It is not far-fetched to imagine that Donald Trump may have been forced out of office if the US followed a parliamentary system of government, in which a Prime Minister is just a vote of no confidence away from being gone. That’s because, thanks to his fascination with tariffs, the US dollar — the most admired and trusted currency in the world — has started losing value.

The whole episode is reminiscent of the fall from grace of Liz Truss, the former PM of the UK. Many of you may recall how on October 20, 2022, a rebellion within Truss’ Conservative Party forced her to leave office in ignominy, becoming the shortest-serving prime minister in British history with a tenure lasting only 45 days.

The Tory rebellion, however, was not for any political reasons. Indeed, just weeks before being forced out of office, Truss had handsomely beaten leading candidates such as Rishi Sunak (who succeeded her as PM) and Kemi Badenoch (now the leader of the Tories) in a nationwide poll.

Why Truss lost trust

The reason for Truss’ exit was the fall in the value of the UK’s currency: the pound.

Here’s a short summary of what happened:

Truss took over when the UK was experiencing historically high inflation in the wake of the Russia-Ukraine war, which had spiked the prices of everything, especially fuel & energy. Moreover, this happened at a time when the UK’s economic growth had stagnated since the Global Financial Crisis of 2008, a situation that was made worse by its decision to leave the European Union in 2016.

Truss, helped on Kwasi Kwarteng, her long-time ideologically aligned friend and Chancellor of the Treasury (read UK’s finance minister), announced a bold plan to turn the UK into “a low tax, high wage, high growth economy”. It is on the back of this plan that she secured the Tory leadership.

Story continues below this ad

To this end, in the mini-budget that was unveiled in September 2022, she did two things. On the one hand, she ramped up government spending as a way to boost domestic demand, and on the other, she promised to cut taxes, as a way to incentivise the private sector to increase supply. On paper, and without context, this sounded like a great plan. But Sunak, her main rival inside the party, repeatedly warned that this prescription will wreck the UK economy.

The speed with which the wrecking happened surprised all and sundry, and underscored that in a modern democracy, markets can be more powerful that any political mandate. While the stock market fell 2%, it was the bond market that truly flexed its muscle. Even as Kwarteng finished updating the Parliament, the UK pound fell in value to a 37-year low against the US dollar.

The importance of bond market

The bond market refers to the marketplace where a government (and even corporates/ companies) go to borrow money. It is different from the stock market where investors buy a piece of a company by owning a share of it.

Governments are the biggest borrowers because they have to meet the gap between their revenues and expenditures. And because governments are not expected to default, when a government floats a bond — a paper which says the government owes the bearer of that paper a particular sum at the end of a year or 10 years — it is considered to be the safest asset in any economy.

Story continues below this ad

Holding a government bond is in practical terms as good as holding cash and the effective return (called the yield) that one earns from a government bond is considered to be the risk-free return in that economy. The curious thing about government bonds is that every single one provides an exact payout — say five pounds over a bond which is priced at 100 pounds — and this payout never changes. But the prices of the bond in the market can change.

That is why the effective interest rate (yield) earned on a government bond changes over time as the price of the bond itself changes. This essentially means that if the bond prices fall, the yield rises and vice-versa.

At any point, the yield on a government bond reflects the bare minimum interest rate one can earn or levy on any other entity in the economy; basically no one can borrow or lend an interest rate lower than the yield of a government bond because who can be more trusted.

There is a flip-side though. If the government yields rise sharply they can upset all calculations and no one is affected worse than the government in question. That’s because if the yields rise, the interest to be paid on future loans will rise. For governments that borrow in hundred of billions of their currency, this increase can wreak government finances.

Story continues below this ad

This is exactly what happened with Truss. The markets read her mini-budget and came to the conclusion that it was a bad plan. This was because it stoked already high inflation, both by supplying more money in the economy via additional government spending as well as by leaving more money in the economy through tax cuts.

Inflation basically refers to money losing value; an inflation of 10% means a toy that could be bought for 100 pounds last year requires 110 pounds this year.

If there is high inflation, investors shun that currency: Why hold an asset that is losing value?

Here’s the most remarkable bit: Typically investors have a lot of trust in the currencies of developed economies such as the UK and US. But Truss’ plan was so outlandish that the investors lost trust in UK’s currency and by the same logic, dumped assets (read UK government bonds) denominated in British pounds.

Story continues below this ad

When the pound fell as rapidly as it did in 2022, it was seen as a reality check moment for the UK economy — a moment that announced that the markets and investors had started treating the UK economy as any other emerging economy such as India or Brazil or South Africa.

Trump’s lost of trust

The US economy has dominated the global order for the past eight decades because not only is it the biggest economy — its GDP is close to $30 trillion — it is also the most well-regulated and freely traded economy. Its currency is managed very professionally and the executive branch (the US President) cannot interfere in monetary policy. In other countries, including India and China, the government has a much greater say on monetary policy and this erodes the confidence an random investor has in the value of the currency.

However, with his adamance to place prohibitive tariffs against all the countries in the world, President Trump has dialled back time to an era when the US was not the standard-bearer of the world. The worst part of Trump’s policy is the uncertainty that it has infused about his own policy stance. There is no clarity what his end goal is when he levies the tariffs, or how he calculates the tariff rates.

Not surprisingly, then, the global investors have spoken by shunning the US dollar this time. Here are four charts that show how stark the shift is in how investors have been treating the US dollar since the start of Trump’s tariff tantrums.

Story continues below this ad

Before this policy shock to the world, the US dollar ( and US government bonds) were treated as a safe haven by investors, much like the position enjoyed by gold. As such, even when the US economy goes through turmoil, US bond yields fell because investors moved away from riskier assets (stock markets in US and elsewhere) and put their money into US government bonds. A case in point was the Truss episode where investors, even British ones, sold the UK government bonds they held (thus leading to fall in UK bond prices and the sharp rise in their yields) and bought US government bonds.

- 01

Dollar index versus Gold and the Volatility Index

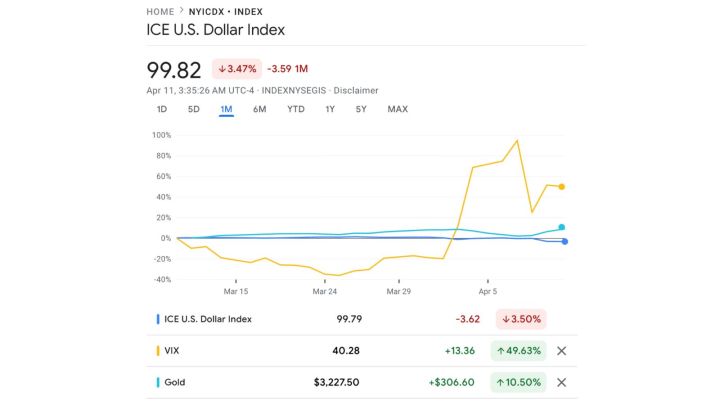

Typically in the past, every time when the stock market experienced a bout of volatility, both gold prices and the dollar index (which maps the international value of the US dollar) rose. But over the past month, this relationship got decoupled.

Chart 1

Chart 1As Chart 1 shows, as the market volatility rose (measured here by the Chicago Board Options Exchange’s CBOE Volatility Index, a popular measure of the stock market’s expectation of volatility based on S&P 500 index), while gold prices went up, the dollar index fell.

In fact, experts say that the monetary stress in the market was so much that investors had to even sell gold to pay off redemptions in different markets and that gold prices would have risen more had the stress been less acute. But what this chart shows is that remarkable shift in investor behaviour where they no longer treat the US dollar as the safest bet.

- 02

Dollar index versus US government bond yields

Chart 2

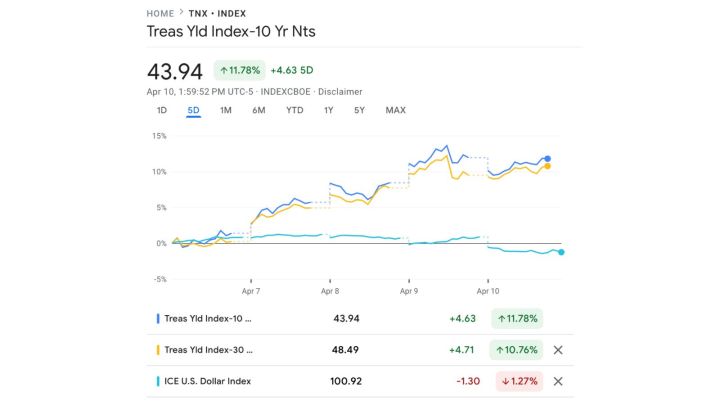

Chart 2Chart 2 shows why and how the US dollar is losing value. It shows how investors sold US government bonds — thus raising their yields — and the fall in the dollar index. The two yields shown rising here refer to the 10-year and the 30-year government bonds — that is, bonds where the US government borrows money over 10 years and 30 year horizons.

Yields have gone up by over 10 percent in just a matter of one month, and this is alarming for a country that has a debt of more than $35 trillion on its books.

- 03

Dollar versus the rest of the hard currencies

Chart 3

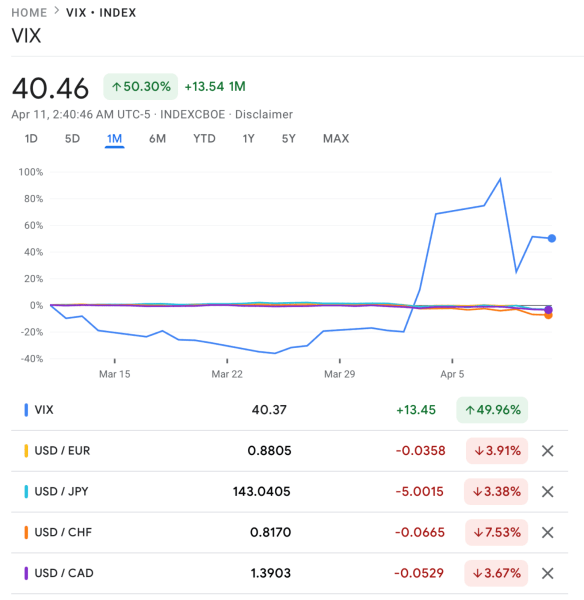

Chart 3Chart 3 shows how investors shifted to other currencies as market volatility increased over the past month. The US dollar has weakened against the EU’s euro, Japanese yen, Swiss Franc, and even the Canadian dollar.

- 04

The end of “drill baby drill”

A big reason why Trump’s US feels emboldened to bully the rest of the world is because of its energy dominance. The US is today the biggest producer and the biggest exporter of crude oil. Trump has given a vision where the US will “drill baby drill” more and more oil and gas, and dominate the global economy by supplying and controlling energy trade.

But the economics of oil trade starts to falter if the oil prices slump. As indeed they did, again threatening the United States’ ability to actually control the global economy. At prices below $60 a barrel, drilling more oil becomes progressively uneconomic. And the prices of oil have been falling as the US, as well as the rest of the world, is expected to suffer a slowdown in economic growth, thanks to the Trump-induced trade disruption.

The upshot

It might appear that Donald Trump has forced countries to negotiate easier terms with the US while the US presses on against China. With reference to some countries this may be true — and in time those countries will be forced to purchase more US goods and bridge the trade deficit that the US has with them.

But the reality is far more stark: Trump has been forced to pull back because global investors have started losing trust in the US currency, and more importantly, the ability of the US economy to be a standard bearer.

It is important to note that it is the combination of rising yields and falling exchange rate that makes the situation so alarming for the US as it works against US influence like a pincer movement.

Story continues below this ad

Share your thoughts and views on [email protected]

Take care,

Udit