Written by Convera’s Market Insights team

Dollar enjoys a debate boost

George Vessey – Lead FX Strategist

Investors kept a close eye on the first US presidential debate between Democratic President Joe Biden and his Republican rival Donald Trump in early Asian hours on Friday, ahead of November’s US election. Market odds have narrowed slightly for a Trump win in the wake of the debate, which could translate to upside risks in inflation. That would mean the Federal Reserve (Fed) keeps rates higher for longer, US Treasury yields stay elevated and the US dollar remains resilient hence the uptick in US yields and the buck this morning.

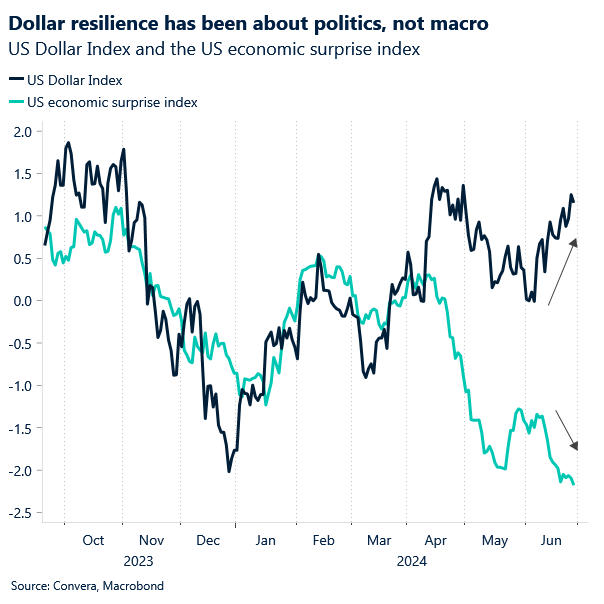

Meanwhile, signs of the US economy losing steam are mounting as the incoming macro data has surprised to the downside on all occasions this week. Weaker consumer confidence and regional Fed PMI surveys, rising initial jobless claims and pending home sales falling to a record low have pushed the US surprise index to its lowest level since mid-2022. Nevertheless, the US dollar Index has continued to slowly trend higher despite both nominal and real yields having fallen in June. The macro and yields based support the US currency has enjoyed for the most part of this year is starting to wane. However, political turmoil in Europe and FX weakness in Asia have added to the dollar’s appeal this month. For the currency to start giving up some of its year-to-date gains, we would have to see a continuation of the global disinflation trend and for politics to move out of the spotlight.

Ahead of the first round of the French election this weekend, investors will turn their focus to the Fed’s preferred inflation gauge today. The market consensus for core PCE is for a 0.1% m/m increase and a decline in the inflation rate from 2.8% to 2.6%.

UK fastest growing G7 economy in Q1

George Vessey – Lead FX Strategist

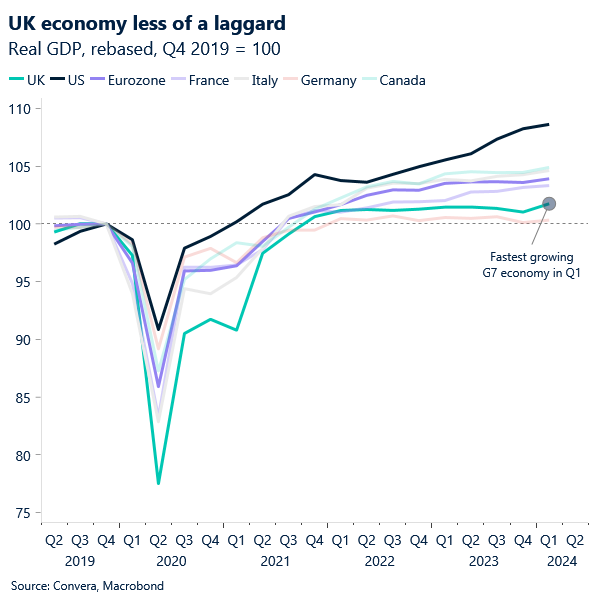

Data this morning showed the UK economy grew more quickly than previously estimated during the first three months of the year and confirms it was the fastest growing G7 economy in the first quarter. Sterling is largely unfazed by the news though, trading steady in the lower $1.26 region versus the US dollar and above €1.18 against the euro as global politics remains a key focus right now. Against the Japanese yen though, the pound sits close to 16-year highs and in overbought territory as traders patiently wait for potential intervention by Japanese officials to bolster their currency.

In a boost for UK Prime Minister Rishi Sunak’s argument that the nation has turned the corner after a recession last year, the ONS upgraded its previous estimate for growth of 0.6% to 0.7% in the first quarter. Services drove the increase, jumping 0.8%, revised up from 0.7%, and capping three consecutive quarters of decline. Consumer spending and trade also came in stronger. In other news, figures from the Bank of England (BoE) Financial Stability Report published yesterday, show the mortgage shock caused by the spike in rates to 5.25% from 0.1% at the end of 2021 is beginning to ease. In total, around 2 million borrowers on variable rates or on short fixed-rate deals will be better off by the end of 2026. Markets expect rates to be reduced to 4.75% by the end of this year, which would immediately help the 18% of household on variable deals.

Meanwhile, also within its semi-annual health check of the financial system, the bank revealed that policy uncertainty associated with upcoming elections globally has increased. This could make the global economic outlook less certain and lead to financial market volatility. FX options traders aren’t betting on fireworks going off at the UK election though, with 1-week implied volatility, a metric that captures the market’s view of the likelihood of future changes in GBP/USD residing well below its 2024 average.

US PCE to guide EUR/USD

Ruta Prieskienyte – Lead FX Strategist

While the euro continues to struggle under the cloud of political uncertainty, the events across the pond in the US continue to hold more sway. The EUR/USD pair recovered the $1.07 mark as upbeat US data fueled market’s optimism and pushed the dollar lower. Overnight the US dollar clawed back some of its losses on the back of the first US presidential election debate that boosted the poll odds of a Trump win yet sentiment ahead of the US PCE print remains EUR/USD supportive.

On the data front, the economic sentiment indicator in the Eurozone missed expectations, edging to 95.9 in June, down from the previous reading of 96.1. The worsening in sentiment was broad based across sectors. Selling price expectations picked up in some sectors, namely construction, services, retail trade, but remained stable across the industry as a whole. In addition, consumer inflation expectations over the next 12 months climbed to the highest in four months. Elsewhere, the Riksbank maintained its key policy rate at 3.75%, but signalled “two or three” further rate cuts this year, having simply forecasted two back in May. The dovish signals come on the back of moderating inflation expectations, which should feed into more modest wage growth at the next round of negotiations scheduled for early 2025 and in turn allowed for further disinflation in the future. On the back of the rate decision, financial markets rushed to price in additional rate cuts for the August meeting, with the probability of a rate cut surging to 93%, up from 76% the day prior, and EUR/SEK rallied over 0.6% on the day to touch a fresh 2-week high above 11.36.

With the first round of French voting due this Sunday, there is a material chance of a spot gap risk at the start of the next week. 1-week implied volatility across euro crosses continues to climb heading into the final trading day of the week, with EUR/USD volatility expectations hovering at 5-month highs. The 1-week 25-delta risk reversal skew widened to -1.46 in favour of euro puts, the most bearish short term market sentiment since July 2022. Renewed political jitters translated to a further widening of OAT-Bund 10-year yields, the so called French election premium, which as a result saw the demand for EUR/USD tail risk surge to the highest level since March 2023.

SEK stumbles after dovish Riksbank

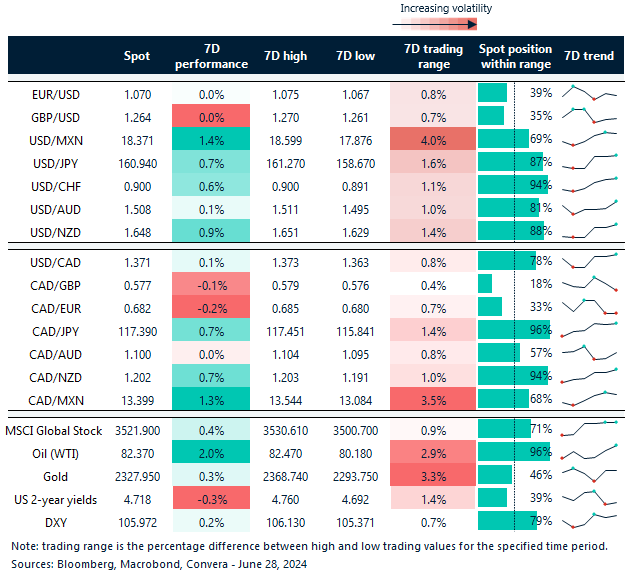

Table: 7-day currency trends and trading ranges

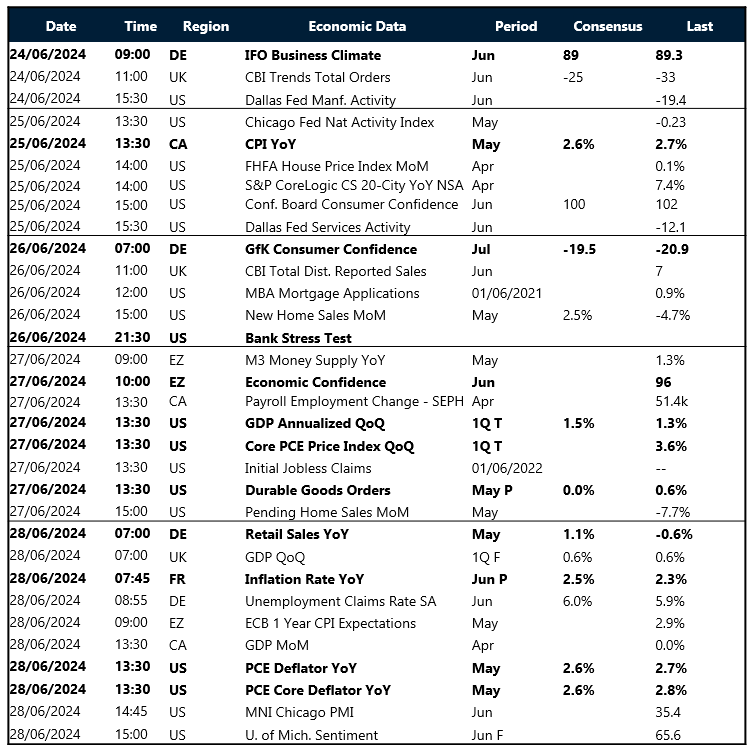

Key global risk events

Calendar: June 24-28

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.