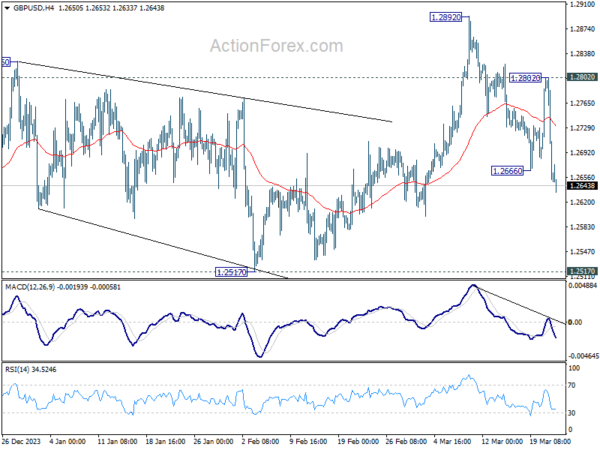

GBP/USD’s steep decline and break of 1.2666 support indicates resumption of fall from 1.2892. Intraday bias is back on the downside for 1.2517 structural support next. Decisive break there will indicate larger bearish reversal. For now, risk will remain on the downside as long as 1.2802 resistance holds, in case of recovery.

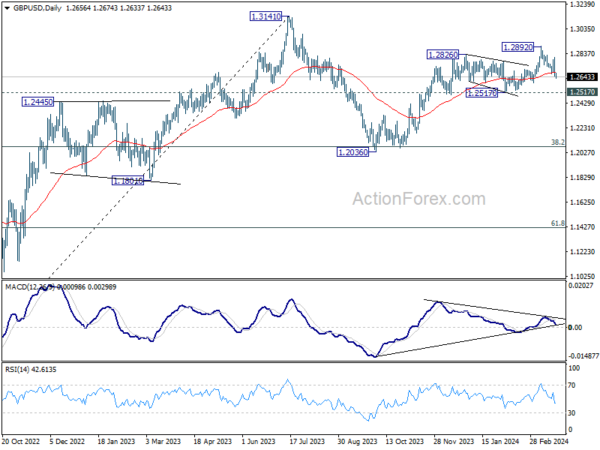

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which is still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (MZD) Feb | -218M | -825M | -976M | -1089M |

| 23:30 | JPY | National CPI Y/Y Feb | 2.80% | 2.20% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Feb | 2.80% | 2.80% | 2.00% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Feb | 3.20% | 3.50% | ||

| 00:01 | GBP | GfK Consumer Confidence Mar | -21 | -20 | -21 | |

| 07:00 | GBP | Retail Sales M/M Feb | -0.30% | 3.40% | ||

| 09:00 | EUR | Germany IFO Business Climate Mar | 86.2 | 85.5 | ||

| 09:00 | EUR | Germany IFO Current Assessment Mar | 86.8 | 86.9 | ||

| 09:00 | EUR | Germany IFO Expectations Mar | 84.7 | 84.1 | ||

| 12:30 | CAD | Retail Sales M/M Jan | -0.40% | 0.90% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | -0.50% | 0.60% |