- The Pound Sterling recaptured 1.2600 versus the US Dollar amid sustained upside.

- GBP/USD braces for a busy economic docket on both sides of the Atlantic.

- The pair broke the consolidative range to the upside on the daily chart.

The Pound Sterling (GBP) extended the recovery from 14-month troughs against the US Dollar (USD) as the GBP/USD pair reclaimed the 1.2500 threshold.

Pound Sterling capitalized on USD downfall

The primary catalyst behind the GBP/USD pair’s ongoing upswing was the sustained correction in the US Dollar across its major currency rivals. US President Donald Trump’s reciprocal tariffs plan and dovish US Federal Reserve (Fed) expectations exerted downside pressure on the Greenback, even though Fed Chairman, Jerome Powell, stuck to his hawkish rhetoric in his Congressional testimonies.

The market sentiment remained in a sweet spot almost throughout the week, courtesy of prospects of a Russia-Ukraine peace deal and the delay in implementing Trump’s reciprocal tariffs. Trump has entrusted Commerce Secretary, Howard Lutnick, to prepare a roadmap for charging reciprocal tariffs on every country that imposes duties on US imports.

Additionally, increased bets that the Fed will maintain its easing trajectory this year offered some relief to the markets.

Following a hot January US Consumer Price Index (CPI) data, the Producer Price Index (PPI) also surprised markets to the upside. However, the index’s monthly components cooled, reinforcing dovish expectations around the Fed’s rate cut prospects.

The annual headline CPI increased 3% in January, up from 2.9% the previous month. The core inflation unexpectedly rose to 3.3% over the year in January versus December’s 3.2% growth. Meanwhile, the PPI increased by 3.5% over the year in January, compared with December’s 3.3% growth and the forecast of 3.2%.

Reuters reported, “Following the PPI data, US rate futures priced in 31 basis points (bps) of easing this year, compared with 27 bps late on Wednesday, according to LSEG calculations. The next rate reduction is expected either at the October or December meeting.”

On Friday, the US Census Bureau reported that Retail Sales declined by 0.9% on a monthly basis in January. This reading came in worse than the market expectation for a decline of 0.1% and made it difficult for the USD to find demand. In turn, GBP/USD climbed above 1.2600.

The Pound Sterling also received support from cautious remarks from Bank of England (BoE) policymakers. BoE Chief Economist, Huw Pill, told Reuters on Thursday that he “urges caution on interest rate cuts.” BoE official Megan Greene said on Wednesday “I believe it is appropriate to maintain a cautious and gradual approach to removing monetary restrictiveness.”

Week ahead: UK inflation and US PMI data to stand out

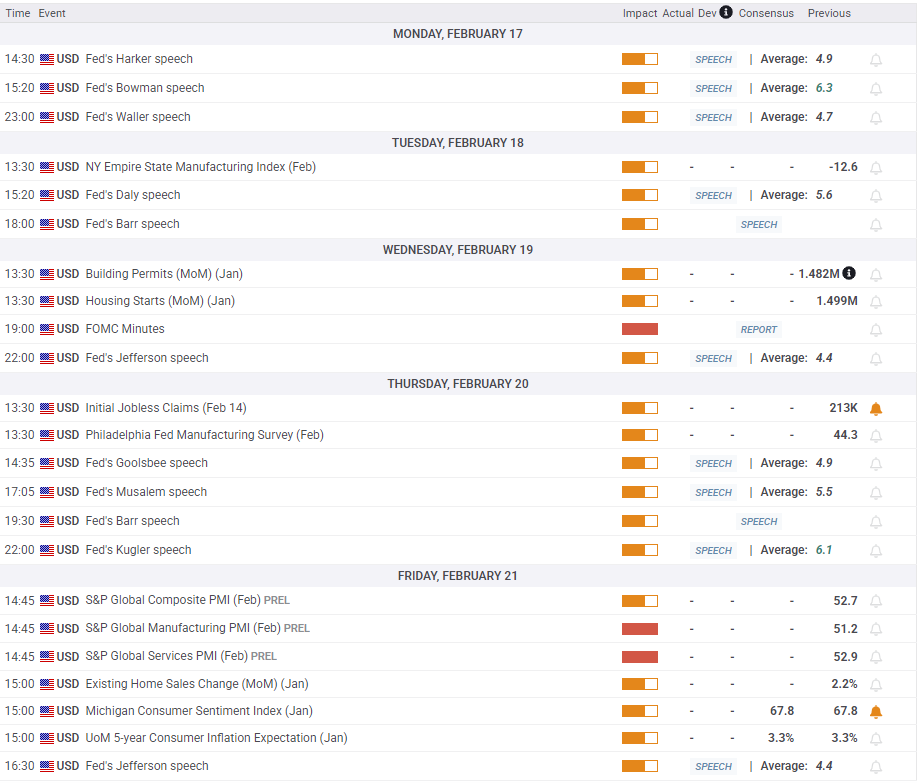

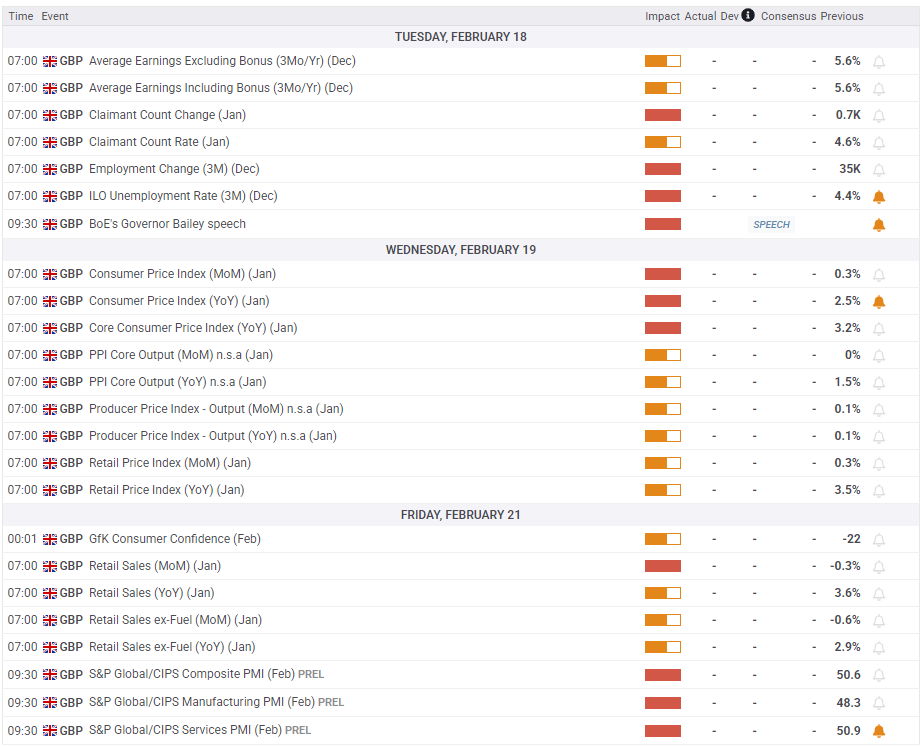

It’s a holiday-shortened week as US markets are closed on Monday in observance of Presidents’ Day. There are no significant events from the UK on Monday either.

On Tuesday, Pound Sterling traders will look forward to BoE Governor Andrew Bailey’s fireside chat on fostering openness in financial markets and the role of central banks.

Any hints on the Bank’s policy outlook could trigger a big reaction in the British Pound.

Ahead of Bailey’s appearance, the UK labor market data will be closely scrutinized for fresh policy cues.

Attention then turns toward Wednesday’s January UK CPI report, followed by the Minutes of the Fed’s January policy meeting.

Thursday will feature the usual weekly Jobless Claims data from the US, while the CBI Industrial Order Expectations data will likely entertain traders earlier that day.

The S&P Global preliminary business PMI data from the US and the UK will make up for a busy calendar on Friday. The UK Retail Sales data will also add to the data-busy day.

Besides the economic data releases, traders will continue closely following fresh developments on Trump’s tariff plans and speeches from Fed policymakers during the week.

GBP/USD: Technical Outlook

The daily chart shows that GBP/USD broke its consolidative phase to the upside after closing Thursday above the 50-day Simple Moving Average (SMA) at 1.2465.

The 14-day Relative Strength Index (RSI) holds firmly above the midline, currently near 64, suggesting more room for gains.

The immediate resistance is at the December 30 high of 1.2608. A sustained break above it will expose the 1.2650 psychological level.

Further up, buyers will aim for the 100-day SMA at 1.2675 and the 200-day SMA at 1.2788.

If Pound Sterling sellers jump in at higher levels, the 50-day SMA resistance-turned-support at 1.2465 will be challenged at first.

The 21-day SMA at 1.2420 will be the next downside target, below which doors will reopen to test the rising trendline support at 1.2332.

Deeper declines could challenge bullish commitments at the February 3 low of 1.2249.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.