Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

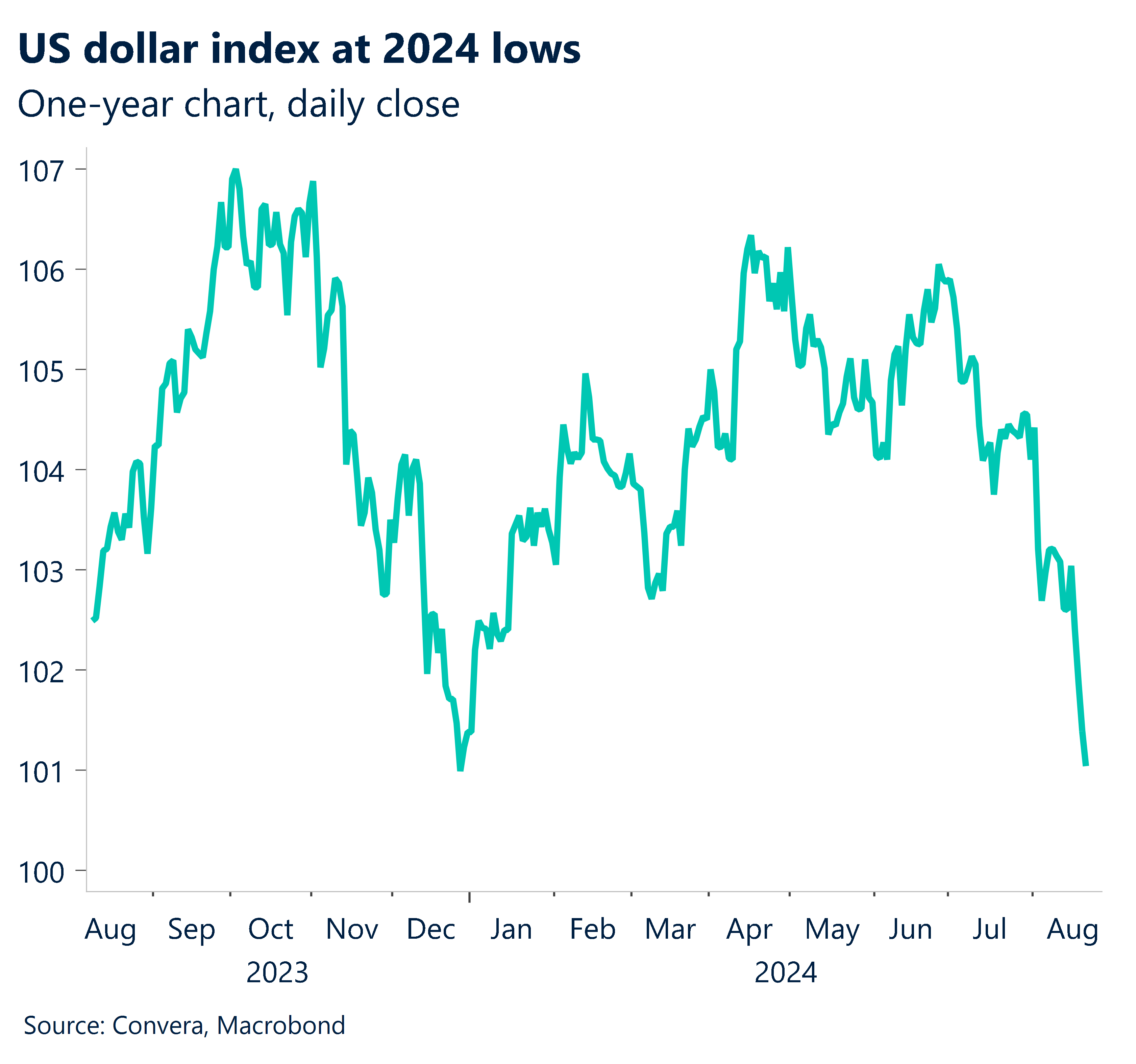

Greenback hit after jobs revision

The US dollar index fell to the lowest level of 2024 overnight after a massive downgrade in recent US job gains seemed to make a Federal Reserve interest rate cut more likely.

The Bureau of Labor Statistics downgraded jobs growth for the year ending 31 March by 818,000 jobs in a sign that the US labour market was weaker than previously thought – a drop of 28%.

Non-farm employment for the year ending 31 March now sits at 2.1 million.

The greenback fell on the news with the USD index at the lowest level since 28 December.

In Asia, however, markets were mostly flat. The AUD/USD and NZD/USD both gained 0.1%.

The USD/JPY fell 0.1% while the USD/SGD and USD/CNH were both broadly flat.

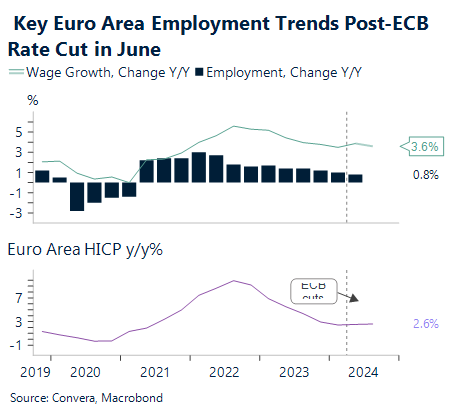

EUR mixed signals from ECB minutes

The European markets were stronger with EUR/USD up 0.2% and the GBP/USD up 0.5%.

The euro could remain supported in the near term with the European Central Bank minutes due tonight.

The July meeting of the ECB saw no changes to interest rates. The guidance was neutral, with dovish adjustments on growth offsetting hawkish adjustments on inflationary pressures. It is obvious that the ECB did not want to cause a stir before the summer vacations.

Despite the unanimous decision made at the July meeting, market players will want to see how much growth worries are outweighing sticky services inflation and what this indicates for the possibility of an October rate cut by the ECB.

With EUR/USD holding above the 1.10 of short-term support level, there’s the potential for another test of anticipated resistance levels around the 1.15 handle.

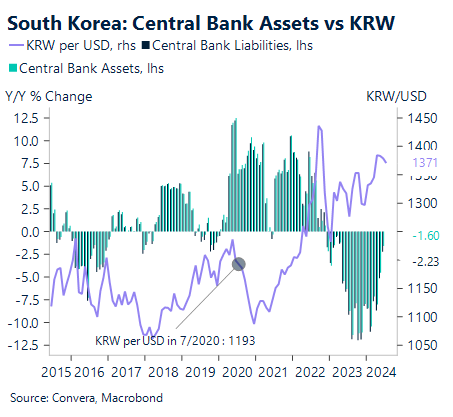

KRW cautious outlook despite recent gains

We anticipate that the BOK will decide unanimously to maintain the policy rate at 3.5% (a hawkish hold). Because of its emphasis on reducing family debt and property prices, we anticipate that the BOK will not indicate rate decreases at this meeting, even in spite of decreasing inflation and lower consumption.

Nevertheless, we anticipate that the BOK will employ a more nuanced and adaptable communication approach in place of signaling policy through opposing votes.

Consequently, we think that BOK Governor Rhee will keep the door open by stating that some dovish MPC members are open to rate reduction later this year, even if the BOK is expected to forcefully push back against market expectations for two 25bp cuts this year.

We anticipate that the BOK will stick to its growth and inflation projections in its updated economic outlook since slower domestic demand is expected to be compensated by greater export growth.

We continue to be cautious on the Won despite the decline in USD/KRW because of (a) the continuous domestic purchase of USD and (b) the movement’s rapidity.

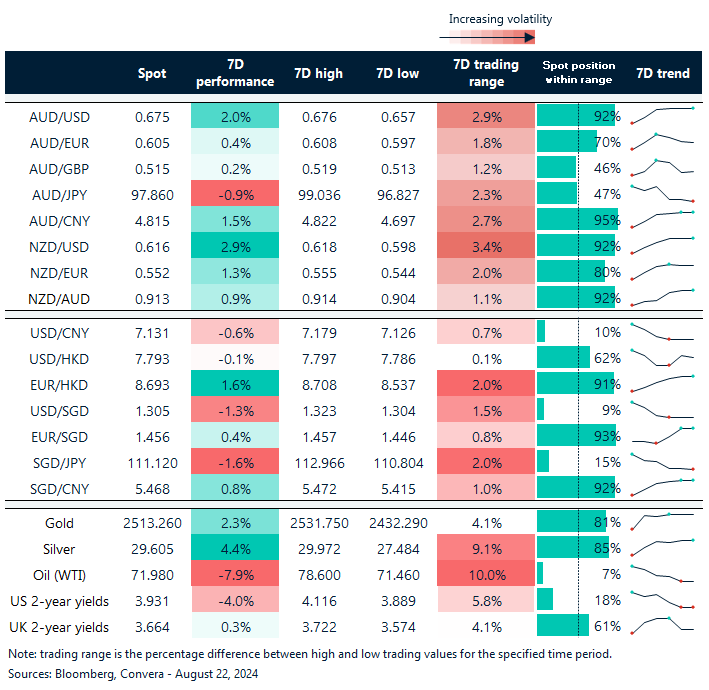

USD extends losses

Table: seven-day rolling currency trends and trading ranges

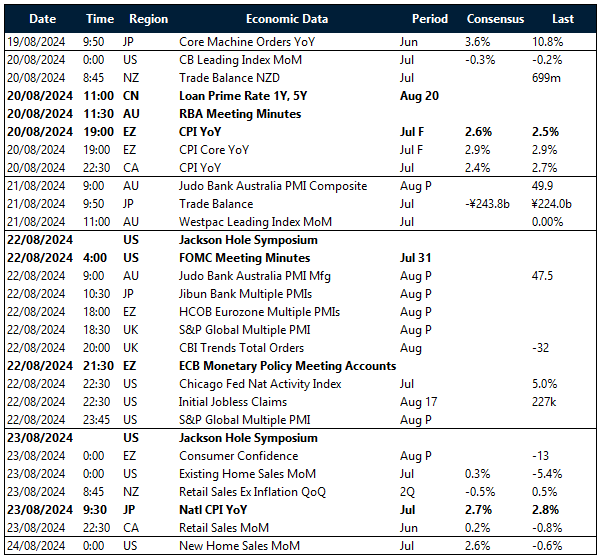

Key global risk events

Calendar: 19 – 24 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]