- The US labor market deteriorated by far more than previously believed through March 2025.

- The European Central Bank left benchmark rates on hold and said it stands at a “good place.”

- The latest US inflation data cements expectations of the first interest-rate cut from the Fed this year.

- EUR/USD keeps consolidating within familiar levels, with bulls holding the grip yet sidelined.

The EUR/USD pair survived yet another uneventful week, hovering in the vicinity of the 1.1700 level. The pair seesawed between gains and losses, confined to familiar levels amid speculation about the upcoming Federal Reserve (Fed) monetary policy decision, scheduled to be announced on Wednesday. Market participants doubted whether the Fed would deliver the widely anticipated 25 basis points (bps) interest rate cut, or go for a more aggressive 50 bps trim.

Weak labor market, mixed US inflation signals

Poor employment-related figures boosted the odds for a larger interest rate cut. Following the dismal Nonfarm Payrolls (NFP) report that showed the economy added a modest 22,000 new jobs in August, the United States (US) published the preliminary estimate of the annual revision to employment data. In the twelve months to March 2025, the number of new jobs created was downwardly revised by 911,000, indicating the labor market was much weaker than previously estimated.

The dismal figures came alongside US President Donald Trump’s anger with the Bureau of Labor Statistics (BLS) work. The White House criticized the way the organization collects and reports data and replaced the BLS head after the discouraging July report. The latest downward revisions gave Trump a reason to keep pressuring Fed’s Chair Jerome Powell into cutting the benchmark interest rate.

Additional pressure on the USD came from the weekly unemployment claims data, as the number of people filing for unemployment jumped to 263,000 in the week ended September 6, much worse than the previous 236,000 and the anticipated 235,000.

Yet employment makes half of the Fed’s decision. Inflation makes the other half, and the data came in mixed. The BLS released the August Producer Price Index (PPI) on Wednesday, which showed that annualized inflation at producers’ levels rose by 2.6%, down from the 3.3% posted in July. The core annual figure printed at 2.8%, easing from a revised 3.4% previously. On a monthly basis, the PPI declined by 0.1%. All figures came in below the market expectations, signaling easing price pressures. The USD fell with the news amid renewed speculation the Fed could go for a 50 bps when it meets next week.

On Thursday, however, the BLS Consumer Price Index (CPI) for the same month showed inflation held above the Fed’s goal. The annual CPI rose to 2.9% in August from 2.7% in July. The core annual reading printed at 3.1%, both meeting expectations. On a monthly basis, the CPI rose 0.4% following the 0.2% increase recorded in July.

The CPI data was not enough for markets to consider anything other than an upcoming interest rate cut, but it weighed on the odds for a 50 bps cut. At this point, market players are looking at three 25 bps rate cuts before year-end, one in each upcoming meeting.

European Central Bank on hold

Across the pond, the European Central Bank (ECB) announced its monetary policy decision, and as widely anticipated, the central bank left interest rates unchanged. At the same time, the ECB delivered fresh economic projections, which temporarily weighed on the Euro (EUR).

Policymakers now see headline inflation averaging 2.1% in 2025, 1.7% in 2026, and 1.9% in 2027. For inflation excluding energy and food, they expect an average of 2.4% in 2025, 1.9% in 2026, and 1.8% in 2027. The economy is projected to grow by 1.2% in 2025, revised up from the 0.9% expected in June. The growth projection for 2026 is now slightly lower, at 1.0%, while the projection for 2027 is unchanged at 1.3%.

President Christine Lagarde reiterated in the press conference following the announcement that interest rate decisions “will be based on its assessment of inflation outlook and risks surrounding it, in light of incoming economic and financial data, as well as dynamics of underlying inflation and strength of monetary policy transmission,” adding the usual statement indicating that the ECB is not pre-committed to a particular monetary policy path.

Additionally, Lagarde noted that the disinflationary process is over, and that the central bank is in a “good place,” hinting at the end of the loosening cycle. Of course, she reaffirmed that the ECB is ready to act if needed, but with inflation stable around the central bank’s goal of 2%, it seems unlikely the ECB would have to intervene.

Besides the ECB, Germany confirmed the Harmonized Index of Consumer Prices at 2.1% YoY in August as previously estimated, while the Eurozone (EU) published the Sentix Investor Confidence index, which resulted in -9.2 in September, worsening from the -3.7 posted in August.

Federal Reserve’s decision and more

The Fed will announce its monetary policy decision after a two-day meeting on Wednesday. Despite sticky inflation, the weakening job market pretty much grants a 25 bps interest rate cut, which at this point, is fully priced in. Inflation remains above target, and Trump’s tariffs are likely to keep it that way, but the employment situation clearly weighs more on Fed officials.

Even further, Chair Jerome Powell hinted at upcoming interest rate cuts: “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said in his annual address at Jackson Hole in August.

The decision itself may have a limited impact on financial markets if the Fed delivers the anticipated 25 bps interest rate cut. Market players will be looking for hints on future decisions, and confirm that more rate cuts are coming in October and December. A dovish scenario will likely take its toll on the USD.

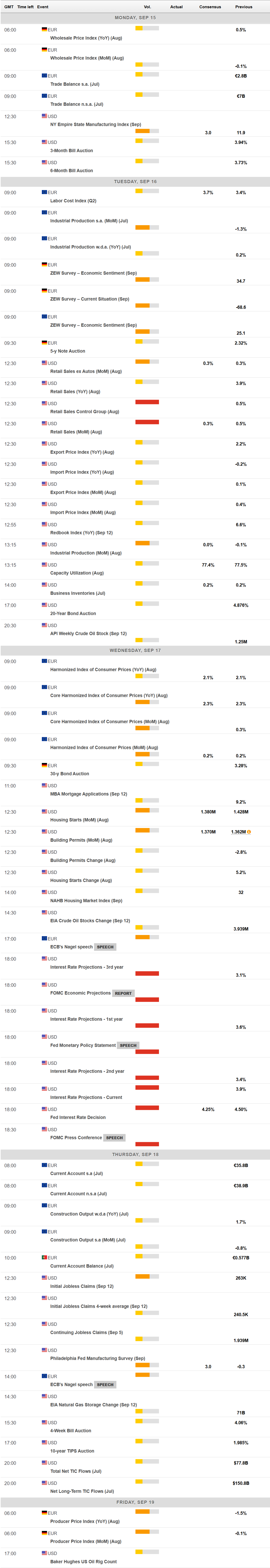

Other than the Fed’s decision, the macroeconomic calendar will include a few relevant data figures throughout the week. The US will unveil August Retail Sales on Tuesday, when Germany will also report the ZEW Economic Sentiment index for September. Later in the week, the Eurozone (EU) will release the final estimate of the August HICP, expected to be confirmed at 2.1%.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows it keeps consolidating within familiar levels, retaining the neutral-to-bullish stance. The pair develops well-above a mildly bullish 20 Simple Moving Average (SMA), which stands at around 1.1560.

The 100 SMA, in the meantime, aims higher above a flat 200 SMA, both far below the shorter one. Finally, technical indicators held directionless within positive levels, keeping the risk skewed to the upside without confirming an upcoming advance.

On a daily basis, the technical picture is pretty similar. The EUR/USD pair develops above all its moving averages, with a directionless 20 SMA providing dynamic support at around 1.1670. The 100 SMA, in the meantime, keeps losing its upward strength, barely aiming higher in the 1.1540 region. The Momentum indicator bounced from its midline, but remains close to it, while the Relative Strength Index (RSI) indicator heads nowhere around 55, all reflecting the lack of follow-through.

The weekly high at 1.1780 comes as immediate resistance ahead of the year’s top at 1.1830. Additional gains expose the 1.1900 mark en route to the 1.2000 psychological threshold. Support can be found at 1.1660, the weekly low, followed by the more relevant 1.1590 area. A clear break below the latter should open the door for a test of the 1.1500 mark.