- The US Dollar Index clinched its third week in a row of losses.

- The steady lack of clarity over US tariffs hurt the sentiment.

- The FOMC Minutes also tilted toward a cautious message.

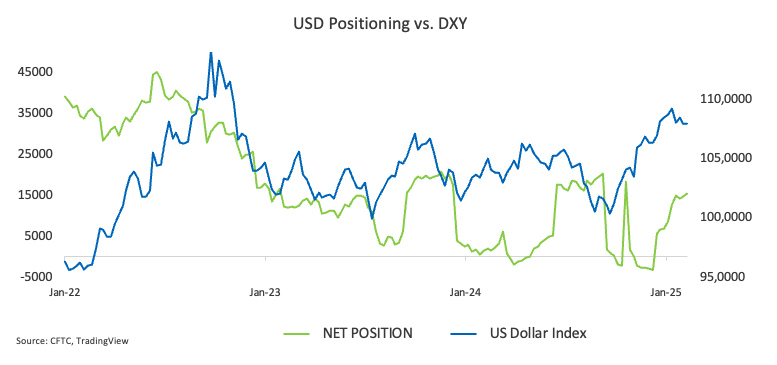

The US Dollar (USD) had another rough week, dipping to the low-106.00s for the first time since early December, according to the US Dollar Index (DXY). That said, the index retreated for its third consecutive week, shedding around 2% since the beginning of the new trading year.

The intense bearish tone in the Greenback has been gathering steam pari passu the unabated uncertainty over the White House’s trade policy. Meanwhile, United States (US) President Donald Trump’s indecisive moves on tariffs have seemingly pushed investors to their limits, further fueling growing skepticism in the market.

Greenback in flux: Tariff turmoil and inflation concerns

The Greenback continues to feel the strain as tariff uncertainty looms large, driven by the Trump administration’s unpredictable trade stance. Yet, there’s a silver lining: Federal Reserve (Fed) Chair Jerome Powell recently reminded markets that the US economy is still “in a very good place,” offering some reassurance amid the chaos.

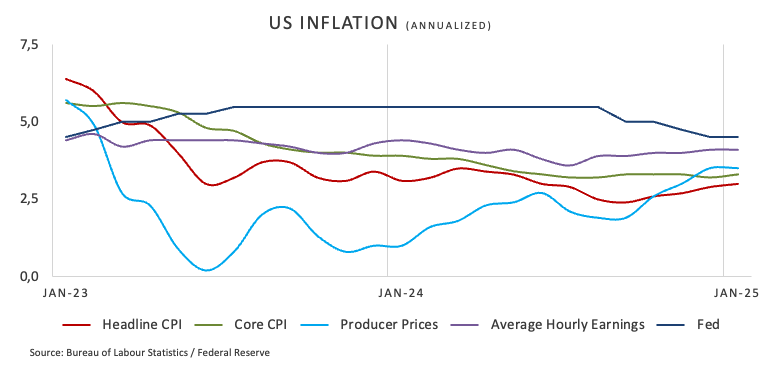

Fresh inflation data—with both the Consumer Price Index (CPI) and Producer Price Index (PPI) coming in stronger than expected—triggered a brief rally in the US Dollar. However, the currency soon slid back from those temporary highs, suggesting more short-term downside may lie ahead.

Investors are not only reacting to higher inflation and the Fed’s potential policy moves; their eyes remain fixed on Washington for any new trade-policy announcements, especially regarding tariffs.

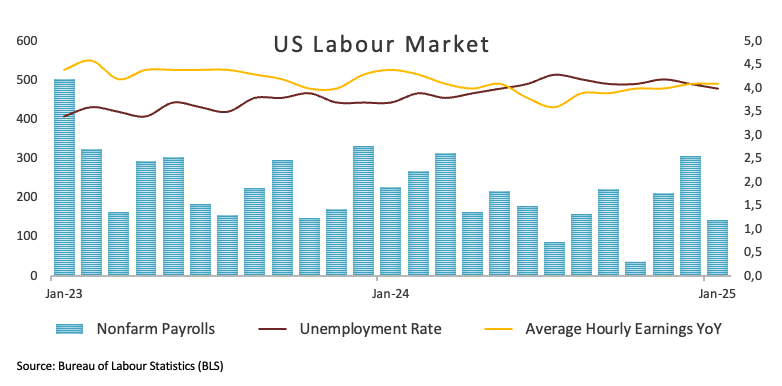

Looking forward, a sturdy labor market, persistent inflation, and robust economic activity—combined with a more cautious Fed—should bode well for the US Dollar in the months ahead.

Fed sticks to its cautious strategy

The Federal Reserve kept interest rates steady within the 4.25% to 4.50% target range at its January 29 meeting, marking a pause after three consecutive rate cuts in late 2024. While this decision signals confidence in the economy’s resilience, policymakers cautioned that inflation remains “somewhat elevated,” suggesting ongoing challenges.

In semiannual testimonies before Congress, Federal Reserve Chair Jerome Powell indicated that the central bank was in no hurry to cut interest rates, pointing to a strong economy, low unemployment, and inflation still above the 2% target.

As the week progressed, many Fed rate setters voiced their opinions. Overall, these remarks illustrate a range of perspectives on tariffs, inflation, and potential shifts in monetary policy. While some officials foresee only a modest impact from tariffs, others remain cautious about the risk of rising prices and the broader economic uncertainties. Most officials appear inclined to wait for clearer signals on inflation and economic momentum before making substantial policy moves. Here we go:

Governor Christopher Waller

- Key point: The Trump administration’s new tariffs will likely have only a “modest” impact on prices.

- Why it matters: Waller believes the Fed should “look through” these tariff effects when setting policy, suggesting that trade developments alone may not be enough to shift the Fed’s course on interest rates.

San Francisco Fed President Mary Daly

- Key point: No reason to be discouraged by the slow progress toward 2% inflation.

- Why it matters: Daly advocates for patience. She says short-term rates should stay put until there’s clear, measurable progress on inflation. This stance implies a cautious approach, prioritizing tangible data over hasty moves.

Fed Vice Chairman Philip Jefferson

- Key point: The economy is robust, inflation remains above target, and the Fed has time to make its next move.

- Why it matters: Jefferson’s comments reinforce the idea that the Fed won’t rush into action. He’s comfortable letting economic data play out before deciding whether more tightening—or easing—is necessary.

Atlanta Fed President Raphael Bostic

- Key point: Expects the Fed could trim rates by half a percentage point before year’s end, despite uncertainties.

- Why it matters: Bostic sees two quarter-point cuts as his “baseline expectation,” but he acknowledges significant unknowns—especially around President Trump’s trade and immigration policies. This signals flexibility if circumstances change quickly.

St. Louis Fed President Alberto Musalem

- Key point: Warned of two big risks—rising inflation expectations and the potential for stagflation.

- Why it matters: Musalem highlighted that taming inflation back to the 2% target could be a slow grind and stubbornly high price pressures could complicate any move to ease rates. Policymakers may need to tread carefully to avoid a situation where inflation sticks around longer than anticipated.

Fed Governor Adriana Kugler

- Key point: Tariffs could push prices higher, but the actual impact is uncertain.

- Why it matters: Kugler points out that the shape of the policies themselves—and whether importers pass costs to consumers—will determine how tariffs influence inflation. Her remarks underscore the complexity of predicting tariff-related price shifts.

Speculative pressure on the US Dollar mounts

Non-commercial players have been piling on the bets for the US Dollar in the week ending February 11. The latest CFTC Positioning Report shows that net long positions have risen for the third consecutive week, reaching around 15.3K contracts—the highest level since last October.

These crowded long positions make the currency more susceptible to negative news, which could trigger a rapid unwind and further intensify any correction in the index.

On a slightly positive note, declining open interest over the past three weeks might help limit the potential downside.

Looking ahead: What’s next for the Dollar?

All eyes are on next week’s US economic calendar. The spotlight will be on the release of US inflation figures—this time measured by the Personal Consumption Expenditures (PCE) index.

Traders and analysts will also be on high alert for any fresh commentary from Fed officials, and, of course, there’s always the chance that President Trump might throw another curveball into the mix.

DXY in focus: Momentum and key levels

If sellers remain in control, the US Dollar Index (DXY) could first find support at the 2025 bottom of 106.33 (observed on February 20), followed by the December 2024 trough at 105.42 and then the crucial 200-day SMA at 104.93. Holding above that moving average is essential to keep the bullish narrative intact.

On the flip side, sporadic buying spurts could drive the index back toward the provisional 55-day SMA at 107.86, prior to its monthly peak of 109.88 set on February 3—or even push it to the YTD high of 110.17 from January 13. Breaking above that level might unlock the next resistance at the 2022 peak of 114.77, recorded on September 28.

Meanwhile, momentum indicators are sending mixed signals. The daily Relative Strength Index (RSI) is bouncing to nearly 40, hinting at a potential recovery, while the Average Directional Index (ADX) hovers around 16, indicating weak overall trend strength.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.