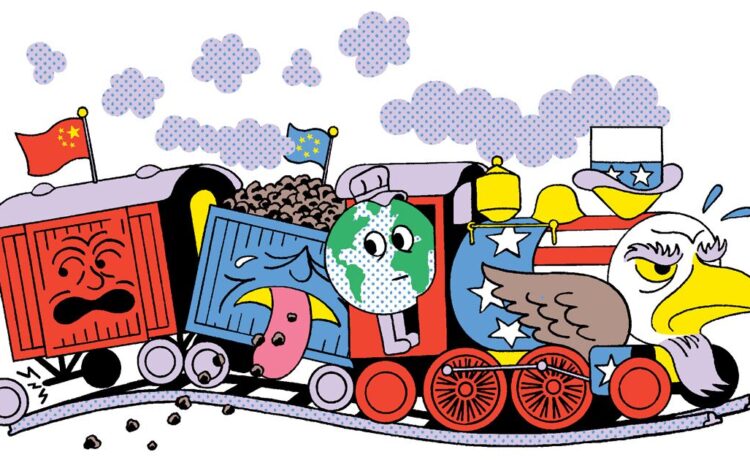

In the US, jobs are plentiful, and consumers are confident and spending. Stocks reached a record in February, and the dollar is strong. The economy last year expanded by more than the size of the Spanish or Indonesian economy, ending 2023 with the fastest gains in back-to-back quarters since 2021. But relying on the US to power world growth poses risks for other nations, as well as the US itself.

China remains bogged down by a real estate slump, and foreign investors have fled the nation amid a stock market rout that’s erased $7 trillion since a peak in early 2021. Prices have fallen for three consecutive quarters, the longest deflationary streak since the Asian financial crisis in the late 1990s. In Europe, the UK slipped into a mild recession in the second half of 2023, and Germany is in danger of contracting again in 2024, dragging on the rest of the euro zone. Japan unexpectedly fell into a recession last year. “The US economy will continue to outshine economies in much of the rest of the world this year, particularly in China and Europe,” says Mark Zandi, chief economist for Moody’s Analytics.