- US Dollar Index (DXY) bounced off multi-month lows.

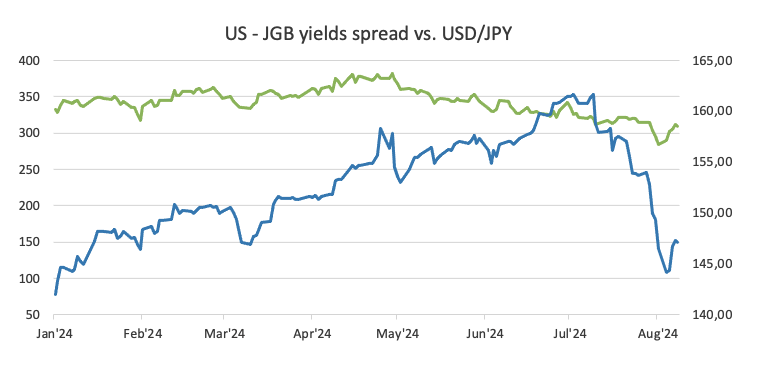

- Focus remains on potential developments around the Yen.

- Fears around a potential US recession have dissipated for now.

Decent contention emerged near 102.00

Following Monday’s pronounced drop to seven-month lows in the 102.20-102.15 band, it’s been all the way up for the US Dollar Index (DXY) since then.

However, that bullish move appears to have run out of steam near 103.50 in tandem with further recovery in global stock markets after recent turbulence, a normalized performance of the Japanese Yen, and somewhat more stable volatility.

All in all, the index ended the week barely changing from the previous one, maybe leaving the door open to continuation of the weekly rebound in the upcoming week.

Recession fears could threaten the Fed’s divergence in monetary policy

Quite a chaotic week for risk-related assets was the result of the Bank of Japan’s (BoJ) unexpected decision to hike rates by 15 bps to 0.25%, a move that caught markets off guard and triggered a strong unwind of the most famous carry trade.

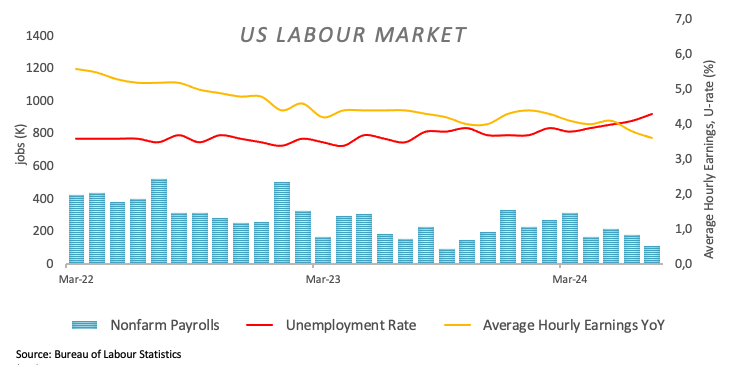

Additionally, July’s lower-than-expected job creation in the US economy, as per Nonfarm Payrolls (+144K jobs), sparked renewed concerns that the US economy might tip into recession, a view that was reinforced by further weakness in the manufacturing sector.

That powerful cocktail reignited strong speculation that the Federal Reserve (Fed) might call an emergency meeting and anticipate a rate cut, a move that, despite being highly unlikely, sent the US Dollar to multi-month lows along with prospects of more and deeper interest rate cuts. That scenario, of course, did not materialize, and it did not come even close to it.

What it indeed did was accelerate the probability of a 50 bps rate cut by the Fed at its September 18 meeting, which, according to CME Group’s FedWatch Tool, now stands near 55% (from around 70% just a couple of days ago).

Now, about those recession concerns, are markets really of the idea that US economic activity could face such a slowdown?. A couple of Fed officials were in charge of clearing the skies of such dark clouds at the beginning of the week.

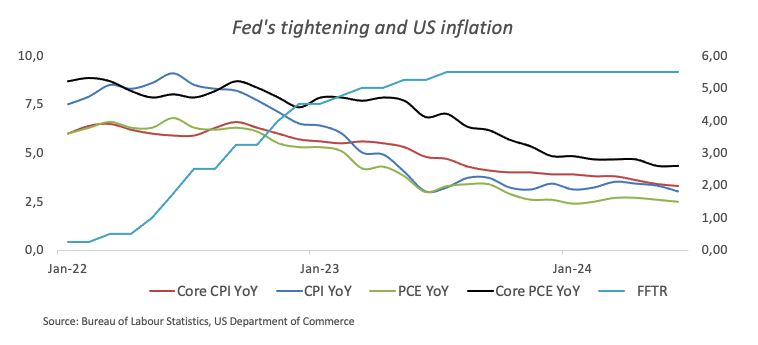

In fact, Chicago Fed President Austan Goolsbee argued earlier in the week that the US economy is not in recession despite weaker-than-expected job data. He emphasized the need for policymakers to monitor changes in the environment to avoid being too restrictive with interest rates. His colleague, San Francisco Federal Reserve Bank President Mary Daly, emphasized the importance of the central bank to avert a downturn in the labour market and expressed confidence that domestic inflation is moving toward the bank’s 2% goal, despite the labour market slowing.

Meanwhile, the European Monetary Union (EMU), Japan, Switzerland, and the United Kingdom are all experiencing growing disinflationary pressures. In response, the European Central Bank (ECB) lowered rates by 25 bps in June and maintained a dovish approach in July, with policymakers suggesting the possibility of another rate cut later in the year (September maybe?). Similarly, the Swiss National Bank (SNB) unexpectedly cut rates by 25 bps on June 20, and the Bank of England (BoE) reduced its policy rate by a quarter-point on August 1. On the other hand, the Reserve Bank of Australia (RBA) delivered a hawkish hold at its event on August 6, and investors anticipate that the bank could begin its easing cycle in the first quarter of 2025. In contrast, the Bank of Japan (BoJ) surprised markets on July 31 by delivering a hawkish message and raising rates by 15 bps to 0.25%.

Rate cuts are still coming

Growing market speculation about an earlier start to the Fed’s easing cycle has been fuelled by the ongoing decline in domestic inflation, along with a gradual slowdown in key sectors like the labour market and manufacturing.

It’s important to recall that at the Fed’s most recent meeting on July 31, Chair Jerome Powell highlighted the need for greater confidence in managing inflation, pointing to Q2 inflation data as supportive evidence. He indicated that the Fed is moving closer to considering a potential rate cut. Powell mentioned that if inflation continues to fall, economic growth stays strong, and the labour market remains stable, a rate cut could be on the table, possibly as early as September.

In the longer term, the growing possibility of another Trump administration and the potential reimplementation of tariffs could disrupt or even reverse the current disinflationary trend in the US economy, which might shorten the planned Fed easing cycle.

US yields showed signs of life

Over the past week, the US money market showed an accelerated rebound in yields, which managed to regain some upside traction after hitting multi-week lows across various maturity periods.

Upcoming key events

The publication of US inflation figures tracked by the Consumer Price Index (CPI) will take centre stage next week. In the same line of relevance will be the release of Retail Sales, which is expected to shed further light on recent recession fears.

Techs on the US Dollar Index

The DXY has decisively broken below the key 200-day SMA around 104.20, maintaining the open door to potential weakness, at least in the near term. As long as it remains below this crucial level, the outlook for the Greenback is expected to stay bearish.

Should sellers regain control, the US Dollar Index (DXY) may initially decline to its August low of 102.16 (August 5), followed by the December 2023 low of 100.61 (December 28), and the psychological barrier of 100.00.

On the upside, the DXY faces immediate resistance at the key 200-day SMA of 104.20, prior to the weekly high of 104.79 (July 30). If this region is cleared, DXY could potentially advance toward the June peak of 106.13 (June 26), ahead of the 2024 high of 106.51 (April 16).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.