- The Pound Sterling consolidated its correction from four-month highs against the US Dollar.

- President Trump’s tariffs and US Nonfarm Payrolls to offer fresh impetus to the GBP/USD pair.

- The GBP/USD’s bullish bias remains intact, as indicated by the daily technical setup.

The Pound Sterling (GBP) sustained its correction from four-month highs against the US Dollar (USD) over the past week, keeping the GBP/USD pair below the 1.3000 threshold.

Pound Sterling stayed volatile, within range

After a brief corrective stint from multi-month highs above 1.3000, GBP/USD entered a phase of consolidation, gyrating between 1.3000 and 1.2870.

Hopes of targeted reciprocal tariffs by US President Trump and stronger-than-expected US S&P Global preliminary PMI data helped alleviate concerns about an economic slowdown, aiding the US Dollar’s recovery while capping the pair’s upside.

According to the report carried by the Wall Street Journal (WSJ) early Monday, the White House is expected to narrow its list of tariffs due to take effect on April 2, likely omitting a set of industry-specific tariffs while applying reciprocal tariffs aimed at countries with significant trade ties to the United States (US). Later that day, S&P Global released its US Composite PMI Output Index, which tracks the manufacturing and services sectors, jumping to 53.5 this month from 51.6 in February.

Additionally, hawkish comments from Atlantic Federal Reserve (Fed) President Raphael Bostic also allowed the Greenback to retain ground. Bostic backed away from the idea of two rate cuts this year and said on Monday that he only sees one rate cut in 2025.

However, the US Dollar upswing faced headwinds from renewed Trump tariff threats. Late Tuesday, the Toronto Star reported that Trump is set to impose three escalating levels of tariffs, with Canada likely to be on the lower end of the April 2 tariffs. Trump later clarified that “all we’re going to do is reciprocal,” adding that “not many exceptions on April 2 tariffs.”

Early Wednesday, Bloomberg News reported that the US President “plans to implement copper import tariffs within weeks.” The resurfacing tariff threats once again fuelled US economic concerns, curbing the USD recovery. The USD buyers soon jumped in during Wednesday’s American trading as risk aversion persisted in full force after Trump re-announced plans for the long-promised 25% tariffs on automotive imports, which are set to take effect on April 2.

Risk-sensitive Pound Sterling was knocked alongside stocks and higher-yielding assets on Wednesday. At the same time, slowing inflation in the UK also dented the sentiment around the domestic currency. The Consumer Price Index (CPI) rose 2.8% year-over-year (YoY) in February, following a 3.0% increase in January, according to data released by the Office for National Statistics (ONS) on Wednesday. Markets expected a 2.9% growth in the reported period.

Following the lower-than-expected UK CPI figures, traders shifted from expecting no change to pricing in a 54% chance of a 25 bps cut at May’s Bank of England (BoE) meeting. But Trump’s tariff exemption on auto parts offered a sigh of relief to markets, rescuing the British Pound. The GBP/USD rebounded firmly on Thursday, retesting the 1.3000 barrier.

Heading into the weekend, a sense of caution prevailed amid uncertainty over Trump’s tariffs and the Fed’s prudent policy stance, as traders keenly awaited the US core Personal Consumption Expenditures (PCE) Price Index data for fresh trading impetus in the GBP/USD pair.

Data published by the ONS on Friday showed that the UK Retail Sales jumped 1% month-over-month (MoM) in February after rising 1.7% in January. The market forecast was for a 0.3% drop in the reported month. Later in the day, the US Bureau of Economic Analysis announced that the annual PCE inflation held steady at 2.5% in February, as expected. This data failed to trigger a noticeable market reaction heading into the weekend.

Trump’s tariffs and US employment data are set to steal the show

It’s time for the clocks to turn back in Europe, with a relatively quiet start to a big week on Monday.

US President Donald Trump’s reciprocal tariffs are set to take effect on Tuesday, April 2, with their details eagerly awaited.

Tariff developments are likely to remain the primary market driver in the lead-up to the US Nonfarm Payrolls (NFP) data release on Friday.

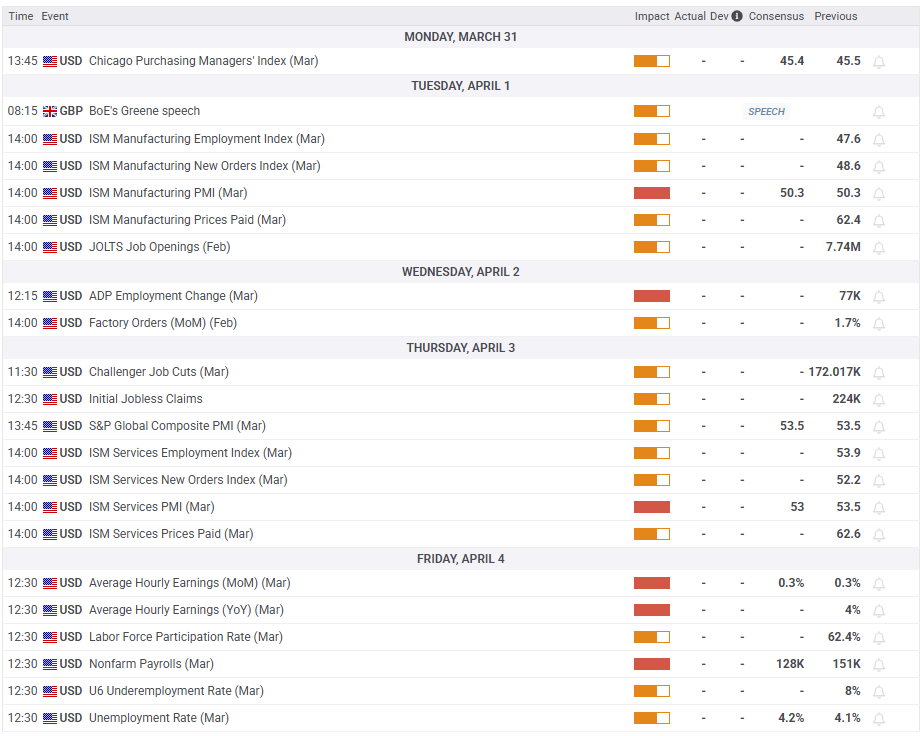

On the economic data front, Tuesday will feature the US Institute for Supply Management (ISM) Manufacturing PMI report and the JOLTS Job Openings and Labor Turnover Survey. Both sets of data will shed fresh light on the state of the US economy, impacting the performance of the US Dollar and the risk-sensitive Pound Sterling.

The US Automatic Data Processing (ADP) Employment Change data will stand out on Wednesday. Meanwhile, the weekly Jobless Claims and the ISM Services PMI will be released on Thursday, entertaining traders.

On Friday, the US labor market data, including the all-important NFP numbers, will drop in, making for an eventful end to an action-packed week.

It’s worth mentioning that speeches from Fed policymakers, as well as renewed developments surrounding tariffs and the Middle East’s geopolitical tensions, will also be closely followed.

GBP/USD: Technical Outlook

The constructive outlook for GBP/USD remains in place in the near term, as indicated by its daily chart.

The pair once again needs to close the week above the 1.3000 barrier to initiate a fresh move higher, initially targeting the November 6, 2024, high of 1.3048.

Further up, buyers would aim for the 1.3150–1.3200 resistance area, a clearance above which would open the door toward the 1.3300 round figure.

The 14-day Relative Strength Index (RSI) remains in the bullish territory, currently trading near 60, suggesting that the bullish potential remains intact.

Additionally, dual bullish crossovers offer credence to the upward trajectory.

In case the correction regains traction, the immediate downside cap is at the 21-day Simple Moving Average (SMA) of 1.2903.

If sellers find a firm foothold below that level, the 200-day SMA at 1.2804 will be next on their radars.

A sustained break below the latter will likely trigger a fresh downtrend toward the 50-day SMA at 1.2667, followed by the 100-day SMA at 1.2614.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.