- The US Dollar Index receded to five-month troughs.

- Trump’s chaotic trade policy remains in centre stage.

- The Fed is unlikely to change its plans next week.

The US Dollar (USD) staged a partial comeback from its steep March retracement, climbing back above the 104.00 handle after bottoming out near five-month lows around 103.20 in the US Dollar Index (DXY).

Notably, this rebound occurred despite falling United States (US) yields—particularly along the short end and mid-curve—amid investors’ ongoing reassessment of the Federal Reserve’s (Fed) rate trajectory, lingering uncertainty around President Trump administration tariffs, and concerns over a potential US economic slowdown.

Even so, the index remains below its key 200-day SMA, currently hovering near the 105.00 mark, suggesting that further downside risk could still materialise in the near term.

Turmoil in trade, pressures on prices

This week, the US tariffs narrative appears to have lost some traction.

Despite that, it is worth recalling that after a 25% levy on Mexican and Canadian imports took effect on March 4, President Trump quickly announced a reprieve, exempting goods under the United States-Mexico-Canada Agreement (USMCA) until April 2. At the same time, an extra 10% tariff on Chinese imports—bringing the total to 20%—remained in place.

Although no new tariff updates have emerged in the past few days, the issue continues to dominate discussions among market participants and governments worldwide.

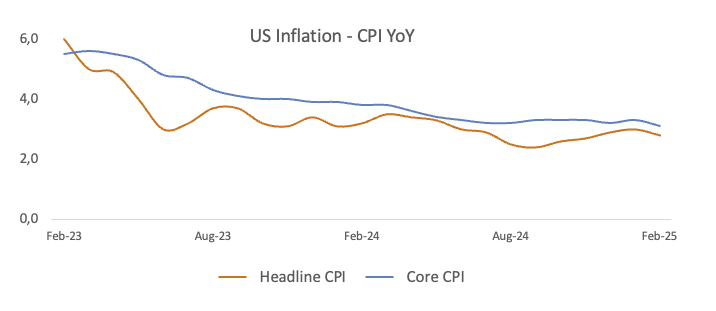

It is worth stressing the importance of distinguishing between the immediate and long-term impacts of these tariff moves. In the short term, higher import duties typically trigger a one-off spike in consumer prices—an effect unlikely to prompt an immediate policy shift from the Federal Reserve. However, if these trade measures persist or intensify, producers and retailers might continue to raise prices due to reduced competition or the pursuit of higher profit margins. This secondary wave of price hikes could dampen consumer demand, slow economic growth, affect employment, and even reintroduce deflationary pressures—factors that might eventually compel the Fed to take more aggressive action.

Economic outlook: A period of uncertainty

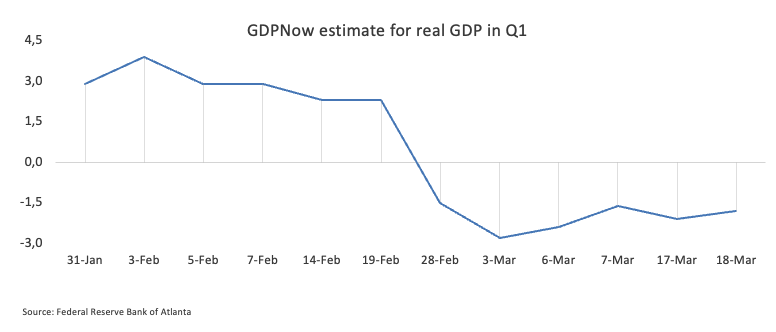

The recent decline in the US Dollar has been fuelled by mounting speculation over a potential economic slowdown—a view reinforced by disappointing data and a drop in market confidence.

Even though inflation continues to overshoot the Fed’s 2% target, as indicated by both CPI and PCE measures, a robust labor market adds another twist to the economic narrative.

This mix of factors, coupled with heightened uncertainty over new US tariffs, ultimately led the Fed to hold interest rates steady at its March 19 meeting.

Fed’s steady hand: A prudent path forward

On March 19, the Fed wrapped up its meeting by opting to keep the federal funds rate within the 4.25% to 4.5% target range. The Committee noted that heightened uncertainty—stemming from recent policy shifts and escalating trade tensions—warranted a cautious approach.

In a simultaneous update to its economic outlook, the Fed trimmed its 2025 real GDP growth forecast from 2.1% to 1.7% while nudging up its inflation projection from 2.5% to 2.7%. These adjustments underscore growing worries about a potential stagflation scenario, where sluggish growth collides with rising inflation.

During his usual press conference, Fed Chair Jerome Powell reiterated once again that there is no pressing need for further rate cuts.

Following the FOMC gathering, rate setters returned to the scenario to voice their views:

- New York Fed President John Williams

-

- Indicated that the current monetary policy is “in the right place” despite economic uncertainty.

- Emphasised the Fed’s ability to “adjust to changing circumstances” to fulfill its dual-mandate goals.

- Noted it was “still too soon” to assess the full impact of President Trump’s tariffs on inflation, pointing out that elevated risks give the Fed more time to decide its policy path.

- Highlighted “the downside risk to economic growth and the upside risk to inflation” as equally significant, reflecting the latest Fed forecasts.

- Chicago Fed President Austan Goolsbee

-

- Voiced concern that the administration’s tariff plans could lead to persistent inflation.

- Stated the Fed needs additional time to “sort through” how trade actions might affect the broader economy.

- Federal Reserve Governor Christopher Waller

-

- Expressed opposition to slowing the pace of reducing securities holdings.

- Argued that the banking system still has ample reserves, suggesting no immediate need for a more cautious approach.

What lies ahead for USD?

All attention shifts to next week’s release of the Fed’s preferred gauge of inflation, the Personal Consumption Expenditure (PCE), and the release of preliminary PMIs in the services and manufacturing sectors, all spiced up by upcoming comments from Fed officials.

Charting the US Dollar: Insights into DXY trends

Technically, the US Dollar Index (DXY) remains below its crucial 200-day simple moving average (SMA) at 104.94, reinforcing a bearish bias.

Buyers seem to have stepped in since last week’s oversold conditions of the index. That said, the continuation of the rebound could see the 200-day SMA revisited, prior to the temporary hurdles at the 100-day and 55-day SMAs at 106.73 and 106.87, respectively. Further upward, the index could face additional hurdles at the weekly high of 107.66 (February 28), the February top of 109.88 (February 3), and finally the year-to-date peak of 110.17 (January 13).

Should selling pressure regain the initiative, support is expected first at the 2025 bottom of 103.22 (recorded on March 11) and then at the 2024 trough of 100.15 (September 27), both preceding the critical 100.00 level.

Momentum indicators offer mixed signals: the daily Relative Strength Index (RSI) has bounced to the 39 area, improving the constructive outlook, while the Average Directional Index (ADX) has climbed to around 33, suggesting that the prevailing trend may be gaining strength.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.